By Grant Engelbart, CFA, CAIA, Director of Research/Sr. Portfolio Manager for CLS Investments

When I originally thought of writing this article, energy companies and oil prices had fallen nearly 60%. Not long after, oil prices went negative for the first time ever, followed by a voracious rebound of nearly 90% in energy equities and even more in oil prices. Does anyone know how to calculate the return from -$37 a barrel? Me neither. All this volatility is enough to make many investors pop an antacid, scratch their heads, and wonder if it’s worth even trying to invest in energy — right now, or ever!

Volatility/Cyclicality

Likely the most obvious reason energy investing is not for the faint of heart is the immense cyclicality associated with the asset class and its translation into volatility. This has been front and center in 2020 after the decline and subsequent rise previously mentioned. Volatility as measured by standard deviation over the past year has been more than 50 percent! If you stretch out the time frame to the past 15 years, volatility declines but the energy sector remains meaningfully more volatile than any other.

Source: Morningstar 6/30/2020

Concentration

The boom-and-bust nature of the energy industry has led to consolidation and concentration in the sector. In fact, we just saw further consolidation as Chevron (CVX) announced it is acquiring Noble Energy (NBL). Chevron and Exxon Mobil make up some 44% of the sector, and the top 10 holdings more than 70% — the most concentrated of any sector. That top 10% rockets to nearly 80% for the Energy Select Sector SPDR (XLE). This makes any alternative-weighting scheme in energy add a huge tracking error to the market-cap-weighted index, for better or worse. The average 3-year tracking error for energy sector ETFs to the sector benchmark is a whopping 15 percent! Market-cap ETFs are much closer to the index, but even the John Hancock Multifactor Energy ETF, which puts weight limits on individual holdings, has a three-year tracking error north of 7 percent. So not only is energy highly volatile on its own, depending on what ETF you choose to get that exposure you may get another dose of intense dispersion in returns.

Source: Morningstar 6/25/2020

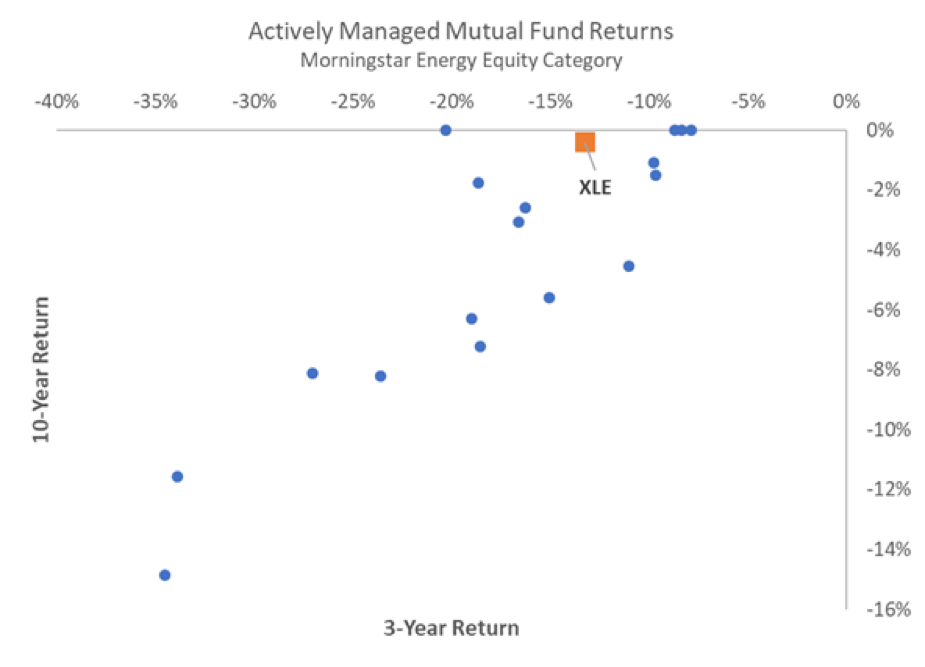

Active Management

There aren’t any actively managed energy equity ETFs at this point. Some of the smart beta options get close, but there is nothing truly active. However, the mutual fund world does have some options for active management in the energy sector, albeit only a handful. These funds are plotted below, with three-year returns across the top and 10-year returns down the side (funds without a 10-year return are plotted at 0%). The XLE ETF is added for comparison purposes. Before running these numbers, I was expecting, wishing really, that actively managed products would add value in a volatile and harsh sector. So far, I don’t see too much evidence of that as no actively managed mutual fund has outperformed the cap-weighted XLE over the 10-year period shown here. Not only does this look bad, but this is also not accounting for survivorship bias — there are likely many closed energy equity funds.

Source: Morningstar 6/30/2020

Environmental

In recent years, the demand curve for fossil fuels has shifted, as has the corporate attitude toward them. The rise of environmental, social, and governance (ESG) investing has begun in earnest with some of the largest institutional investors. Large sovereign wealth funds (such as Norway’s) have vowed to cut or eliminate fossil fuel exposure and shift toward renewable investments. This lowers the overall demand for investing in most energy companies. The good news, here, is that many of the largest energy companies are focused on building out their renewables business and diversifying away from highly cyclical fossil fuels.

As we sit here today, the energy sector has declined to now make up less than 3% of the S&P 500. Microsoft, Apple, Amazon, and Alphabet are all individually a larger weight than the entire sector! This makes the decision to not even have a weight in energy at all easier to make. If it were larger, many investors would not want to take the tracking error associated with not having an entire sector in a portfolio. We haven’t even addressed the craziness in commodity prices, as we are only focused on equities here! What on earth is an investor to do?

Even after all the compelling evidence I just provided against investing in energy, I do believe there is some opportunity, if these issues can be overcome. Hear me out:

- Energy equities are trading at some of the most attractive valuations in decades, even after the rebound.

- Oil prices have stabilized. OPEC has committed to stabilizing prices via output cuts, and front-month crude oil prices have stayed above $30 per barrel for two months now, recently crossing $40. Stability in prices is crucial for many energy companies’ survival.

- There have been signs of a pickup in mergers and acquisitions activity. I mentioned earlier the large CVX-NBL deal; it’s possible more consolidation is on the way, which can be supportive of equity prices.

- The economic recovery is continuing. Despite the strong returns in equity prices, we still have a long way to go to dig out of our economic hole. As the economy recovers and people begin to travel more worldwide, the demand for energy will rise.

Hopefully this article has provided readers with greater clarity into the energy sector. Energy companies have a lot working against them. But they have for several years, and a contrarian would say that is all priced in and more so. The world has changed and is changing still. Is energy on its last gasp? Can companies adapt to the new world? Is the apparent opportunity in energy worth the associated risks? Time will tell!

1949-CLS-07/29/2020