By Solomon G. Teller, CFA, Chief Investment Strategist, Green Harvest Asset Management

Assessing the after-tax performance of a tax-beneficial strategy may appear intuitive but can be surprisingly complex. For one thing, investors are often more familiar with observing pre-tax performance numbers. When you hear about the incredible performance of hedge fund xyz, it’s often reported in pre-tax terms. But many hedge funds are not tax efficient. On average, according to Greenline Partners, hedge fund investors only keep “about 40 percent of gross returns after fees and taxes.” In other words, a 10% pre-tax return would only equate to a 4% after-tax return.

Assessing the after-tax performance of a tax-beneficial strategy may appear intuitive but can be surprisingly complex. For one thing, investors are often more familiar with observing pre-tax performance numbers. When you hear about the incredible performance of hedge fund xyz, it’s often reported in pre-tax terms. But many hedge funds are not tax efficient. On average, according to Greenline Partners, hedge fund investors only keep “about 40 percent of gross returns after fees and taxes.” In other words, a 10% pre-tax return would only equate to a 4% after-tax return.

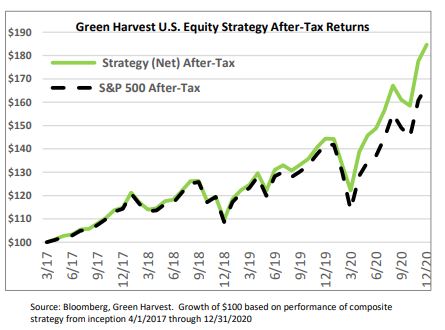

Tax-beneficial strategies, such as Green Harvest’s U.S. Equity Strategy (see chart), that seek to capture tax benefits (by capturing or harvesting realized capital losses), can help offset this tax cost and offer comparatively better after-tax returns. In assessing the after-tax performance calculations of any particular strategy, investors should be mindful how after-tax performance is calculated. It’s based on assumptions surrounding applicable tax rates and other factors and should determine how they might apply to their particular situations. Beyond that, there is at least one way in which the investors’ real-life after-tax returns may actually be underestimated and one way in which they are potentially underappreciated:

1. Compounding – Stated after-tax returns over multiple periods often ignore the benefits of compounding. In real life, tax savings may be reinvested and can grow over time. For instance, investors who captured tax benefits and successfully reduced their tax burden in 2020 may go on to reinvest those savings in 2021. The outperformance versus the benchmark – such as that shown in the chart above – does not include the reinvestment of prior tax alpha and nor will any growth from reinvesting the current accumulated tax alpha be applied to future after-tax calculations. As many investors are aware, however, the benefits of compounding over multiple years can lead to enormous gains. Thus in practice, tax benefits captured in earlier years can be even more valuable.

2. Risk – Unlike other forms of excess performance, tax beneficial strategies do not require taking significant additional risks. It is commonly understood that risk and return are related, such that more return often comes with more risk. For instance, many active managers intentionally deviate from a designated benchmark to seek out higher returns. Those deviations may lead to outperformance, but obviously could also lead to underperformance. On the other hand, tax beneficial strategies employing loss harvesting typically seek to minimize significant risks or deviations from a target benchmark. As a next step, investors and their advisors should ask themselves two questions:

- Do I have positions with unrealized gains that I would like to reduce exposure to and/or are realized gains expected from other parts of my portfolio or financial situation?

- Can I remain invested in a tax beneficial strategy for at least a year?

If the answer to both questions is yes, then it’s time to learn more about tax beneficial investing. Contact us for more information.

Download Our White Paper: Future Value of Tax Benefits

Disclaimers:

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when the portfolio is liquidated. Current performance may be higher or lower than that quoted. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

GHAM does not provide tax advice. Although GHAM does not employ a Certified Public Accountant on its staff, we have, and continue to work with outside accounting firms and outside tax counsel that provide ongoing guidance and updates on all relevant tax law. Federal, state and local tax laws are subject to change. GHAM is not responsible for providing clients updates on any changes in tax laws, rules or statutes.

Reasons to harvest capital losses, sources of capital gains and the suggestion that mutual funds distribute capital gains are for example purposes only and not meant to be tax, estate planning or investment advice in any form or for any specific client.

All performance and estimates of strategy performance, after tax alpha, after tax alpha opportunities and other performance figures are derived from data provided from multiple third-party sources. All estimates were created with the benefit of hindsight and may not be achieved in a live account. The data received by GHAM is unaudited and its reliability and accuracy is not guaranteed.

The availability of tax alpha is highly dependent upon the initial date and time of investment as well as market direction and security volatility during the investment period. Tax loss harvesting outcomes may vary greatly for clients who invest on different days, weeks, months and all other time periods.

All estimates of past returns of broad, narrow, sector, country, regional or other indices do not include the impact of advisor fees, unless specifically indicated. Past performance and volatility figures should not be relied upon as an indicator of future performance or volatility.

This material is not intended to be relied upon as legal, investment or tax advice in any form or for any specific client. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. All investments carry a certain degree of risk, and there is no assurance that an investment will perform as expected over any period of time.

As a convenience to our readers, this document may contain links to information created and maintained by third party sites. Please note that we do not endorse any linked sites or their content, and we are not responsible for the accuracy, timeliness or even the continued availability or existence of this outside information. While we endeavor to provide links only to those sites that are reputable and safe, we cannot be held responsible for the information, products or services obtained from such other sites and will not be liable for any damages arising from your access to such sites.

Hedged Strategies Risk

The Hedged Strategies take “short” positions by selling an index ETF that the client portfolio does not own, which exposes the portfolio to costs and risks that are not associated with owning securities long. Certain of these costs and risks are described in the margin disclosure statement provided to you by the financial institution holding your account, and we encourage you to discuss those risks and costs with your advisor. The following disclosure discusses the risks related to Green Harvest’s investment strategy.

A short position has an opposing or “inverse” relationship to a long position on the same asset. Generally, the short index position will lose money when the overall long portfolio is rising in value, and the short position will increase in value when the long portfolio is losing money. This relationship provides the “hedging” aspect of the Strategy. Green Harvest seeks to short an index ETF that is expected to have a strong inverse relationship with the strategy benchmark. If the index ETF underlying the short position deviates from this inverse correlation to the benchmark performance, then the Strategy will not perform as desired, and you could have limited tax loss harvesting outcomes as well as low or negative portfolio returns. Although the short position is intended as a hedge against negative or low returns of the markets, the Strategy’s return may be negative. Any dividends paid

by ETFs underlying the short position must be paid to the institution lending the security and thus will not generate income for your account.

Tax loss harvesting opportunities exist when the long portfolio has gains and when the short position has losses. Portfolio losses may result in margin calls from your financial institution, and when you instruct Green Harvest to sell portfolio assets in response to margin calls, such sales could generate taxable capital gains. Alternatively, you will be required to add cash to the account in response to margin calls.

Short positions can lead to more volatile performance of the underlying security. In addition, the ETFs underlying short positions may experience periods of low trading volume or reduced liquidity, which would restrict the ability to enter short positions. In these periods, Green Harvest can seek to enter short positions through other available transactions, which may have higher transaction costs. All investments are subject to liquidity risk, especially when markets are not functioning normally. If Green Harvest is unable to acquire or dispose of holdings quickly or at prices that represent perceived market value, then the Strategy will be negatively impacted. Examples of events that can lead to heightened liquidity risk include domestic and foreign economic crises, natural disasters, political instability, and regulatory changes.

GREEN HARVEST ASSET MANAGEMENT LLC Disclosure Related to After-Tax Performance

The Composite includes all portfolios managed by Green Harvest Asset Management LLC according to Strategy. The Strategy’s after-tax returns are calculated using actual before-tax returns that have been adjusted to estimate the benefits of using tax losses harvested to offset capital gains and reinvesting the resulting tax savings in the portfolio. For short-term and long-term capital gains realized in each client account, the after-tax return calculation uses the maximum federal tax rates applicable during the tax years shown, which were 40.8% and 23.8%, respectively. For dividend income received in each account, the estimate assumes the maximum federal tax rate of 40.8% applicable to ordinary income. The after-tax returns are hypothetical and may not reflect clients’ actual after-tax performance due to differences in tax rates and other circumstances. As examples, clients with lower applicable tax rates, capital loss carryforwards or no capital gains outside the portfolio are likely to experience lower levels of after-tax returns. In addition, the tax savings and reinvestment are assumed to occur in the tax year, although tax savings are not available during the tax year, and any reinvestment of such savings would occur following the tax year.

Green Harvest has approximated after-tax returns for the benchmark by increasing the Index’s monthly price returns by its dividend yield after applying a 32.3% tax rate, which assumes that half of dividends are taxed at the 23.8% rate applicable to qualified dividends and the other half at the 40.8% rate for ordinary income. Benchmark after-tax returns are provided for informational purposes only and are not intended as a measure of Green Harvest’s tax alpha compared to the benchmark. Significant differences between the calculation methodologies for Strategy and benchmark after-tax returns limit comparability between the returns. For example, the benchmark returns do not include the after-tax impact of capital gains, and different rates have been applied to dividend income.