As investment managers, it is important for us to define a worldview that can accurately forecast or, at the very least, set reasonable expectations for future outcomes. The markets and the election cycle have investors hyper-focused on lagging inflation data as the Fed continues to aggressively tighten through interest rate hikes and a steady balance sheet reduction. However, we cannot stress enough the importance of forward-looking inflation expectations. Our model for inflation expectations is primarily driven by the level of broad money growth through investing.

In October 2021, our model suggested that strong consumer balance sheets resulting from excessive cash and liquidity being pumped into the economy due to stimulus checks, enhanced unemployment benefits, and other factors would create demand that outstripped the global supply chain. Prolonged above-trend liquidity growth and retail sales would support continued economic growth and persistent inflation. The net effect would be increased jobs creation, higher corporate revenues, and higher long-term bond yields.

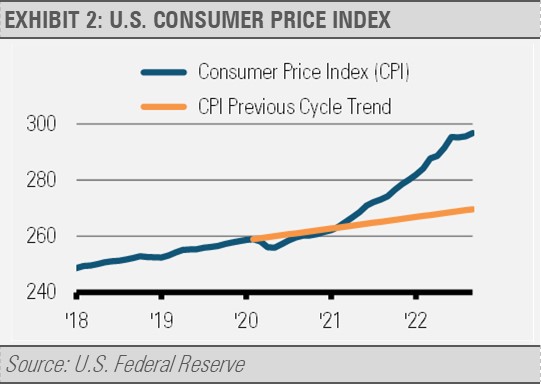

The same model that we used to forecast strong inflation for 2022 currently suggests that a year from now we should expect the Consumer Price Index (CPI) to be closer to a more normal 2% area. This is not a new or groundbreaking theory. This belief system is consistent with renowned economist Milton Friedman’s view that inflation is a monetary phenomenon. Importantly, we have experienced continued economic growth, persistent inflation, increased jobs creation, higher corporate revenues, and higher long-term bond yields this year, just as the model forecasted. However, we are seeing a very different picture today that has significantly changed our outlook for each of these factors. Our work suggests that the primary drivers of inflation are weakening, which leads us to believe that the pace of inflation will fall significantly in the months to come.

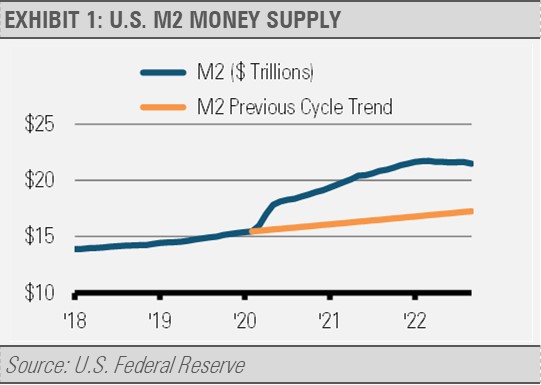

The growth rate of broad money seems to have peaked and is now declining. It is important to keep in mind that inflation lags money growth. As previously mentioned, inflation is primarily driven by too much money chasing too few goods and services. Too much money in the system relative to output is what initiated the inflationary spike we are seeing today. Given that changes in CPI lag months behind changes in M2 growth, we expect inflationary pressures to decline precipitously over the next few months. Importantly, this decline is occurring primarily due to the policy tightening that the Fed already implemented and is now being reflected in softer commodity and energy prices.

It is important to note that there is a lag between Fed policy changes and their impact on the real economy, even though markets tend to respond in real-time. In our view, the full impact of the Fed’s previous policy tightening has yet to be reflected in the real economy. For now, our work suggests that we should expect a relatively shallow recession in the U.S. next year, along with reduced inflationary pressures, and a potentially quick rebound.

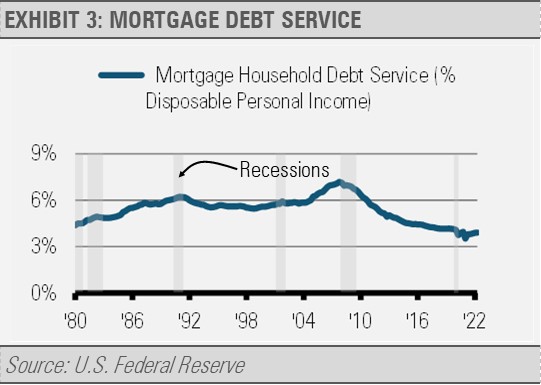

This view, in part, is based on the strength of household finances overall. Strength in household balance sheets and debt ratios along with strong employment are very different from what we saw leading into the 2007-2009 period. While much posturing has been made about the recent jump in mortgage rates, higher rates only immediately impact those shopping for houses.

According to Federal Reserve data, approximately 85 million U.S. households own their own home, with approximately five to seven million new and existing home sales annually. The current higher interest rates are indeed a challenge to home buyers, but there are many more families in existing homes than there are looking to buy a home. We expect that millions of the existing homeowners refinanced during the period of ultra-low interest rates to lock in those rates. Importantly, mortgage payments relative to disposable income are lower today than during any previous business cycle going back to 1980 and are only about half the level that they were during the 2007 housing market peak. Fannie Mae estimates that the average 30-year mortgage refinanced in 2021 saved owners $2,700 annually in interest payments for the life of the mortgage. We think that the positive impact of years of lower interest rates more than offsets the potential headwinds from higher current mortgage rates.

INVESTMENT IMPLICATIONS

We are not looking past the challenges the economy faces. In fact, we expect a recession in the U.S. in 2023. Relatively strong household and business finances means the private sector is in good shape overall, and we think the private sector can ride out the economic turbulence that may lie ahead. At the end of the day, market and economic declines do not last forever. The environment we foresee should be full of opportunities for disciplined investors. We expect to shift from our current defensive posture to take advantage of stock and bond market investments that should benefit from the eventual recovery. Note that markets themselves are leading indicators. A sustainable market rally is likely to take hold before headlines turn from our expected economic challenges to reflect more positive economic trends. We think that now is a good time to be engaged in an active management strategy that can respond quickly in this environment.

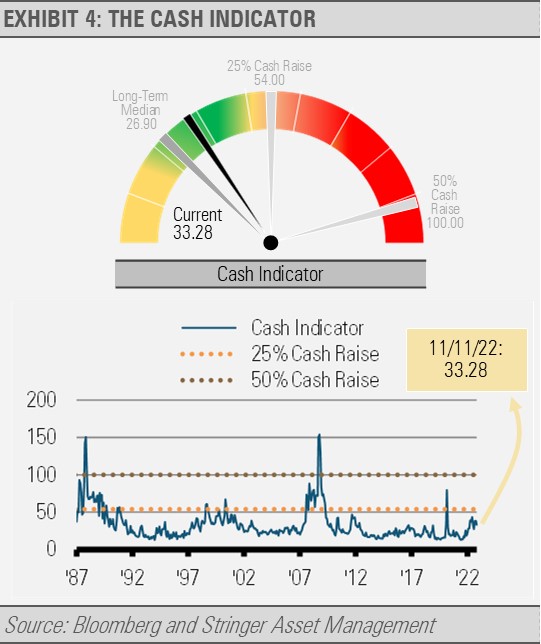

THE CASH INDICATOR

The Cash Indicator (CI) has pulled back from recent highs. We think this decline reflects recent consensus optimism about the global economy and markets. Though our work suggests that we should be more cautious going into 2023, the CI reflects market stability that is far from a crisis.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.