All too frequently investors use the rear-view mirror to determine an investment’s attractiveness. An upward sloping price chart often automatically makes a stock more attractive. Recent performance helps determine a “good” manager. Past interest rate movements can cause changes to bond portfolio duration.

However, investing according to what seems obvious in the rear-view mirror has clearly had a detrimental effect on investors’ performance. Investors seem to consistently follow the unwise investment strategy of buying high and then selling low, and their performance over the past 10 and 20 years has accordingly suffered.

Hindsight might be 20/20, but investors have performed miserably by repeatedly attempting to time a market, a manager, or an investment.

Future fundamentals, and not past performance, are more likely to dictate future returns.

2018 DALBAR data

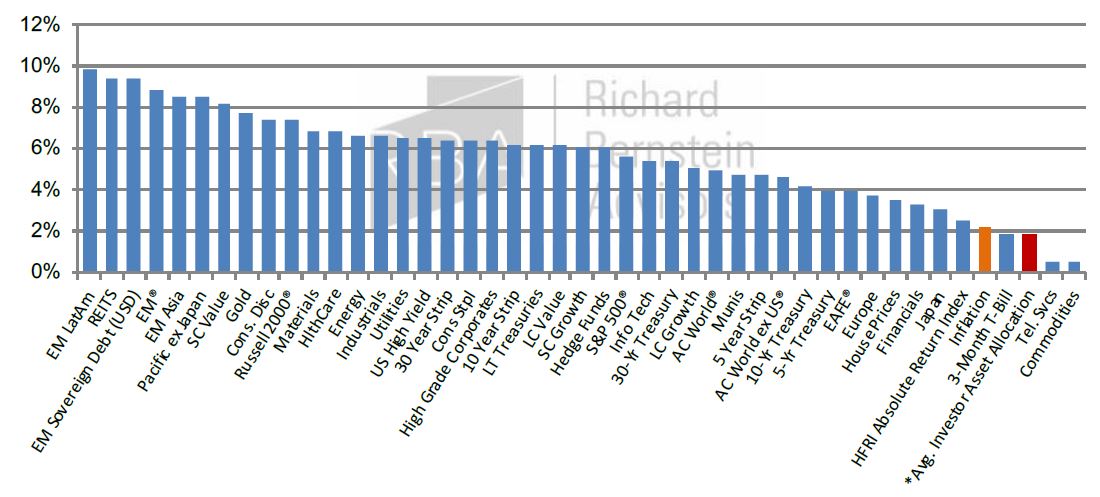

The annual DALBAR study that estimates investors’ performance was recently released for 2018. Investor returns are calculated by DALBAR using the change in total mutual fund assets after excluding sales, redemptions and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, expenses and any other costs. Each year RBA then analyzes DALBAR’s results to see how the “average investor” would have performed over the past 10 and 20 years. RBA compared the DALBAR returns with those of 43 different asset classes and sub-classes for the 20-year period ending 2018.

Trying to time their investments and ultimately buying high and selling low has effectively ruined investment performance. Chart 1 quantifies “ruined”. Investors underperformed nearly every category.

Only Telecom Services and Commodities performed worse than individual investors over the past 20 years. Investors even slightly underperformed cash during the past 20 years, meaning they would have performed better if they had simply left their money in a money market account for the full 20 years!

Perhaps most important, individual investors didn’t outperform inflation (i.e., they had negative real returns). So, not only did investors underperform just about every asset class and sub-class by trying to time investments, but they also lost the purchasing power of their savings. In other words, they made themselves poorer.

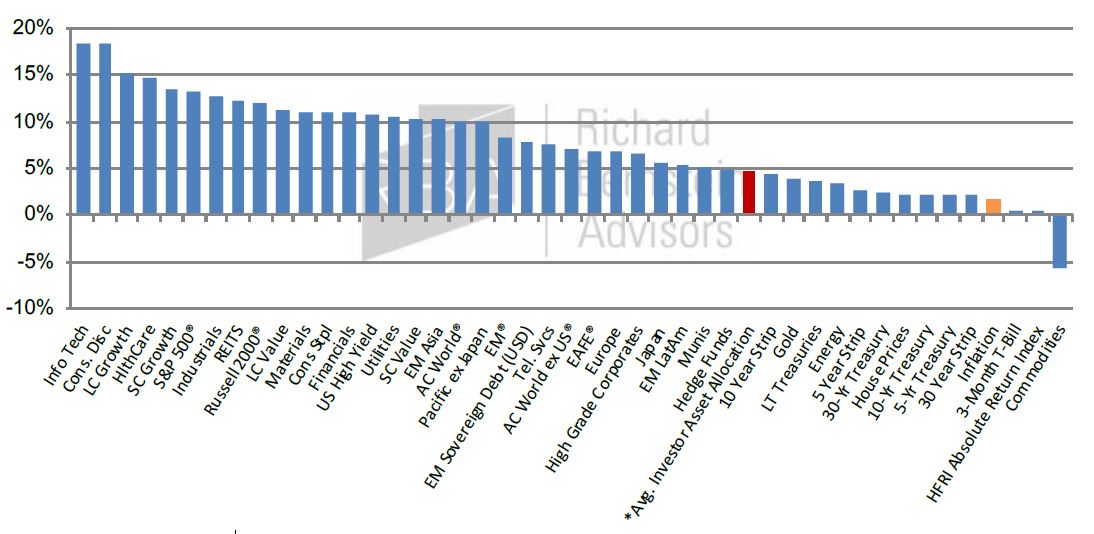

Returns over the past 10 years have not been quite as dire, but are still very subpar (see Chart 2). Investors did outperform both cash and inflation over the past 10 years, but they nonetheless still underperformed most asset classes and sub-classes by buying high and selling low.

Chart 2 should give investors some pause. After all, consider what are today’s “hottest” investments: Technology, online retailing, and the US. One could reasonably argue that the simple reason there is so much interest in these investments is they are among the best performers of the past 10 years.

The conclusion remains the same regardless of whether one uses 10 or 20 years: investors’ attempts to time investments have seriously hurt returns and long-term wealth.

Source: Richard Bernstein Advisors LLC., Bloomberg, MSCI, Standard & Poor’s, Russell, HFRI, ICE BofAML, DALBAR, FHFA, FRB, FTSE. Total Returns in USD. *Average Investor returns are represented by DALBAR’s investor returns which represent the change in total mutual fund assets after excluding sales, redemptions and exchanges.

The “Mirage”

Investment research generally encourages individual investors to look backward rather than forward, and using that research can contribute to the poor performance shown previously. For example, The Wall Street Journal published in 2017 an article titled “The Morningstar Mirage”1 in which they examined the performance of mutual funds incorporating Morningstar’s “star” ratings. According to the article 250,000 financial advisors use these ratings and their accompanying data, and “Morningstar’s analysis and ratings influence investment decisions for

a vast landscape of retirement plans and brokerage accounts”.

The star system is largely based on historical return and volatility data and incorporates no information regarding the potential for a strategy to outperform in the future. The star rating ranges from 1 to 5 stars with 5 being the best performing funds. Many investors limit fund searches to 4- and 5-star funds exactly because they have previously been the best performing funds.

The Wall Street Journal highlighted several points regarding the star system’s rear-view mirror approach to predicting future performance:

1. Five-star funds’ average rating over the subsequent 3 years was 3 stars.

2. Half of funds that received a fifth star held on to it for just 3 months before performance waned.

3. For all the time periods measured (i.e., 3, 5, and 10 years), a five-star US equity fund was more likely to become a 1-star fund than it was to maintain its 5-star rating.

4. Among bond funds, only 16% of 5-star funds maintained their rating over the next five years.

5. The Wall Street Journal found that money flowed into 5-star funds in 69% of the months they held the ratings, whereas it was only 29% for 1-star funds.

The points from the article seem to strongly reinforce our contention that investors focus on the rear-view mirror when picking investments, and that such backward-looking strategies can cause significant and persistent

underperformance.

“Past performance is not a guarantee of future results.”

Every RBA report has a compliance footnote that says, “Past performance is not a guarantee of future results.” This standard footnote warns that extrapolating trend could lead to sizeable gaps between expected and realized returns. Yet, despite that everyone knows the truth imbedded in that footnote, investors habitually look backward when picking stocks, bonds, managers, asset classes, countries, etc. Investors’ historical performance seem to demonstrate that the footnote’s warnings should really be taken to heart. Chasing past performance, and

the resulting buy high and sell low strategy, significantly hurts performance through time. Investors have actually made themselves poorer over the past 20 years by looking backward.

At RBA, our forward-looking analyses typically lead us to be decidedly out of consensus. Whereas most investors are chasing yesterday’s winners, we seek tomorrow’s winners.

To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative.

www.rbadvisors.com/images/pdfs/Portfolio_Specialist_Map.pdf.