Index Strength

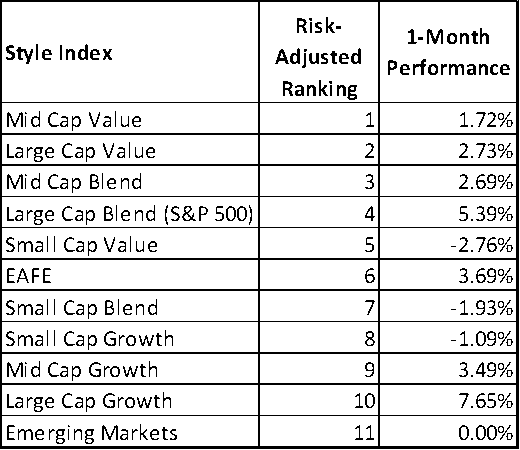

The S&P 500 has had some strong momentum over the last month. In fact, if you look at the style indexes along with the EAFE and Emerging Markets, the S&P 500 has been the second-best performer over the last 20 or so trading days, right behind Large Cap Growth. If we look at Canterbury’s risk adjusted rankings, Large Cap growth lags other indexes and Value stocks remain favorable.

As a side note, the S&P 500 does appear to be extended. As for a positive, there has been broad participation among different market segments, rather than strength being exclusive to just one segment.

An Interesting Statistic

Our good friend and expert market technician, David Vomund, had an interesting observation. Looking at the S&P 500, it would appear that stocks have moved up far, and at a quick pace. Currently, it sits at about 16% above its 200-day average price and has been above it by as much as 17% this year. Prior to 2021, the last time the S&P 500 was that far above the moving average was back in April of 1999.

What does this mean? Well, the market is overbought. That doesn’t necessarily mean it will pullback soon, but it could move sideways or even continue to be overbought. As mentioned above, the market is having broad participation, which is a positive signal.

Market Comment

We are seeing broad participation among stocks. As we mentioned in the last update, the Advance-Decline Line is at an all-time high. This means that stocks are rising together. We do not want to see a market being carried by a select few stocks. Most major market indices remain strong. Rotations in the markets continue to occur. One month ago, small cap stocks were the best area to be in, but over the past month, there have been some rotations.

One particular area to keep an eye on is international equities. They have lagged, or at least fallen to the middle of the pack for most of this year. Looking at a chart of the EAFE (Europe, Australia, and Far East), it appears this grouping of stocks is moving in an upward, orderly fashion, with a series of higher lows and higher highs and declining volatility.

Regardless of where the markets stand, it is important to have an adaptive approach to investing. We want to be able to rotate with the markets and adapt to whichever environment that is currently in place… bull or bear. An investment portfolio should not aim to predict where the markets will head but should rotate its holdings and allocations to move in concert with changing market environments.