Astoria’s Monthly Commentary Report

Fed Ready to Raise? At the FOMC meeting on Wednesday, January 26th, the Federal Reserve kept the federal funds rate at the 0-0.25% range and suggested tapering should end in March, but also indicated that it may soon be time to raise rates. As the Consumer Price Index (CPI) rose to its highest reading in 40 years of 7% in December from the prior year, the Fed seems ready to hike rates in order to combat inflation. “With inflation well above 2% and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate,” read the statement from the FOMC. It is believed that the Fed is likely to raise rates by 25bps at the next FOMC meeting in March, which would mark the first interest rate hike since December 2018. Fed Chairman Jerome Powell also stated, “I think there’s quite a bit of room to raise interest rates without threatening the labor market,” causing many to think that this tightening cycle may be more aggressive with numerous rate hikes to come over the course of 2022.

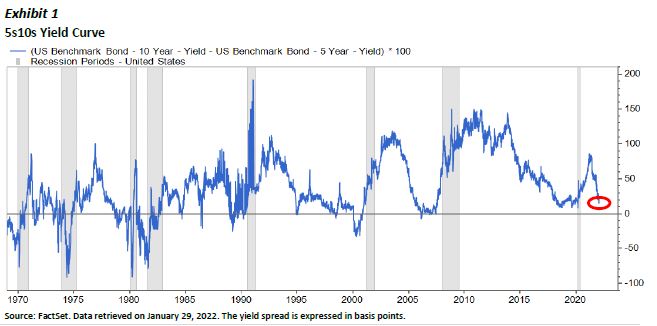

Yield Curve Flattening: Yield spreads have fallen sharply in 2022. The spread between the widely followed 2-year and 10-year Treasury yields (2s10s) decreased to its lowest level since November 2020 and the spread between the 5-year and 30-year Treasury yields (5s30s) shrank to their lowest reading since January 2019. Yield curve inversions, when spreads decline below zero, are thought to be indicators of impending economic downturns. Such inversions have preceded 7 of the last 8 recessions as displayed in the 5s10s yield curve in chart below. While we are still far from a large inversion, the bond market is signaling that there may be limits regarding how aggressive the Fed implements its tightening cycle without sparking fears of an impending recession.

Earnings Update

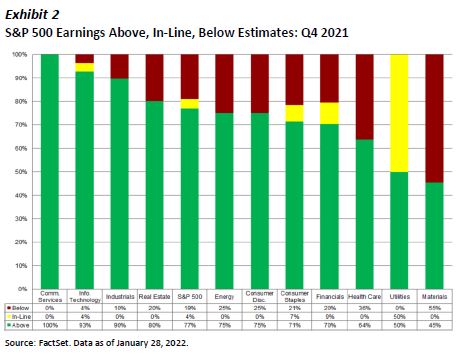

As of Friday, January 28th, 33% of companies within the S&P 500 have reported Q4 2021 earnings. 77% of these companies have beat their estimates, which tops the 5-year average of 76%. As a percentage, the Communication Services sector leads in companies with reported earnings that exceeded estimates, followed by Information Technology and Industrials (see chart below). Additionally, the index is currently reporting earnings growth of 24%, and if it remains near this level, it will mark the fourth straight quarter of earnings growth over 20%. The last time this occurred was the period from Q4 2009 through Q3 2010. For all of 2021, the S&P 500 is currently reporting earnings growth of over 40%. Given COVID-19’s detrimental impact on many companies in 2020, these above-average growth rates are likely explained by the change from relatively lower to higher earnings from 2020 to 2021, respectively.

Increased Volatility

The Cboe Volatility Index (VIX) is commonly used as a fear gauge for the S&P 500. Through Thursday, January 27th, this index has almost doubled this year amidst concerns of soaring inflation and tighter monetary policy. From January 18th through January 26th, the VIX also rose for seven straight trading days which has only happened 10 other times in the past 20 years. Consequently, investors are rotating out of pandemic play growth stocks and into safer and more defensive value-centric stocks.

Better than Expected Economic Growth

Despite the spread of the Omicron variant, US Gross Domestic Product (GDP) for Q4 2021 increased 6.9%, exceeding economists’ expectations of 5.5% and coming in well above the 2.3% growth in Q3 2021. The strong quarterly growth is likely attributed to both the rebuilding of inventories and boost in consumer spending in the last months of 2021. Moreover, GDP rose 5.7% for the full year, marking the strongest yearly increase since 1984. However, US economic growth is anticipated to slow this year as the economy faces extreme levels of inflation.

Is My Portfolio Positioned for Higher Inflation?

For the past 10 years, investors have experienced portfolio gains from lower interest rates which fueled large gains in US growth and technology stocks, as well as outperformance in interest rate products. Going forward, a 60/40 portfolio may struggle as interest rates continue to rise unless appropriate inflation hedges are put in place. TIPS alone may not be enough as they underperformed on an inflation-adjusted basis last year (TIPS +5.7% while CPI +7%). However, cyclically oriented sectors such as energy, materials, industrials, and financials have historically shown higher sensitivity to rising inflation. Additionally, as future large-cap index returns may be relatively lower, investors should focus on total return in which dividends strategies play a crucial role. Commodities may also serve to provide additional protection as they tend to move at a different stage of the inflation cycle.

There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.