By Kevin Nicholson, CFA

Since the beginning of the year, the yield on the ten-year Treasury has risen by approximately 80 basis points, delivering a return of -6.37%, which brings to the forefront that bonds can lose value when yields rise, especially when yields start at such low levels (see table below). While this is not the first time that bonds have underperformed in history, the move up in yield of the 10-year Treasury resembles that of the Taper Tantrum that began in May 2013. The Taper Tantrum was a reaction to the Federal Reserve (Fed) announcing that it was going to reduce its bond buying program known as Quantitative Easing (QE). In just a month, the 10-year Treasury yield went from 1.63% to 2.13%, eventually peaking in September at 3.00%. It is often stated that history is our guide and if we do not know our history, we are doomed to repeat it. Therefore, as fixed income investors we must know our fixed income neighborhood; whether our bonds have long or short maturities.

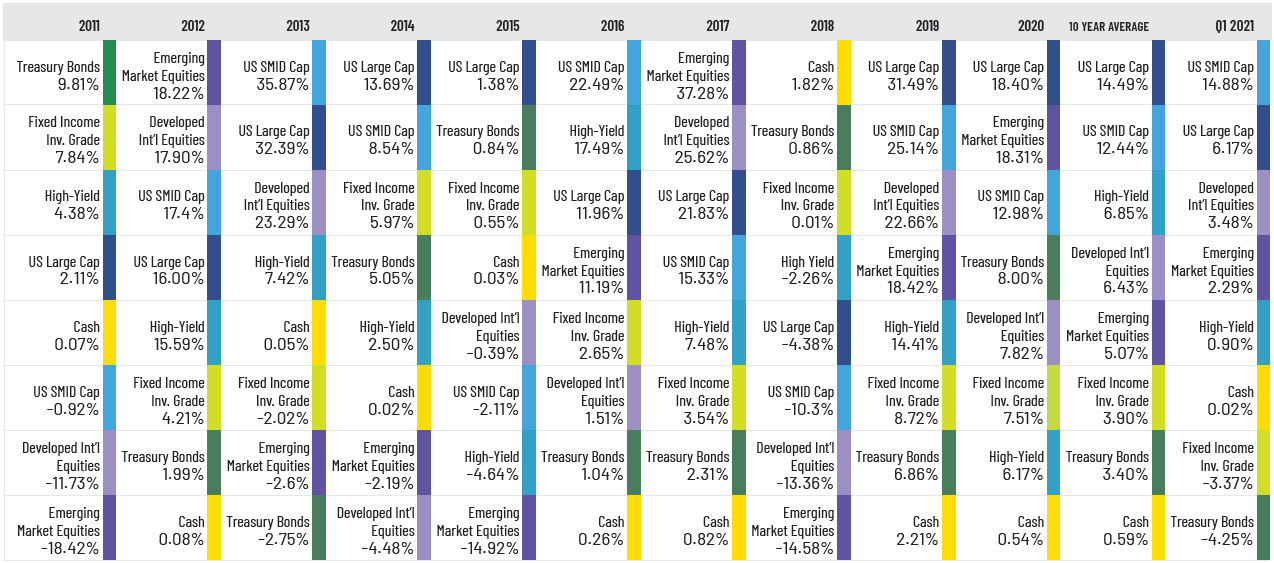

Returns of Asset Classes by Calendar Year (as of 03.31.2021)

Source: Morningstar Direct, RiverFront. 10-year average is the average of the annual returns listed for each category. Past performance is no guarantee of future results. Diversification does not guarantee a profit or eliminate the risk of loss. Index returns are provided for informational purposes and are not indicative of RiverFront portfolio performance. Q1 2021 data through March 31, 2021.

Historically, fixed income has played an important role in investors’ portfolios. For some, fixed income served as the income vehicle in portfolios that allowed investors to retire and live comfortably, receiving the interest payments without touching their principal. For others, fixed income was used to help offset the risk in the equity portion of their portfolio. Owning bonds provided peace of mind for investors who bought high quality US Treasuries. Unfortunately, times have changed as the bull market in bonds drove yields to historic lows and signs of yields reversing course create added risk for bond investors. We believe that it is important for investors to understand the impact of yield movements prior to investing in the asset class, as we have seen a significant move up in rates to start 2021.

Eight years have passed since the Taper Tantrum but somehow it feels like déjà-vu, as the 10-year Treasury currently yields near 1.70% and the US economy is accelerating after a year of pandemic lockdowns. Additional pressure on bonds will likely come from the growing fiscal policy that has added nearly $3 trillion of stimulus over 5 months and proposed a $2.25 trillion infrastructure deal in concert with the Fed’s $120 billion per month in monetary stimulus. These conditions are leading some analysts to predict that the Fed will not be able to stick to their zero-interest policy and will have to raise interest rates earlier than the 2023 timeframe that most expect. While yields have already moved up considerably over the first 3 months of the year, using the Taper Tantrum as our guide, we could see yields rise another 50 basis points to around 2.20%.

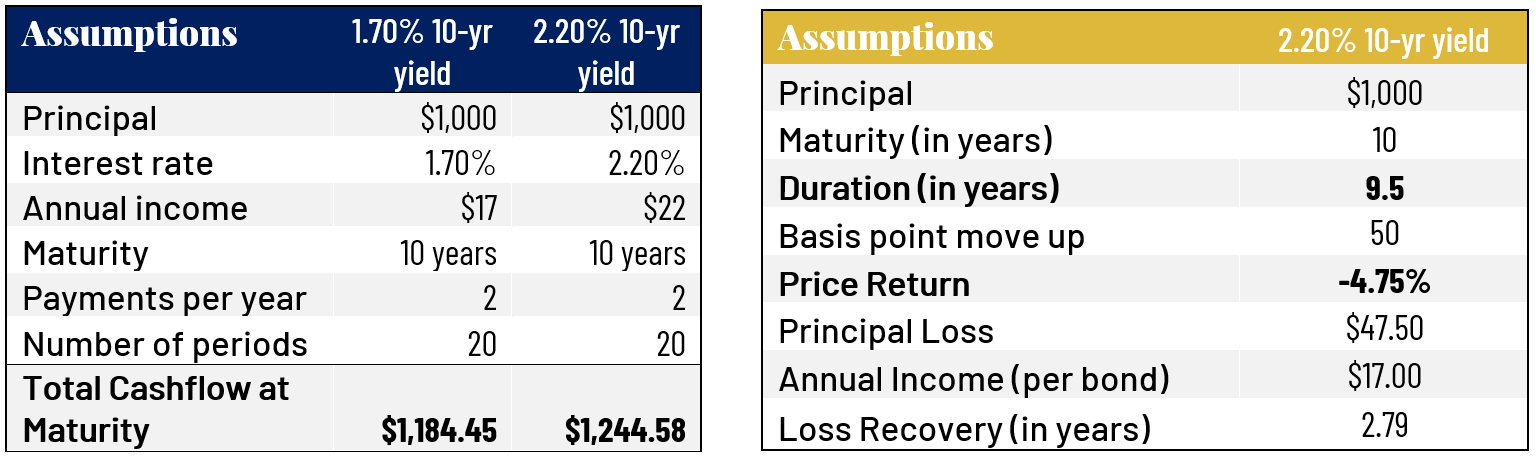

How long to recover your losses – an example:

Based on the approximate yield on the 10-year Treasury of 1.70%, if bond yields rise to 2.20%, that equates to a decline in the price of the ten-year Treasury of approximately 4.75%. It would take 2.79 years of receiving income of $17 per $1,000 bond just to cover a 50-basis point move higher in yields as illustrated in the chart below.

Traditionally, investing in treasuries has been viewed as a risk-free investment because investors received semi-annual interest payments and their principal back at maturity. However, to think bonds are without risk is a misnomer. As we have illustrated investors can face the risk of principal erosion if yields move dramatically higher and they elect to sell the bond prior to maturity. Under this scenario, interest payments are used to offset principal losses when calculating the total return of the investment prior to maturity. For those investors that choose to hold the bond until maturity, they are foregoing their true earning potential as they will be earning a below market interest rate.

While we have focused on interest rates moving higher from current levels, it is possible that rates could go lower if the economic recovery hits a snag. Therefore, it is important that we point out, if yields were to fall by 50 basis points, there would be a positive 4.75% price return on the 10-year Treasury if sold prior to maturity but the investor would not be maximizing their income potential. We point out these nuances, so that investors understand the implications of interest rate moves prior to making an investment.

Here at RiverFront, we believe that given the abundance of fiscal and monetary stimulus it is more likely that the 10-year Treasury yield will rise to 2.20% than fall to 1.20%. Thus, we continue to underweight fixed income as we expect equities to provide a better total return for our investors. By knowing the fixed income neighborhood, we understand the ramifications of our decisions, and we believe it is important for individual investors who have experience various parts of the bond bull market to do the same.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1600238