SUMMARY

- The era of broad growth stock outperformance is likely over, in our view.

- Our balanced portfolios are paying more attention to yield.

- We like ‘stocks that look like bonds’, and ‘bonds that look like stocks’.

In A High-Inflation World, It Pays To ‘Pay Attention To The Yield’

T.I.N.A.’ – ‘There Is No Alternative’ to stocks- was the acronym that defined the ‘Quantitative Easing’ era, circa 2009 to 2021. TINA referred to the implicit belief that inflation and interest rates would stay low ‘forever’, leading balanced investors to own more stocks than normal. With central banks anchoring short term interest rates around zero, short-term US treasuries’ traditional role of ‘risk-free rate of return’ became instead viewed as ‘return-free risk.’ In a low-growth, low-interest rate environment, the ability to grow was prized, and thus growth stocks garnered a large premium in this era.

Copyright 2022 NDR, Inc. Further distribution prohibited without prior permission. See NDR Disclaimer at www.ndr.com/copyright.html. Chart shown for illustrative purposes only. Past performance is no guarantee of future results.

But the paradigm has now shifted, thanks to high inflation and tightening Federal Reserve policy. This new environment acknowledges that interest rates were held artificially low due to the Fed’s ‘growth at any cost’ mandate that no longer is required – and in fact, is now antithetical to the Fed’s most pressing mission of controlling inflation. We humbly submit a new acronym to define this new era, marked by positive and rising inflation-adjusted bond yields: ‘P.A.T.T.Y.’ It stands for ‘Pay Attention To The Yield’– and it is another way to say that we believe income generation will likely be one of investors’ best weapons against a highly volatile stock and bond market driven by tightening monetary policy and rising rates.

The previous TINA era was marked by muted nominal economic growth and even lower inflation, giving the Fed and other global central banks carte blanche to keep a lid on interest rates. This allowed a massive premium to accrue to business models which promised well above average long-term revenue growth – aka ‘growth’ stocks. If real yields move higher, we believe the demand for growth stocks will continue to decline. In its place, we expect stock and bond themes that generate durable income will find higher demand and better long-term total returns among investors.

Introducing PATTY…The Thrifty ‘Coupon Clipper’

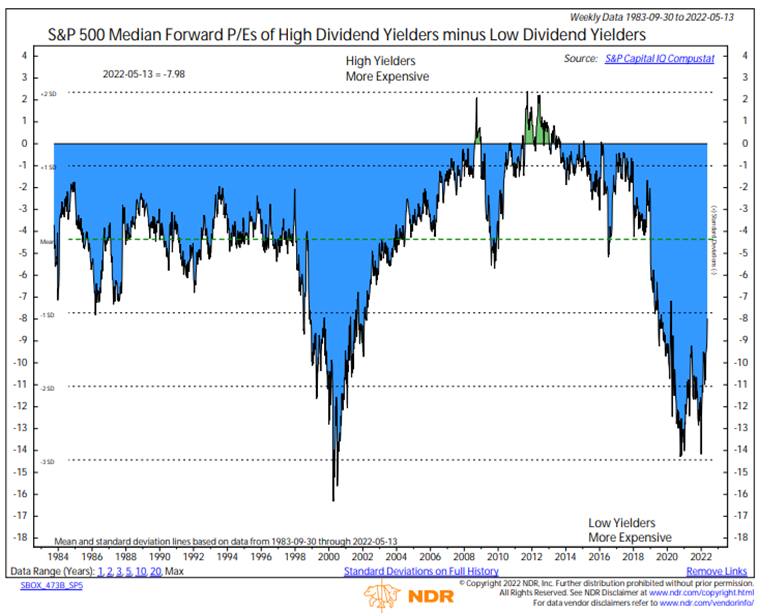

PATTY is thrifty by nature, as dividend stocks generally don’t trade at a significant premium to the broad market. High dividend stocks look particularly cheap relative to low dividend yielders, which are often growth stocks. In comparing the valuation of the top and bottom quartiles by dividend payment over time, high dividend stocks have rarely been this ‘cheap’ relative to low dividend ones throughout history, going back to the 1980s (see chart, courtesy of Ned Davis Research, previous page).

PATTY also loves to clip coupons on fixed income investments. After the recent market downdraft, many bond asset classes now have significantly higher yields than they did at the beginning of the year (see table, below). We believe the higher yields that these PATTY securities now provide can serve as a more protective cushion to protect against additional near-term downside as the Fed normalizes interest rates. This is a theme we wrote about in our Weekly View last week.

Source: Ned Davis Research, Bloomberg Barclays, RiverFront Investment Group. Data as of 5/13/22. Chart shown for illustrative purposes only. Past performance is no guarantee of future results.

Looking For PATTY ‘In All The Right Places’ – Quality Dividend Payers And Growers, Short-Duration Credit, And Covered Call Strategies

A key common attribute for these ‘stocks that look like bonds’ is not only current dividend payments, but the stable earnings and cash flow needed to support dividend payments in the future. We caution investors against looking for dividend love in ‘the wrong places’. To us, this includes companies with dividend payout ratios (the percentage of dividend payments that are covered by corporate earnings) above their capacity to pay. We would also express caution toward companies with high levels of debt relative to their capitalizations, and low levels of debt interest coverage. Those characteristics could make a company vulnerable if their business prospects or the economy experience a downturn.

In a PATTY world, growth-oriented stocks without discernable cash flow or dividends may remain vulnerable to further valuation downside if inflation continues to rise, as we now expect. In contrast, we think dividend generators will remain relatively attractive. We think target-rich environments for these types of US stocks exist in energy, materials producers, financials, some healthcare and selected consumer plays, and even in some mega-cap technology companies that pay and grow dividends. For long-term, more risk-tolerant investors, PATTY-style stocks can also be found overseas in geographies such as the UK, Norway, Canada, and Australia.

PATTY strategies suggest also owning ‘bonds that look like stocks’ –including shorter-duration high yield bonds, bank loans, and intermediate term corporate bonds. We think this is the type of environment that rewards sustainable alternative yield strategies that benefit from heightened volatility, such as covered call writing. All of these types of assets have been part of RiverFront’s balanced portfolio purchases over the last couple quarters.

PATTY: A Long-Term Partner, But Can Suffer Volatile Mood Swings…Use In Conjunction With Risk-Management

The PATTY strategy will require patience and emotional management by investors – after all, your dividend and coupon payments only come in a few times a year, but stock and bond prices change every day. This emotional management will prove important, because we believe the stock market will remain volatile for the foreseeable future. A heavily growth-oriented index such as the S&P 500 is particularly sensitive to the movement in rates. The valuation multiple of the S&P 500 has rerated down significantly since its highs at the end of last year, from over 22x to around 18.3x today, moving in conjunction with the rise in interest rates.

While valuation is starting to appear more attractive, the next uncertainty for the S&P 500 could be related to a corporate earnings downturn, should a recession materialize. We are encouraged by the fact that forward earnings estimates have generally been stable throughout the year, even improving throughout 2022 thus far (see our Weekly View from May 2, 2022 for more on earnings estimates). However, we are watching earnings revisions closely as a potential risk.

We suggest that investors with a shorter time-horizon pair a PATTY strategy with the use of cash and equivalents during times when market trends are primarily negative. This ‘dry powder’ can be used opportunistically to purchase PATTY assets at attractive levels after large corrections in asset prices.

In Summary

- The ‘TINA’ era of growth stock outperformance is likely over, given positive and rising real interest rates.

- We believe the new era will be marked by ‘PATTY’ – ‘Pay Attention To The Yield’ – a strategy of generating income from a combination of dividend stocks in industries like energy and high-quality tech, as well as credit-focused fixed income, and alternative yield strategies.

- The PATTY era will likely remain volatile; we are keeping ‘powder dry’ by holding some cash on hand to use opportunistically during large market downdrafts.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The ICE BofA ML Current 10-Year US Treasury Index is a one-security index comprised of the most recently issued 10-year US Treasury note.

The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

ICE BofA US Corporate Index Tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have an investment grade rating (based on an average of Moody’s, S&P and Fitch) and an investment grade rated country of risk (based on an average of Moody’s, S&P and Fitch foreign currency long term sovereign debt ratings). In addition, qualifying securities must have at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $250 million.

Definitions:

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Principal Risks:

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Dividends are not guaranteed and are subject to change or elimination.

Current yield is a bond’s annual return based on its annual coupon payments and current price (as opposed to its original price or face). The formula for current yield is a bond’s annual coupons divided by its current price.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices.

An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset, in this case U.S. common equities, and writing a call option on that same asset with the goal of realizing additional income from the option premium. Certain ETFs use a covered call strategy. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the fund. While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2203915