During the depths of the COVID pandemic economic crisis, the U.S. Federal Reserve (Fed) committed to a series of supportive monetary policies that included bond purchases. Right now, the markets are very focused on potential changes in Fed policy including tapering, or the cessation of these bond purchases. The expectation is that over time the Fed will stop buying bonds. More specifically, the Fed will not sell these bonds, rather just stop buying more and let their current inventory mature.

We think that the Fed might be overdue in initiating tapering, and it’s probably a good idea for the Fed to backout of these markets. During the depths of the crisis, we thought that the Fed’s broad array of policy support was needed to help the economy and the markets recover. However, now that the U.S. economy is well on its way to a sustained recovery, we have an excess of liquidity adding to inflationary pressures. Despite the week August employment report, the labor market is well on its way to a full recovery, so we think that the Fed should further reduce its policy support and mitigate the chances of negative unintended consequences from buying bonds and injecting even more liquidity into the financial system.

THE ECONOMIC RECOVERY HAS MOMENTUM

Most of the economic indicators that we track, such as monetary conditions and business surveys, point to solid economic growth in the coming months and continuing into 2022.

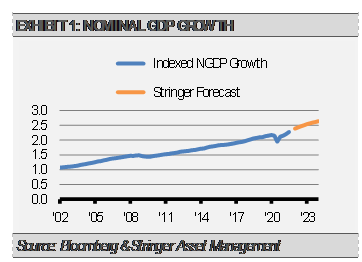

The size of the U.S. economy, as measured by nominal GDP (NGDP) should rise to its pre-COVID trend growth path in the coming six to nine months as economic growth momentum continues. This momentum suggests that the Fed’s role in the recovery has been a success.

INFLATION LIKELY TO PERSIST

The Fed’s response to the crisis is unlike anything seen before. Continued stimulus, especially through bond purchases, has led to enormous liquidity (M2) growth. Though some “transitory” inflationary pressures, such as the rate of increase in used cars, may be easing, other longer-term pressures, such as wages and rents, are just beginning to build.

Furthermore, the markets are pricing in inflation above the Fed’s inflation target. For example, the 5-year breakeven inflation rate, which reflects the market’s expected average inflation rate of the next five years, is near 2.5% and above the Fed’s 2% target. This suggests that, unlike the previous business cycle, the Fed is on track to meet or exceed its inflation target.

THE U.S. HAS MORE JOB OPENINGS THAN EVER BEFORE

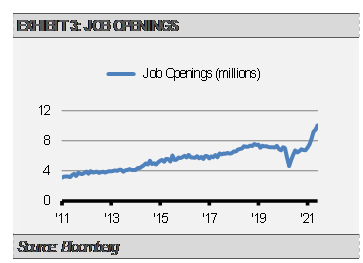

Additionally, business surveys continue to suggest that business confidence is high, broad economic activity is strong, and demand for more workers is at record levels. For example, the Job Openings and Labor Turnover Survey (JOLTS) shows job openings continue making new all-time highs.

The record number of job openings combined with business surveys depicting that job openings are hard to fill suggest that the Fed has done all it can to support the labor market recovery. Other issues we may have with the labor market are beyond the Fed’s scope.

The data shows that the Fed’s supportive policies have been successful in helping the U.S. economy get back on track. Economic growth has been strong, and the number of open jobs has never been greater. Meanwhile, inflationary pressures continue to build. As a result, we think the Fed should back away from the markets satisfied in the knowledge that they did all they could do for the economy. It is now time for the economy to evolve on its own.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.