By Solomon G. Teller, CFA, Chief Investment Strategist

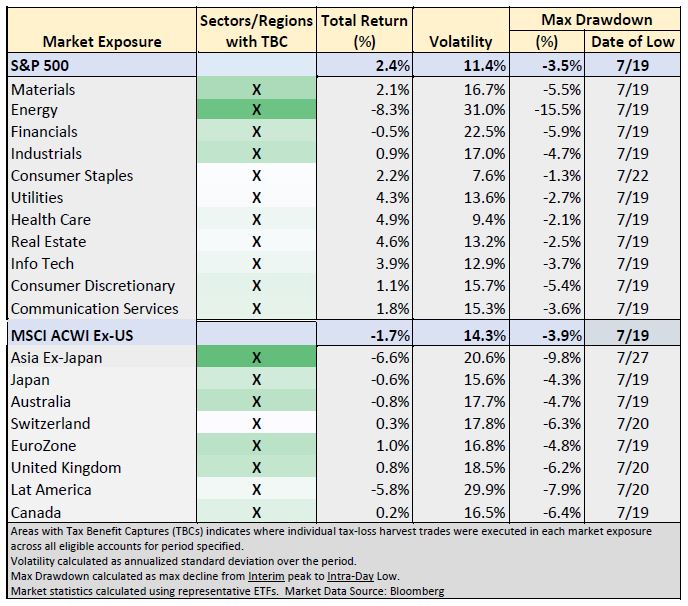

Markets retreated in July, providing opportunities for Tax Benefits Capture (TBC) or Tax Loss Harvesting. But then, in the latter half of the month, markets rebounded, ending in the green. Overall, the S&P 500 gained 2.3% in July – its sixth straight month of gains – culminating in 18.0% year to date and doubling in value since its March 23, 2020 bottom. Here are highlights of Green Harvest Asset Management’s TBC activity last month along with accompanying statistics in the table on page 2:

- While many stocks dipped, one sector and one region each declined considerably more than others, enabling targeted and meaningful TBC.

- The Energy sector fell over 15.5%, far and away the biggest sufferer in July’s pullback. Energy sector trades comprised fully 1/3 of all U.S. Equity TBC related trading.

- Asian stocks were hit hard last week amid news of tightening Chinese regulations. Asian stocks rebounded after the news somewhat, but not before we were able to capture further tax benefits.

- Accounts invested in Green Harvest’s flagship U.S. Equity strategy at the beginning of July achieved a cumulative TBC of between 1.5% and 2.0%.1

- Much of the TBC-related trading occurred during the day on July 19th, when many sectors and regions were bottoming.

- As positions with realized losses were sold, similar but not identical positions were simultaneously purchased that kept clients invested in the subsequent rebound.

The markets’ continued ability to decline and rebound within short periods is a reminder of the importance of a strategy that nimbly captures tax benefits – while also ensuring that portfolios remain invested every day.

Hoping you have a great August.

1 In comparison, the S&P 500’s maximum decline through mid-month was 0.85%. Cumulative TBC percentage reflects cumulative realized losses as a percentage of starting account values in cash accounts only; i.e., accounts with existing legacy positions were excluded.

Market Data and Green Harvest TBC Heat Map Summary for the month of July 2021:

Disclaimers:

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when the portfolio is liquidated. Current performance may be higher or lower than that quoted. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

GHAM does not provide tax advice. Although GHAM does not employ a Certified Public Accountant on its staff, we have, and continue to work with outside accounting firms and outside tax counsel that provide ongoing guidance and updates on all relevant tax law. Federal, state and local tax laws are subject to change. GHAM is not responsible for providing clients updates on any changes in tax laws, rules or statutes.

Reasons to harvest capital losses, sources of capital gains and the suggestion that mutual funds distribute capital gains are for example purposes only and not meant to be tax, estate planning or investment advice in any form or for any specific client.

All performance and estimates of strategy performance, after tax alpha, after tax alpha opportunities and other performance figures are derived from data provided from multiple third-party sources. All estimates were created with the benefit of hindsight and may not be achieved in a live account. The data received by GHAM is unaudited and its reliability and accuracy is not guaranteed.

The availability of tax alpha is highly dependent upon the initial date and time of investment as well as market direction and security volatility during the investment period. Tax loss harvesting outcomes may vary greatly for clients who invest on different days, weeks, months and all other time periods.

All estimates of past returns of broad, narrow, sector, country, regional or other indices do not include the impact of advisor fees, unless specifically indicated. Past performance and volatility figures should not be relied upon as an indicator of future performance or volatility.

This material is not intended to be relied upon as legal, investment or tax advice in any form or for any specific client. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. All investments carry a certain degree of risk, and there is no assurance that an investment will perform as expected over any period of time.

As a convenience to our readers, this document may contain links to information created and maintained by third party sites. Please note that we do not endorse any linked sites or their content, and we are not responsible for the accuracy, timeliness or even the continued availability or existence of this outside information. While we endeavor to provide links only to those sites that are reputable and safe, we cannot be held responsible for the information, products or services obtained from such other sites and will not be liable for any damages arising from your access to such sites.

Hedged Strategies Risk

The Hedged Strategies take “short” positions by selling an index ETF that the client portfolio does not own, which exposes the portfolio to costs and risks that are not associated with owning securities long. Certain of these costs and risks are described in the margin disclosure statement provided to you by the financial institution holding your account, and we encourage you to discuss those risks and costs with your advisor. The following disclosure discusses the risks related to Green Harvest’s investment strategy.

A short position has an opposing or “inverse” relationship to a long position on the same asset. Generally, the short index position will lose money when the overall long portfolio is rising in value, and the short position will increase in value when the long portfolio is losing money. This relationship provides the “hedging” aspect of the Strategy. Green Harvest seeks to short an index ETF that is expected to have a strong inverse relationship with the strategy benchmark. If the index ETF underlying the short position deviates from this inverse correlation to the benchmark performance, then the Strategy will not perform as desired, and you could have limited tax-loss harvesting outcomes as well as low or negative portfolio returns. Although the short position is intended as a hedge against negative or low returns of the markets, the Strategy’s return may be negative. Any dividends paid by ETFs underlying the short position must be paid to the institution lending the security and thus will not generate income for your account.

Tax-loss harvesting opportunities exist when the long portfolio has gains and when the short position has losses. Portfolio losses may result in margin calls from your financial institution, and when you instruct Green Harvest to sell portfolio assets in response to margin calls, such sales could generate taxable capital gains. Alternatively, you will be required to add cash to the account in response to margin calls.

Short positions can lead to more volatile performance of the underlying security. In addition, the ETFs underlying short positions may experience periods of low trading volume or reduced liquidity, which would restrict the ability to enter short positions. In these periods, Green Harvest can seek to enter short positions through other available transactions, which may have higher transaction costs. All investments are subject to liquidity risk, especially when markets are not functioning normally. If Green Harvest is unable to acquire or dispose of holdings quickly or at prices that represent perceived market value, then the Strategy will be negatively impacted. Examples of events that can lead to heightened liquidity risk include domestic and foreign economic crises, natural disasters, political instability, and regulatory changes.