By Kimberly Woody, Senior Portfolio Manager, GLOBALT Investments

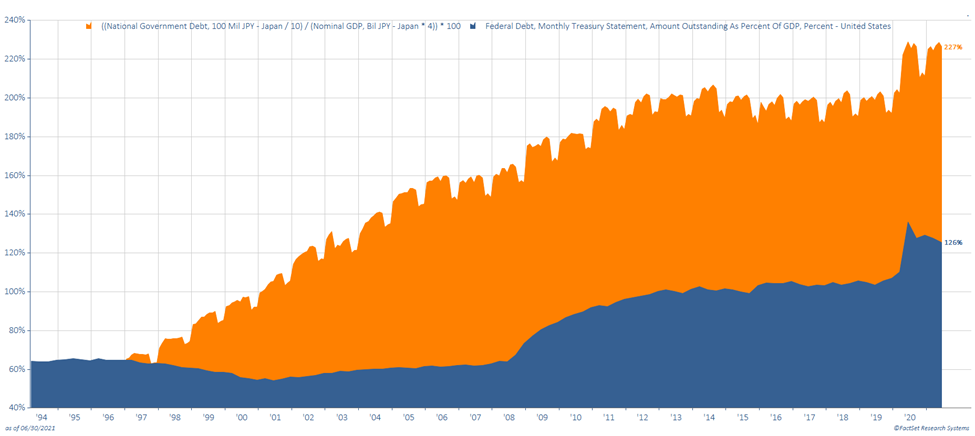

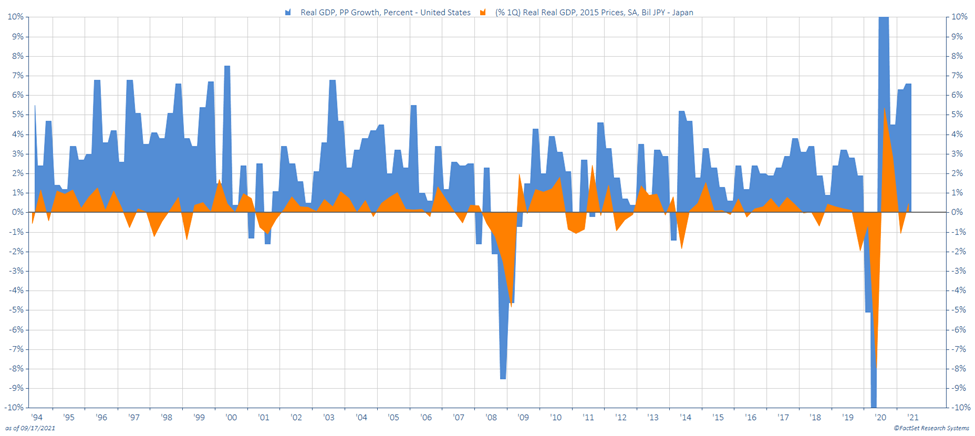

Japan’s asset price bubble burst in 1992 following a period of runaway prices and overheated economic activity coupled with uncontrolled money supply and credit expansion. The result was excess optimism and speculation regarding real estate and equity prices. And so followed the lost decade – a period of chronic deflation, low growth, and a pronounced shift to temporary employment. This “Lost Decade” eventually lasted over 20 years. By 2013, the Nikkei 225 index still well below a peak reached in 1990 and nominal GDP was at the same level as 1994. In the years preceding, Japan spent considerably on extensive public works, most of which were notoriously unproductive (recall the “bridge to nowhere”). Japanese short-term rates remained at or near-zero and the Bank of Japan significantly expanded its balance sheet becoming the most indebted developed country in the world on a debt-to-GDP basis. Despite this, the economy was still slumping. Japan was experiencing a liquidity trap in which monetary policy became largely ineffective. Consumers fearing deflation or rates below zero have demonstrated a preference for savings. As a result, no amount of monetary stimulus elicited economic activity and Japan made scant progress in generating growth or inflation. In 2012, following 5 one-year prime minister tenures, Prime Minister Shinzo Abe hatched an aggressive plan nicknamed “Abenomics” involving his three arrows: money printing, more stimulus spending and pro-Japan regulation to break out of the decades-long slump. The Japanese government issued 10.3 trillion yen for spending on infrastructure, (roads, buildings, bridges, etc.). The Bank of Japan began large-scale asset purchases worth >$660 billion dollars annually in order to push the inflation rate towards the 2% target. The final component of Abenomics were reforms to drive the birth rate and labor force participation among women higher to combat a secular decline in the population.

Because so many developed economies are now utilizing tools first implemented by Japan in the early 1990’s, it warrants paying attention. We have yet to see any country successfully reverse a zero-interest rate policy or meaningfully curtail stimulus spending. Debt is ballooning world-wide and the balance between interest rates, inflation, and asset prices is increasingly delicate and precarious. Japan was late to raise rates and, in doing so, created a bubble so big only Draconian measures were effective in mitigating the fallout. What was not known at the time was how difficult it would be to reverse a deflationary spiral and, thirty years later, Japan remains firmly entrenched in it- and heavily indebted. Much like the end of the bubble in Japan in 1992, Europe and the U.S. combatted the fallout from the Great Financial Crisis by propping up a warped housing market with asset purchases and money supply. A diet of monetary sugar from which the U.S. and Europe have not yet been able to ween. We’ve witnessed the conditions that trigger a liquidity trap and the difficulty combatting it in Japan and its difficult not to extrapolate those same experiences elsewhere.

So how do we reverse this widespread liquidity trap? One bright spot is that China’s regressive and severe actions of late to limit a few sectors appears to have broadened into a much larger campaign. A potential default by property developer Evergrande is potentially as disruptive as Bear Stearns in the U.S. In addition, China’s thinly veiled aggression towards Taiwan further alienates the developed world. Simultaneously, we are seeing clear evidence of a slowing in China exacerbating the political and financial turmoil. Developed markets should benefit as capex shifts away from China – not just the U.S. with its manufacturing renaissance, but Japan too, and perhaps the Eurozone.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice, and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers by accessing www.adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission.

The opinions and some comments contained herein reflect the judgment of the author, as of the date noted.

Investment products and services provided are offered through Synovus Securities, Inc. (SSI), a registered Broker-Dealer, member FINRA/SIPC and SEC Registered Investment Adviser, Synovus Trust Company, N.A. (STC), Creative Financial Group, a division of SSI. Trust services for Synovus are provided by STC.

Regarding the products and services provided by GLOBALT:

NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY