By John Eckstein, Astor Investment Management

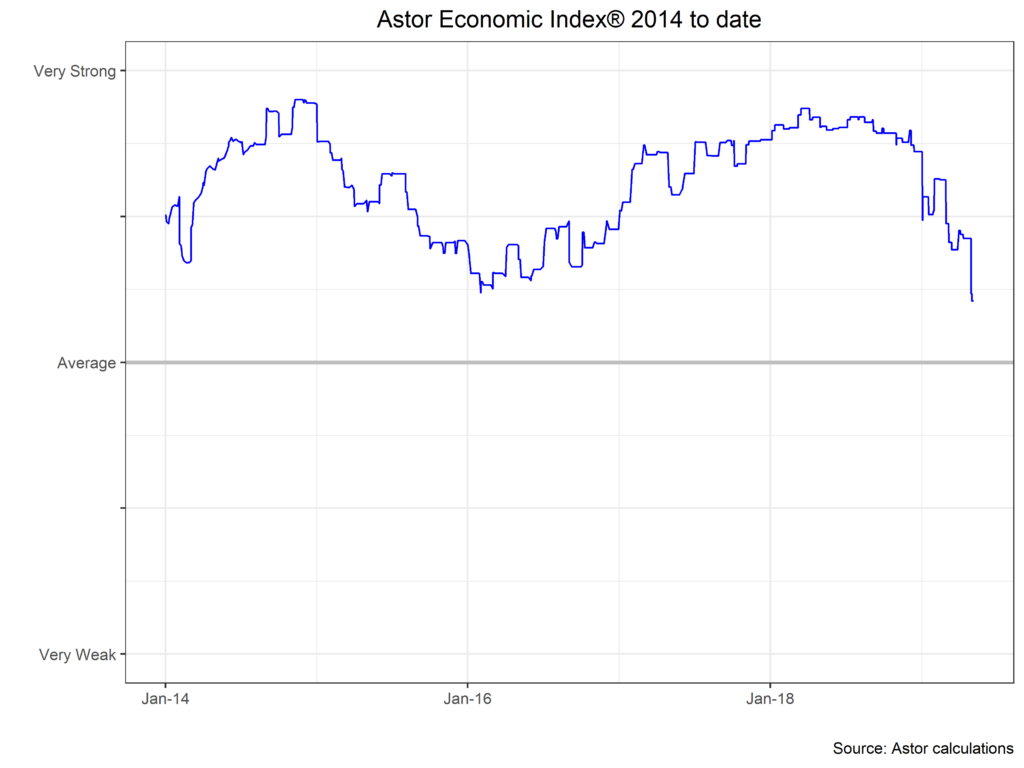

Our proprietary Astor Economic Index® is showing slightly above average growth in the U.S. economy. The index deteriorated last month despite the upward surprise in first quarter GDP growth. While still showing above average growth the index is below where it was during the energy bust of 2016.

First Quarter Growth

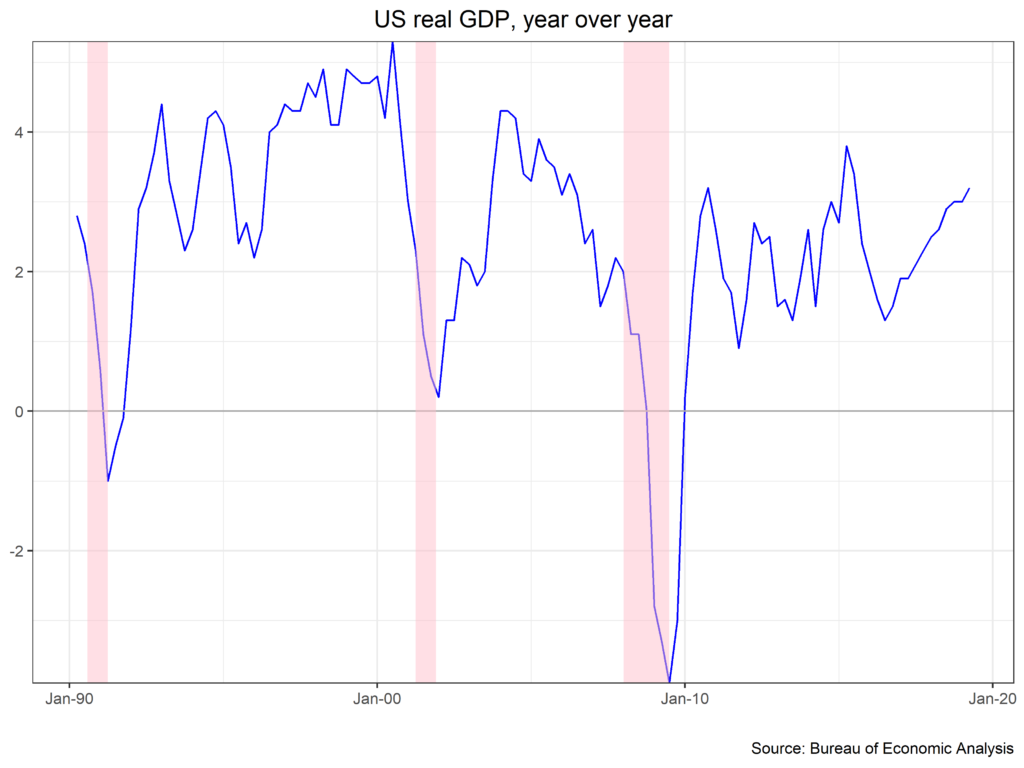

The first reading on Q1 growth is 3.2%. This is better than expected and above what most economists see as the economies potential growth rate. This strong reading was despite the government shutdown and a recent history of first quarter disappointments. A closer look at the guts of the numbers show some potential soft spots. The first is an unusual positive contribution from lower imports. The U.S. runs chronic trade deficits and our increased government borrowing will only exacerbate that tendency. The second is a large build in inventories – these tend to be reversed in subsequent quarters. The concern is that strong Q1 growth cannot be sustained in the case of net exports and will be reversed in the case of inventories.

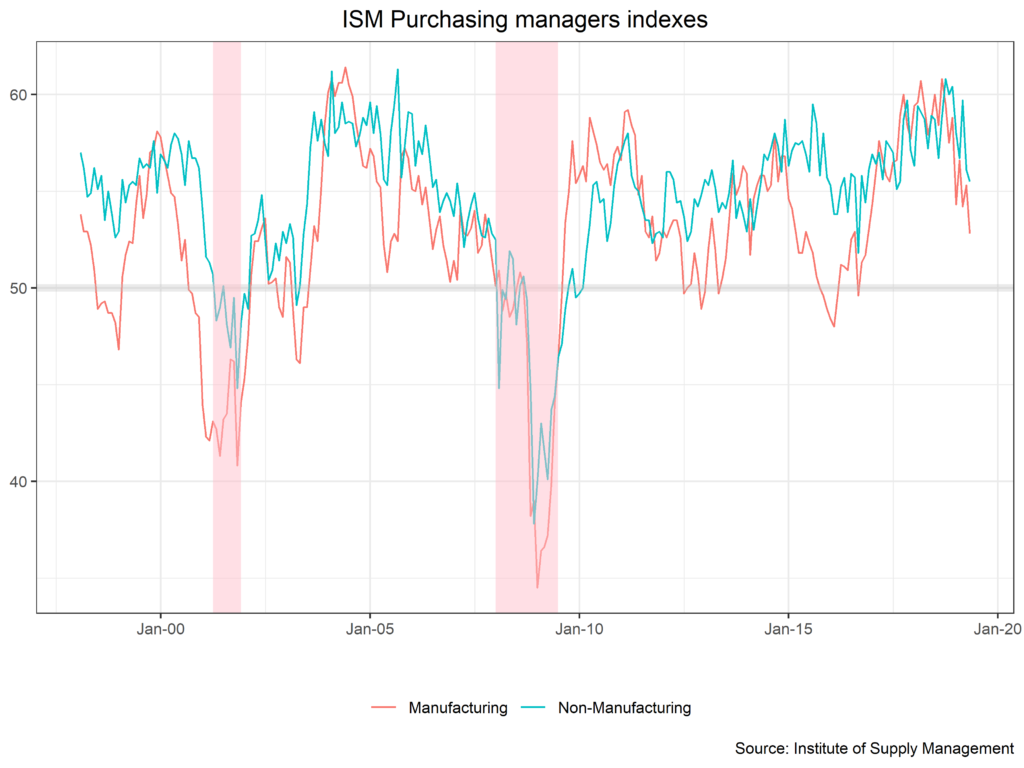

We may be seeing signs of a weaker manufacturing environment in the manufacturing purchasing managers index which has fallen the last few months as can be seen in red in the chart below. This fall started in the fourth quarter of 2018 and so seems unlikely to be due to any inventory correction. The index is not as low it got in 2016, though the services index dropping contemporaneously is a source for concern. We will be watching the evolution of the manufacturing sector especially closely in the coming months.

The Fed Is Patient

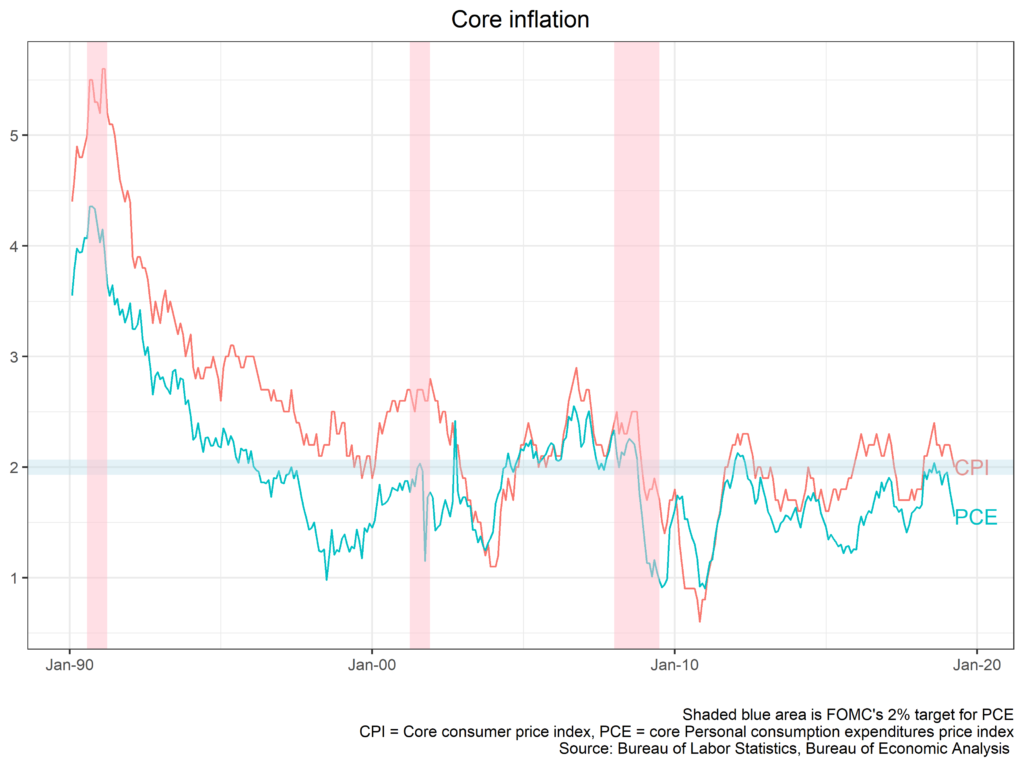

The FOMC is waiting for more data to decide the next move on rates. The market was hoping for forward guidance on cuts coming by the end of the year but no such reassurance was forthcoming. The chart below shows the Fed’s preferred inflation rate (in blue) along with its 2% target. Normally, with unemployment so low, most economists would expect inflation to be accelerating not declining. Why it isn’t is a bit of a puzzle.

With the labor market very strong but inflation below target you can either think of the Fed as having done an excellent job – right now the U.S. is at price stability with maximum employment – or that low inflation is evidence of room to continue to expand the labor force. Chair Jay Powel has not been completely consistent meeting to meeting as to how concerned the committee is with the inflation situation: in March’s press conference he sounded quite concerned but at April’s he seemed to think the current undershoot transitory. Either way, it’s clear the Fed is waiting for the economy and is open to hikes or cuts as the next move

Conclusion

Overall, I still see positive economic growth in the U.S. around potential though recent weakness is concerning.

For still more charts you can see our collection of economic charts or download the Astor Economic Research App from the App Store. As always, we at Astor will be monitoring the economy closely to inform our investment decisions.

Astor Investment Management LLC is a SEC registered investment adviser. All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. They are not intended as investment recommendations. These materials contain general information and have not been tailored for any specific recipient. Astor and its affiliates are not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information. These materials are not intended to cause Astor to become a fiduciary within the definition of Section 3(21)(A)(ii) of the Employee Retirement Income Security Act of 1974, as amended or Section 4975(e)(3)(B) of the Internal Revenue Code of 1986, as amended. There is no assurance that Astor’s investment programs will produce profitable returns or that any account will have similar results. You may lose money. Past results are no guarantee of future results.”

The Astor Economic Index® is a proprietary index created by Astor Investment Management LLC. It represents an aggregation of various economic data points: including output and employment indicators. The Astor Economic Index® is designed to track the varying levels of growth within the U.S. economy by analyzing current trends against historical data. The Astor Economic Index® is not an investable product. When investing, there are multiple factors to consider. The Astor Economic Index® should not be used as the sole determining factor for your investment decisions. The Index is based on retroactive data points and may be subject to hindsight bias. There is no guarantee the Index will produce the same results in the future. The Astor Economic Index® is a tool created and used by Astor. All conclusions are those of Astor and are subject to change.

2019-241