Asymmetrical risk and reward has always been a dilemma for fixed income investors, and the benefits are even more difficult to assess in the current environment. When thinking of fixed income, there is always more potential downside risk, and plain bond math would indicate that the upside is limited when you have a security with a defined maturity at par value. With limited upside potential, investors really want to know that they are being compensated fairly when risks are elevated as they are currently. That is where the relative value comes into play. Fixed income securities are generally priced based on their yield relative to other bonds of similar risk characteristics, such as duration, credit quality, or risks around optionality. Sectors within fixed income can also be assessed for value relative to each other while taking into consideration the historical spread levels. While each security and sector have different risks to be considered, one common risk is liquidity which has impacted most fixed income products this year as we saw in the spring. Liquidity can be the biggest risk of them all and can send bond prices in some sectors down almost as much as equities.

Bond investors come in many shapes and sizes. To understand this concept, we should consider the different purposes that fixed income can play in a portfolio. Income, diversification from equity risk, and institutional asset-liability management are good examples of fixed income usage. Because of this, assessing value may differ for each type of investor. Traditionally, value in fixed income is assessed on a relative basis. However, in the post Great Recession environment with fewer market makers and more regulation, any bond investor can fall short of their goal due to liquidity risks.

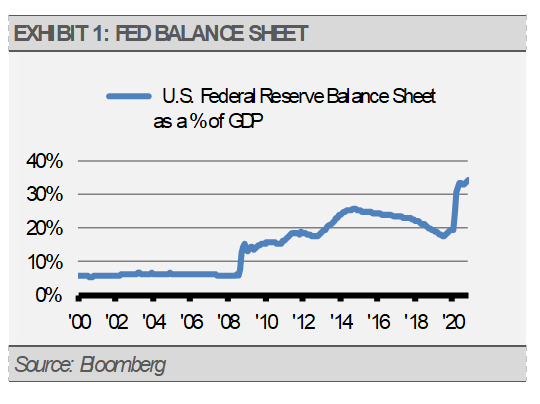

The long-discussed risks due to a lack of fixed income market makers and regulation finally came to fruition recently and exposed even the most solid and well researched bonds to meaningful downside risk. Luckily, the U.S. Federal Reserve (the Fed) jumped in to support several bond market sectors, such as corporate bonds and municipals, with unprecedented purchases. The Fed even went as far as purchasing high yield bonds and fixed income ETFs. The chart below is a good illustration of the Fed’s involvement in providing liquidity for fixed income markets this year.

Now that things seem to be settling down and markets are functioning again, there is still the question of whether or not a market that provides record low yields, limited upside, and the potential for almost equity like downside makes sense at all. Some sectors of the bond market may not be the right answer for investors looking for risk diversification. Assuming the Fed’s stance with respect to quantitative easing and asset purchases is not impacted by a change of power in the White House, we expect the Fed to continue purchases of U.S. Treasuries and agency Mortgage-Backed Securities through the end of 2021 at the current pace according to the recent FOMC minutes. These purchases should slow down in 2022 and 2023. Purchases of corporate bonds, high yield bonds, non-agency MBS, and municipal bonds are set to expire at the end of the year, which will expose those spread sectors to more liquidity risk.

Unlike the changes after 2008, which allowed for the continuous purchases of agency Mortgage-Backed Securities, the liquidity facilities and tools used to prop up spread sector markets this time will expire. In the case of COVID-19, there was no moral hazard case making it easier for Congress to pass legislation to support credit markets. Essentially, navigating this market may not be as easy as it was during previous times of crisis. In the absence of the Fed, these sectors would be at higher risk for liquidity events and higher correlations to equities.

In this environment, we remain relatively benchmark neutral to overweight in mortgage-backed securities and U.S. Treasuries within our fixed income exposure. We have moved some of our allocations to active management in the hopes of better navigating the other risks associated with optionality, credit, and interest rates.

Originally published by Stringer Asset Management

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.