By Ryan O’Malley, Fixed Income Portfolio Strategist

Many high yield investors favor the asset class due to higher yields and lower durations than investment grade bonds of similar maturities. However, during periods of interest rate regime changes like we are currently experiencing, high yield durations often extend significantly. High yield bonds often contain embedded call options that allow issuers to “call” the bonds away from investors at pre-determined prices (usually 3-4 years after issuance), and as those bonds get closer to the call date they often trade “yield to call”, meaning that investors assume they will be taken out at the call price.

When rates rise and bond prices fall, the prices of these “yield to call” bonds will often drop well below the call level, and their yields will be significantly below where issuers would be able to issue new bonds. Therefore, the bonds aren’t called, and the durations must adjust to reflect the new reality that the bonds are more likely to reach maturity rather than being called a few years earlier. This phenomenon can catch casual high yield investors off guard and cause the duration of their holdings to extend, exposing them to increased interest rate risk.

Sage ran a scenario analysis on the Markit iBoxx Liquid High Yield Index, the index that is tracked by “HYG”, the High Yield ETF with the most assets under management. Currently, this index carries an option-adjusted duration (OAD) of 3.58 years.

An internal study done by Sage suggests that high yield may see a significant extension of option-adjusted duration (OAD) if interest rates continue to rise:

- A 1% parallel shift in the U.S. Treasury curve (Treasury yields increase evenly across the curve) would cause duration to extend by 0.29 years to 3.87 years.

- A 2% parallel shift in the U.S. Treasury curve would cause duration to extend by 0.54 years to 4.13 years.

Markit iBoxx Liquid High Yield Index Scenario Analysis

Source: Bloomberg Port

| Scenario | Option-Adjusted Duration | Option-Adjusted Convexity |

| Up 200bps (all curves) | 4.13 | -0.06 |

| Up 100bps (all curves) | 3.87 | -0.16 |

| Up 50bps (all curves) | 3.71 | -0.20 |

| Down 50bps (all curves) | 3.38 | -0.20 |

| Down 100bps (all curves) | 3.23 | -0.16 |

| Down 200bps (all curves) | 3.00 | -0.09 |

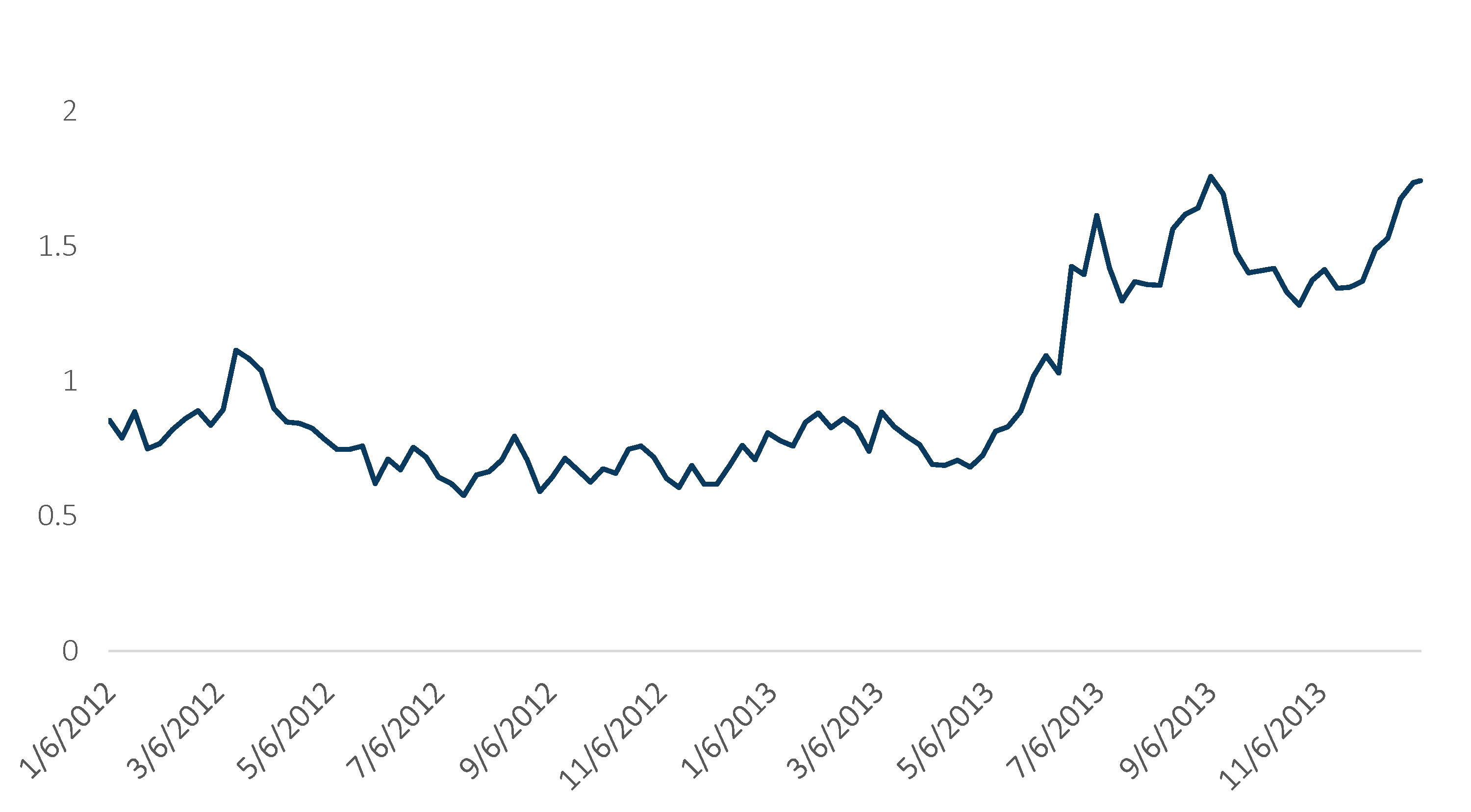

We’ve seen this happen before. During the “taper tantrum” days of 2013, we saw the 5-year U.S. Treasury go from 0.72% at the start of the year to 1.74% by the end of the year. The OAD on the Bloomberg High Yield Index extended from a low of 3.79 years in May, to 4.40 years by July – likely catching many high yield investors by surprise.

U.S. Treasury 5-Year Yields

Source: Bloomberg Port

Bloomberg High Yield Index OAD

Source: Bloomberg Port

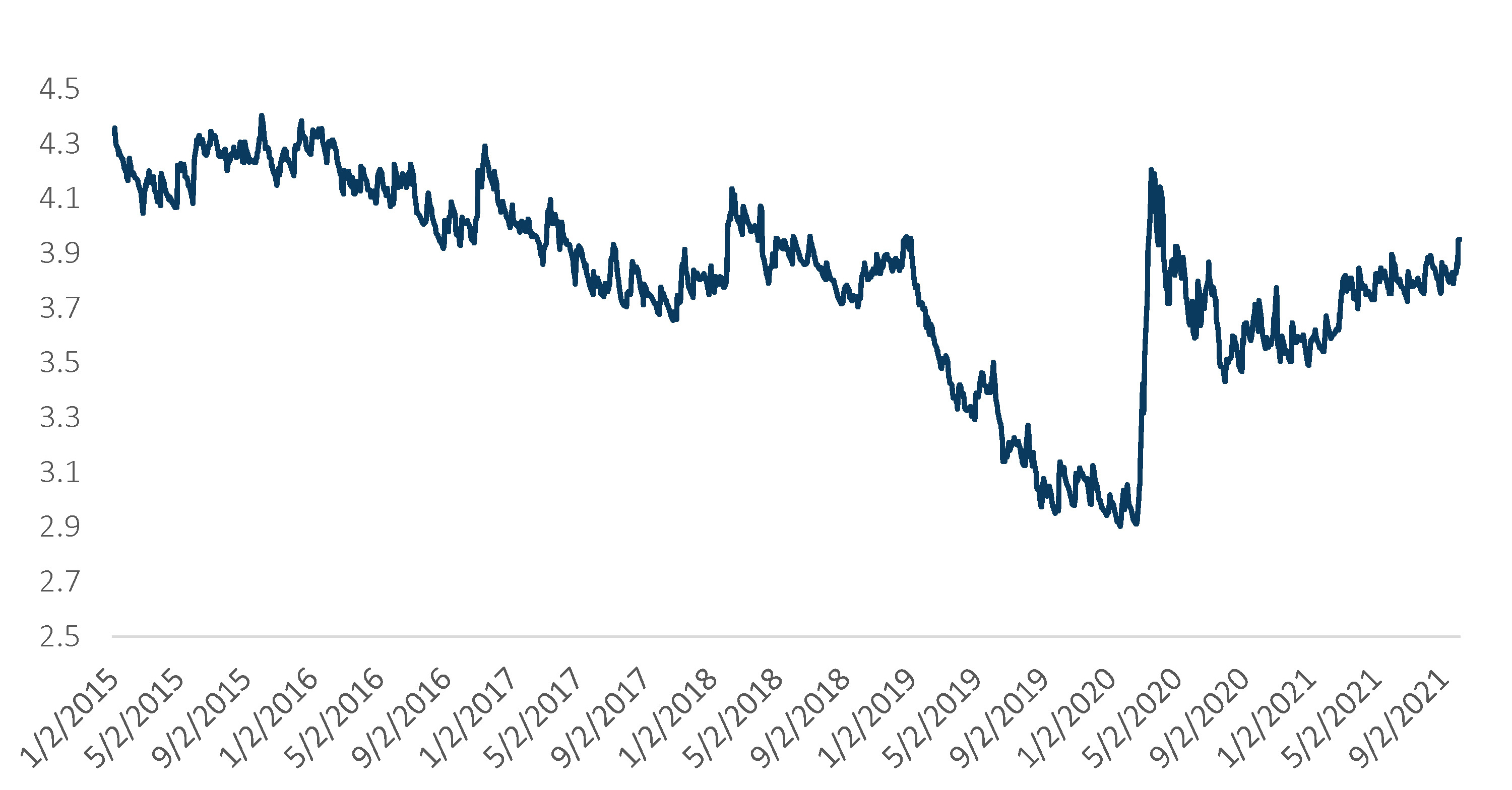

In 2021, we’ve seen the 5-year U.S. Treasury Note yield increase from a low of 0.35% on the first trading day of January, to 1.02% as of September 28th. The OAD on the Bloomberg High Yield Index has already increased from 3.58 years to 3.95 years during the same time period – are we heading back toward 4.5 years?

Bloomberg High Yield Index OAD – The Last 5 Years

Source: Bloomberg Port

Generalist investors often view high yield corporate bonds as an area of the taxable universe that is relatively safe from extreme duration risk. While this is still mostly true, during periods of rapid interest rate increases brought on by FOMC rate hiking cycles, there are many callable high yield bonds that may see their durations extend significantly. Sage recommends combing through high yield holdings to identify candidates for such an extension as they often see their duration extend rapidly by up to half a year, along with spread widening, which can cause extreme price volatility. Stay tuned for some examples of these types of bonds and the implications for fixed income portfolios.

For more news, information, and strategy, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.