Investors become myopic during bubbles. They believe the universe of attractive investment opportunities is small and growth can be found only in a few select sectors. As we’ve repeatedly highlighted, it is exactly that narrow-mindedness that presents opportunities because investors ignore the broad range of potential investments outside the bubble.

Today’s bubbles are following that precedent. Investors are squarely focusing on technology, innovation, disruption, cryptocurrencies, and housing, but very little else. They seem enamored with vacations in outer space and electric vehicles, yet ignore the dire need for improving US logistical and electrical infrastructure.

Ironically, many equity markets around the world not known as hotbeds of innovation and disruption are outperforming NASDAQ so far during 2021. Our guess is most investors are completely unaware of the fundamentals supporting these markets’ outperformance.

Chart 1: Equity markets outperforming NASDAQ 100 year-to-date

Source: Richard Bernstein Advisors LLC. MSCI, Bloomberg Finance L.P. For Index descriptors, see “Index Descriptions” at end of document.

Bubbles’ misallocation of capital creates opportunities

Bubbles misallocate capital within the economy. Investors often extrapolate shorter-term price momentum for longer-term potential returns, but bubble sectors attract too much capital which actually lowers future returns. Too much capital chases too few ideas. However, the overcapitalization of bubble sectors means non-bubble sectors become relatively starved for capital and ultimately provide better long-term returns.

The romantic futuristic stories that often fuel bubbles may indeed come true within the economy, but that doesn’t mean bubble assets outperform. Bubble assets’ valuations often discount potential returns very far into the future. Chart 2 demonstrates if one had bought the NASDAQ 100 Index in December 1999 (i.e., months before the bubble burst), it would have taken 14 years for investors to simply break even.

The energy sector at the time was probably the sector most starved for capital. As the Tech Bubble deflated, capital naturally flowed to assets with higher rates of return, and the S&P 500® Energy sector tripled over the same 14-year period during which tech investors broke even.

Chart 2: NASDAQ 100 vs S&P 500® Energy Sector

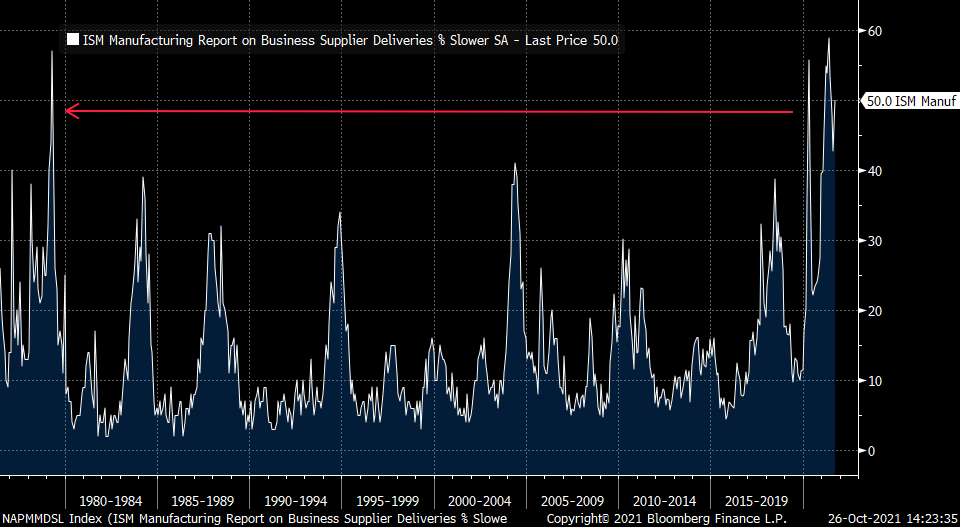

The flow of capital to outer space-related stocks is perhaps today’s most stark misallocation of capital within the equity market. There are significant and potentially long-lasting logistical problems here on earth that reflect significant under-investment similar to 1980/90s’ under-investment in the energy sector. Chart 3 highlights today’s delivery delays haven’t been seen since the 1970s.

Chart 3: ISM Manufacturing: Percentage of Slower Supplier Deliveries

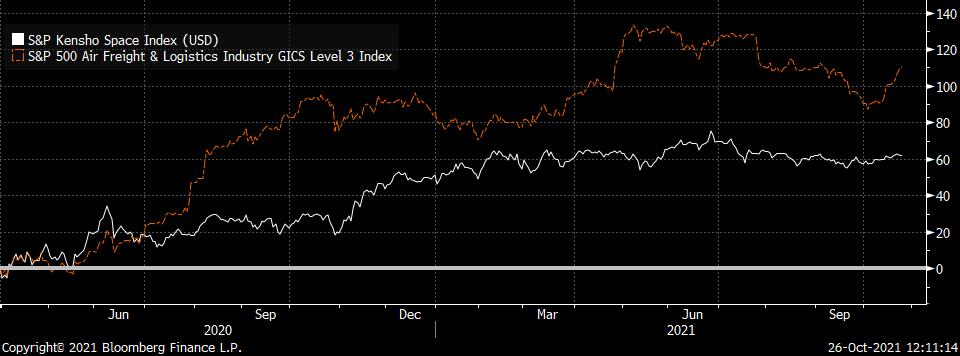

Just as investors ignored the opportunities in the energy sector during the Technology Bubble, today’s investors continue to flood space-related companies with capital regardless of the significant need for capital in boring earth-bound logistical infrastructure. As the basic rules of investment suggest, too much capital is indeed hindering returns. Despite all the hoopla about Star Trek-like ventures into space, earth-bound logistics companies have been significantly outperforming space stocks during the recovery from the pandemic (See Chart 4).

Chart 4: S&P Kensho Space Index vs. S&P 500® Air Freight & Logistics Index

It doesn’t matter when the bubble bursts. Historically, it’s been a bad idea to invest in a bubble.

Some investors discount concerns about the current set of bubbles because no one truly knows when the bubbles will burst. Without precise timing, they prefer to stay invested in bubble assets for fear of missing out on further momentum.

However, our research shows one could invest in non-bubble assets without the knowledge of a bubble’s peak and still get better long-term returns. The data suggest not knowing when a bubble will burst justifies diversification away from the bubble rather than myopically focusing on bubble assets and potentially missing returns.

The table below compares the returns of small cap value, financials, and energy to the NASDAQ 100 (i.e., the “real” technology companies). The vertical axis shows how early one would have bought the sector rather than the NASDAQ 100, whereas the horizontal axis represents various end points.

The other assets outperformed the NASDAQ 100 even if one bought several years early before the bubble popped. This seems to strongly support our notion that return on investment is highest when capital is scarce. The misallocation of capital toward the technology sector during the bubble so hindered returns for years to come that it didn’t matter if investors mistimed the absolute peak of the bubble. In most cases, investors’ returns were superior in the other assets even if one totally missed the entire technology bubble (i.e., investing a full 5 years before the bubble burst).

Table 1: Market Timing & Performance: Non-Bubble Assets vs. Bubble Assets

Source: Richard Bernstein Advisors LLC. For Index descriptors, see “Index Descriptions” at end of document.

Note: All time periods are relative to the Tech Bubble peak (March 27, 2000) and trough (October 9, 2002)

The performance of emerging markets shows similar results. Chart 5 compares the returns of the MSCI Emerging Markets Index to the NASDAQ 100 from December 31, 1998 (i.e., more than a year before the technology bubble burst). If one had invested in emerging markets one certainly would have underperformed during the bubble period, but emerging markets ultimately outperformed. Judging by the first table in this report, the rotation from NASDAQ to other parts of the world may be starting.

Chart 5: MSCI Emerging Markets Index vs. NASDAQ 100 Index

Don’t be excited over excitement

Bubbles build on the combination of liquidity and hype, and the current set of bubbles in long-duration assets has had plenty of both. Investors must remember that return on investment is typically highest when capital is scarce.

Hype and stories are fun, but our portfolios are built on fundamentals. Whereas consensus is focused on technology, innovation, disruption, cryptocurrencies, and the like, we will continue to follow our process that right now argues there is, literally, a world of opportunity.