A return to deflation might not be a good thing, even if better than inflation

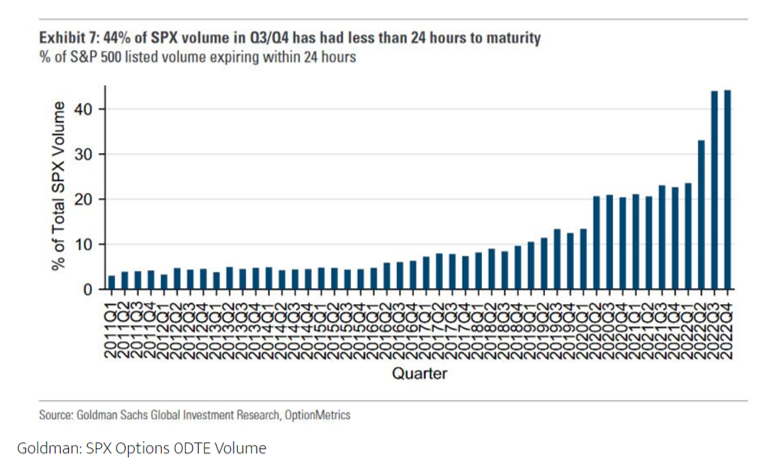

Markets are partying like it’s the 2010s in hopes of rate hikes nearing an end. A sense of deflationary pressures on the horizon have breathed new life into beaten down tech stocks through January 2023. Who is doing the partying? Will the music stop as it did so many times in 2022 with fake rallies? Much of the rally in 2023 has been driven by the most loved retail stocks, often the most shorted by the institutional world. The unwind of hedge fund shorts coupled with increased positioning in the CTA world due to muted volatility and improving correlations between stocks and bonds. Retail is trading in full force both on overall volume and option volume. The birth of zero days to expiration (0DTE) options has changed market structure. Large, quick movements are much more possible. Goldman suggests that options with less than 24 hours to expiration represent 44% of index trading volume.

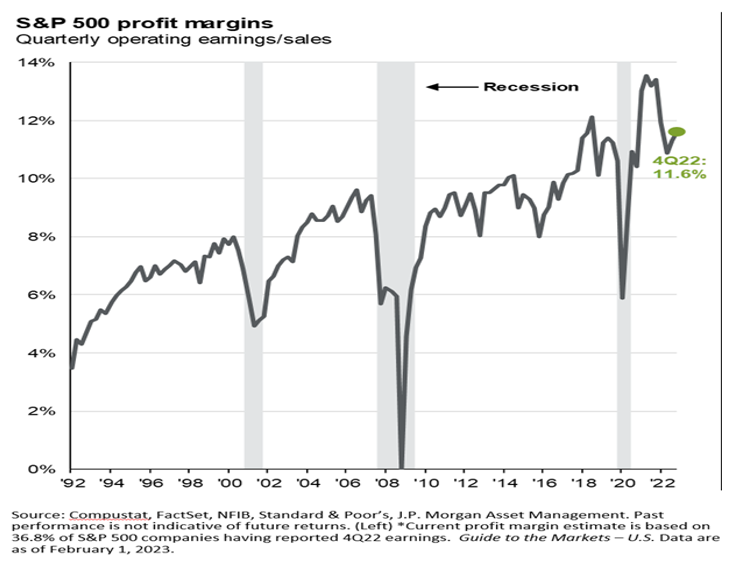

No one seems to believe the Federal Reserve will retain their hawkish stance for nearly as long as they are signaling. All of this might be missing the point that top line growth is sputtering at best, and continuously climbing profit margins will be put into question on many fronts. Growth comes from more hours worked, more wages paid, or productivity.

We’ve recently come off peak earnings margins and now face a wave of global onshoring, or “friendshoring.” This could negatively impact the bottom line, but many are thankful to get back to the “normal” pre-Covid market of 2019, when future growth was all but expected to be obsolete with an aging developed world. Add in friendshoring and tightened geopolitical pressures causing immigration frictions around the world, making the service economy in developed worlds one of the only areas with strong wage growth potential going forward. The social distaste for quantitative easing and its effects on economic stagnation and income inequality from both the anti-MMTers as well as countries within the social movement “Wellbeing Economy Alliance” make the QE-fueled growth cycle that some are hoping for unlikely, at least in the US.

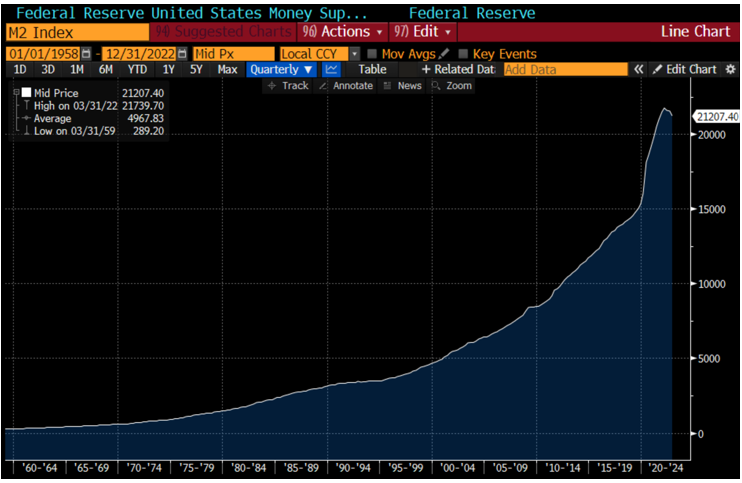

We were terrified of interest rate hikes because of how the markets responded to them in the past. 2022 might have been the year to prove that quantitative tightening is actually much more damaging to liquidity than interest rate hikes. Our anticipated massive multi-year roll off of balance sheet debt that has just begun is almost certainly going to fall off track – it’s a matter of when, not if.

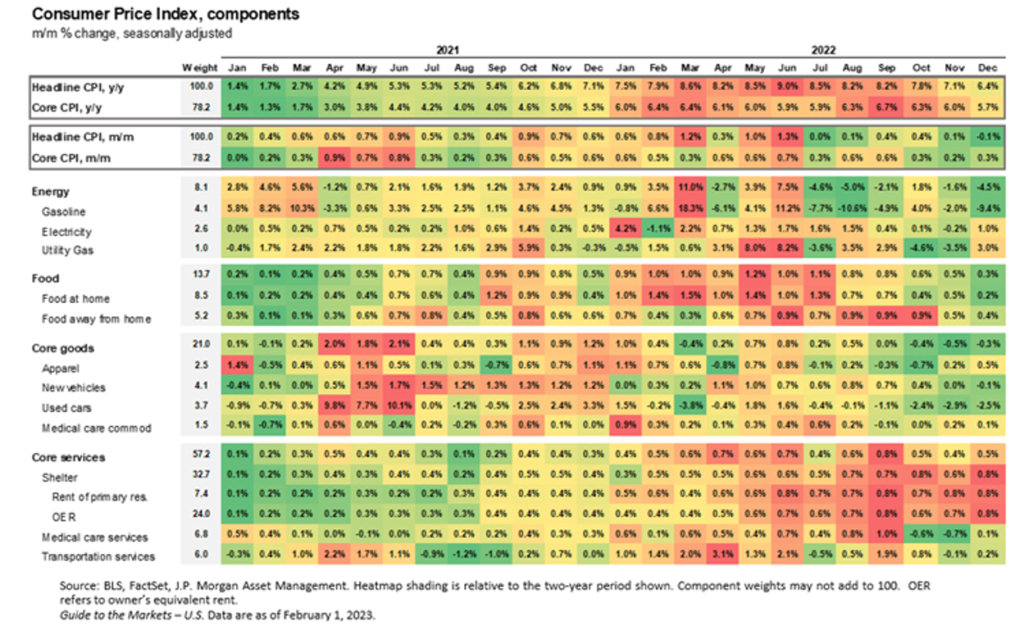

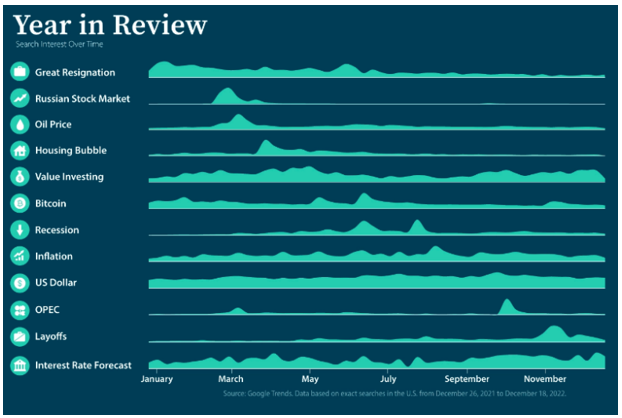

What is Inflation?

Prices are certainly high. Labor markets are certainly tight, even if white collar wage growth and job security is diminishing. The case might be that market participants are confusing high prices of goods and services with perpetually increasing prices. Everything feels expensive. But inflation is a perpetual, continued increase in price, and that is certainly slowing down. Medical care and shelter are two of the remaining categories pushing inflation. While medical care could remain high, it doesn’t take an economist to understand that there is a lot of green in the December 2022 column.

Residential Real Estate, too Big to Fail?

So much of the middle class’s wealth is tied up in home equity. Tied up, by ways of an unmatchable 30-year mortgage that would require a significant downgrade in lifestyle to replace. This has caused artificially low supply and has continued to keep real estate markets from plummeting. There are fewer buyers, but also fewer sellers. The private REIT market has had outflows for the first time in a long time, and funds across the board are reaching quarterly redemption limits. We’ve said time and time again, the length of a recession can be more important than the actual depths of it in a debt-fueled economy. There are only so many institutional investors BREIT can let in ahead of the locked-up retail, to provide liquidity for the retail. Doing so makes the retail investment return prospects that much lower, in turn making redemption requests go up faster. This is a merry-go-round the federal reserve cannot let stop, but it is slowing.

The American Dream was always to own a home. This transitioned into owning a home eventually, after you pay off a mortgage. This transitioned into a world where everyone anticipated a refi every 5 years, and never actually paying off the debt. Then Covid changed our relationship with work and use of personal space. In today’s world, renters just have to wait for rates and prices to fall in hopes of entering the world of homeownership.

What Deflation Could Look Like

More volatility, more mixed signaling, and potentially a good amount of deflationary pressure. The explosion of artificial intelligence that hit the world at a record pace might be one of the most deflationary launches of mankind. What happened to US manufacturing could happen to media and other industries. The effect of AI on white collar wage growth is potentially massive. Potential deflation means the return of negative correlation between bonds and stocks, but the return to previous norms is unlikely to occur as the social stance on QE has significantly been altered. The Chat GDP deflation is actually the rosy one, as increased productivity will lead to overall economic growth. But the other kind of deflation is one where austerity creeps into consumption, with M2 slowing, a low savings rate, and top line revenues taking a hit.

US EQUITIES

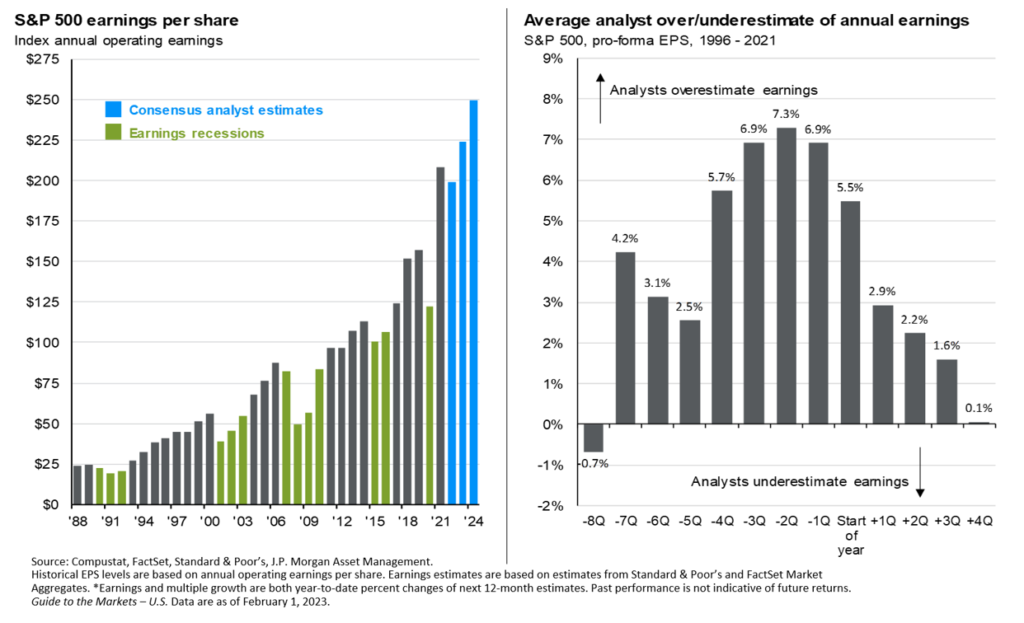

Earnings expectations for 2023 have dropped from a high of $250 all the way down to $225 per share for the S&P 500. This is nothing new – it has been Wall Street’s playbook for over 25 years. The S&P 500 ended 2022 down -18.13%. It has since bounced back to 6.28%. S&P recently changed their growth methodology such that it now includes a 12-month price (momentum) as one of its top factors, leaving energy at around 11% of growth and 2% of value, with Meta in the value side of the portfolio.

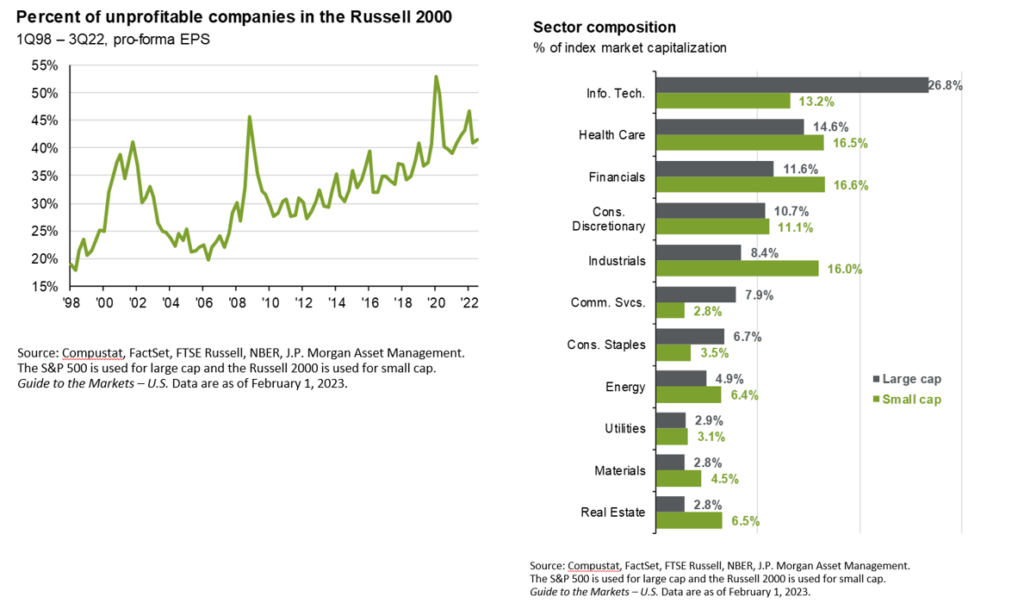

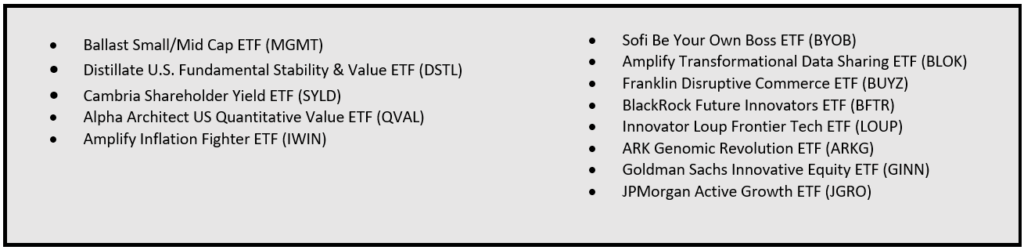

If you look at the sector composition below, you can see how much of the US market is still, despite last year’s pullback, dependent on large cap tech growth stocks. The charge to unprofitability in the small cap space continues onward. Diverse stock pickers with opposing strategies and heavy rebalances between the bunch is the best outcome.

International Developed and Emerging Market Equity

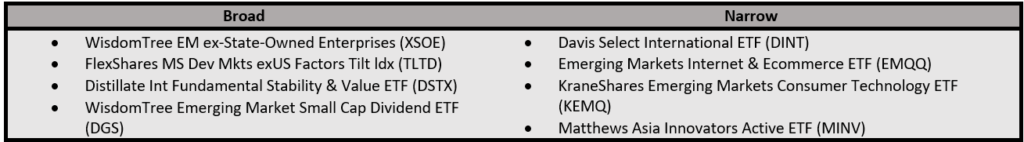

The iShares MSCI EAFE ETF (EFA) returned -14.27% for 2022 and is up 8.56% this year. The iShares MSCI Emerging Markets ETF (EEM) returned -20.55% for 22 and is up 8.54% for January. The reopening of China has unleashed their technology sector, although it is still too early to call this a return of a longer term bull market. Seeking deep value and high growth in the emerging market space makes sense, and selective stock pickers for the broader developed – ex US world. The 15-year reign of outperformance by US equities remains strong, but a turn in the dollar could further increase this yield differentiation to a point where international equities become the ultimate value play, or continued widow maker trade!

FIXED INCOME

iShares Barclays Aggregate Bond ETF (AGG) finished the year down -13.06%, and has bounced back 3.25% for January. Long term treasuries, measured by the PIMCO 25+ Year Zero Coupon US Treasury ETF (ZROZ) are down -41.5% on the year, up 10.98% for January. High yield has held up relatively well, as much of its composition is focused in the energy sector. One of the biggest risks in this market continues to be the massive amount of issuance rated just above high yield in the BBB category. Vehicles meant to protect against rising interest rates offering negative duration saved some investors’ fixed income allocations. The FolioBeyond Rising Rates ETF (RISR) was up 33.6% for 2022, and the Simplify Interest Rate Hedge ETF (PFIX) returned an eye opening 93.8% for 2022. This was one of the worst years for fixed income in history. The yield curve is inverted. Spreads are widening. Mortgage bonds are underperforming as the Fed is a seller. There is ample opportunity here, but active management and curve management is key. The two-year looks extremely attractive at these levels.

Alternatives

Right on cue, as gold was set to disappoint and lose its position to crypto currencies, gold had a strong 4th quarter, ending the year down only -0.82%, and is up 6.12%. Much of it has been timed with the dollars peak in September 2022. In the 3 months ending January 30th, 2023, the dollar is down a staggering 7.49%. After a terrible year, highlighted by platform blowups, crypto is off to a roaring start. We are wary of these short term moves.

A hypothetical high-active-share reconstruction of a traditional 60/40:

• 5% PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ)

• 2% BondBloxx USD High Yield Bond Energy Sector ETF (XHYE)

• 2% Simplify Short Term Treasury Futures (TUA)

• 2% Simplify Managed Futures (CTA)

• 10% Saba Closed,-End Funds ETF (CEFS)

• 2.5% AGFiQ US Market Neutral Anti-Beta Fund (BTAL)

• 1% Ionic Inflation Protection ETF (CPII)

• 1% FolioBeyond Rising Rates ETF (RISR)

• 2.5% WisdomTree Enhanced Commodity Strategy Fund (GCC)

• 1% Tecrium Agricultural Strategy No K-1 ETF (TILL)

• 4% SPDR Gold MiniShares Trust (GLDM)

• 4% Amplify Inflation Fighters ETF (IWIN)

• 5% Amplify Transformational Data Sharing ETF (BLOK)

• 5% Sofi Be Your Own Boss ETF (BYOB)

• 5% Franklin Disruptive Commerce ETF (BUYZ)

• 5% BlackRock Future Innovators ETF (BFTR)

• 4% Ark Genomic Revolution ETF (ARKG)

• 4% Emerging Markets Internet & Ecommerce ETF (EMQQ)

• 5% Ballast Small/Mid Cap ETF (MGMT)

• 5% ETF 6 Meridian Small Cap Equity ETF (SIXS)

• 5% Alpha Architect US Quantitative Value ETF (QVAL)

• 5% Cambria Shareholder Yield ETF (SYLD)

• 5% Distillate International Fundamental Stability Value ETF (DSTX)

• 2.5% Distillate US Fundamental Stability & Value ETF (DSTL)

• 2.5% GS Innovative Equity (GINN)

• 5% Mathews Asia Innovators Active (MINV)

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).