By Dan Suzuki, CFA, Deputy Chief Investment Officer

Which bubble camp are you in?

Back in June, we put out a piece making the case for why we think our criteria for financial bubbles have now been met in long duration assets like technology, innovation, disruption, and cryptocurrencies. We heard two types of responses: “duh” and “you just don’t get it, boomer” (speaking for myself, I’d like to point out I am NOT a boomer). Given today’s elevated valuations and extreme market concentration, it’s clear most people are in the “you just don’t get it” camp, which isn’t surprising in the least. How can you have a bubble if everybody agrees there’s a bubble?

Recognizing the bubble is only the first step in dealing with the bubble

Recognizing the existence of a bubble is a critical step in assessing risk, but it opens up the bigger question of how to manage that risk. As we often point out, if we knew exactly when the bubble was going to end, investing would be easy: simply own the most speculative bubble assets right up until the peak and then sell it all. While we have no doubt some investors think they can do just that, history suggests most will fail. In our view, the only prudent alternative to trying to time the bubble is to steadily shift exposures away from the epicenter of the bubble.

Where is capital scarce today (i.e. what’s the anti-bubble)?

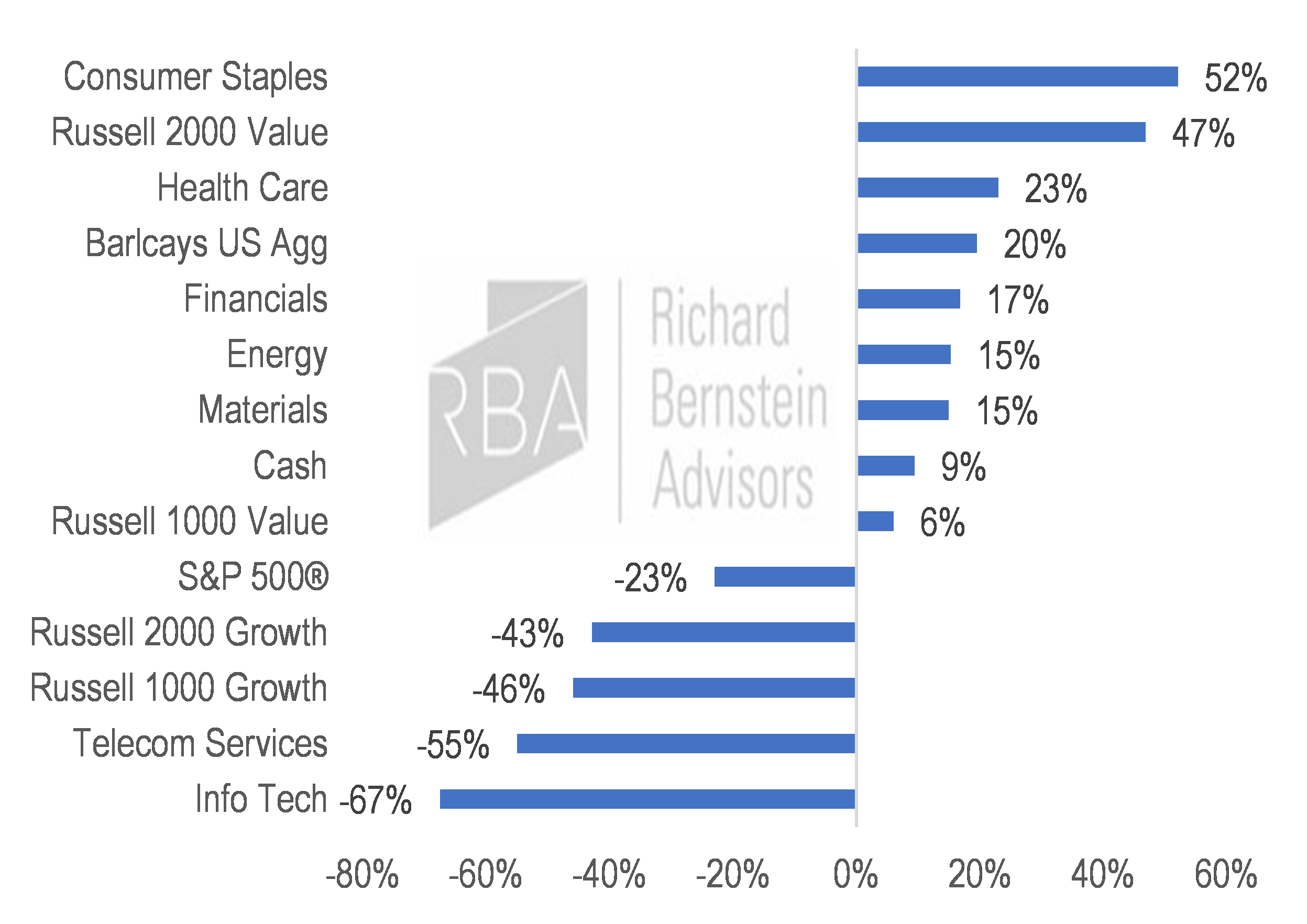

By their nature, bubbles attract an overabundance of capital, thereby creating enormous investment opportunities from the resulting capital scarcities in other parts of the market. In the two years following the Tech bubble peak, Tech and Telecom stocks led the way down with losses exceeding 50%, growth indices fell over 40% and the S&P 500® declined more than 20%. The scarcity of capital at the time was in defensive assets (Staples, Health Care, bonds, etc.) and small cap value stocks (the antithesis of the sought-after secular growth stocks), including Financials and Energy. Having been left behind in the hype surrounding the internet bubble, these stocks did far more than simply cushion portfolios. Consumer Staples stocks and small cap value stocks both surged over 45% even as the major market indices were tumbling (Chart 1).

Timing a bubble may be easier than you think

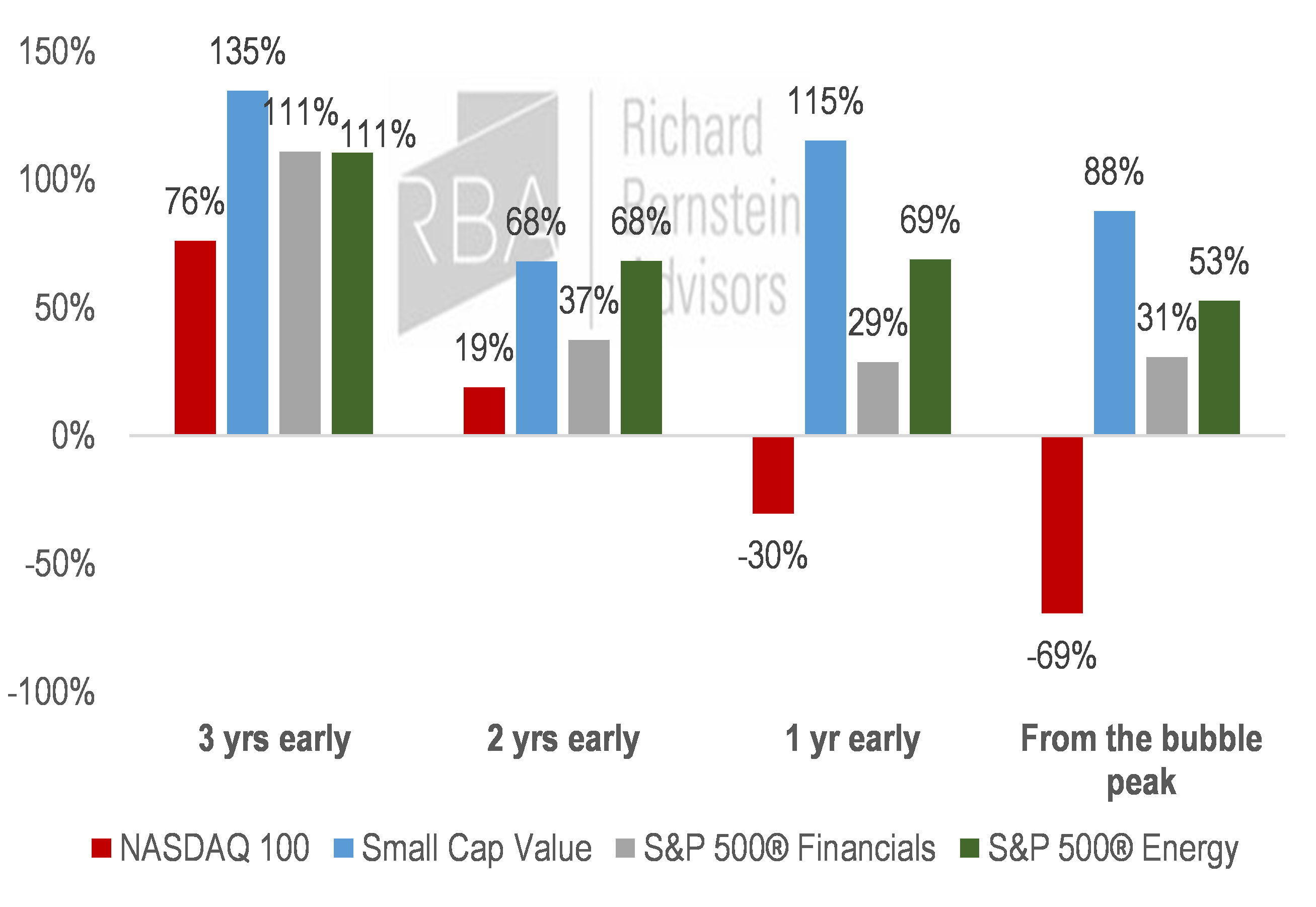

What if you reduce exposure too early? A critical distinction between a bubble and a typical investment peak is that you can essentially sell a bubble at any time and it will be additive to your longer-term wealth creation. Chart 2 below illustrates that had you sold Tech and bought the other side of the market seesaw (i.e. small cap value, Financials, Energy), you could have been three years early and still had superior returns. For this analysis, we gave the market two years to recover from the trough, but the conclusion holds true 3, 4 and 5 years post-trough.

Dan Suzuki is registered with Foreside Fund Services, LLC which is not affiliated with Richard Bernstein Advisors LLC or its affiliates.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. The investment strategy and broad themes discussed herein may be inappropriate for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.