By Chris Konstantinos, CFA

SUMMARY

- In our view, international markets are less efficient, creating opportunities for active portfolio management.

- We believe a passive approach to international investing may lead to unintended sector concentrations.

- A surprising number of the best performing stocks in a given year are based outside of the US.

One of the great joys of being a part of a firm like RiverFront is access to some of the most thoughtful, intelligent, and grounded minds in the asset management space. This comes not only within our own walls, but also with other firms who we’ve been fortunate enough to count as partners.

One such partner is Boulder, CO-based Chautauqua Capital Management, a division of Robert W. Baird. Chautauqua is a boutique international and global asset manager which has managed relatively concentrated, high-conviction international stock portfolios since 2006, and shares RiverFront’s cultural emphasis on humility and intellectual curiosity. We recently had an opportunity to pick the brain of David Lubchenco, a partner at Chautauqua, on the always-entertaining, always-controversial topic of international investing. Chautauqua’s investment views are the product of a team-based approach, and herein David neatly summarizes the team’s collective sentiments.

Chris Konstantinos: We hear all the time in the United States that active US managers consistently underperform their benchmark, and that outperforming the S&P 500 is difficult to do consistently. Is this dynamic different internationally?

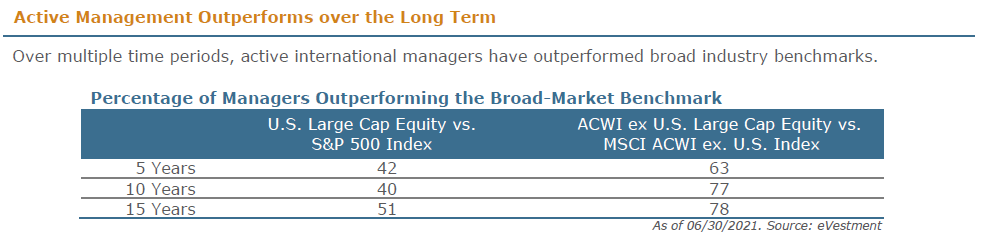

David Lubchenco: Statistically, over the past 5, 10, and 15 years, most US managers have underperformed their benchmark. However, the majority of international managers have had higher success rates outperforming their benchmark – as illustrated below (see chart).

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

We believe this is because investing internationally is different. International markets are less efficient, their index composition differs from the US indexes and the composition of public companies within international indices are different, providing unique opportunities for active managers of international portfolios. For example, in many countries, the local stock market indices are dominated by current or former state-owned enterprises (SOEs) which are often uncompetitive and have serious corporate governance issues.

I have to say I concur. David, talk to us a little bit about the sector composition differences you see between US indexes and abroad? Do you think this helps contribute to the greater success money managers have had outperforming benchmarks overseas?

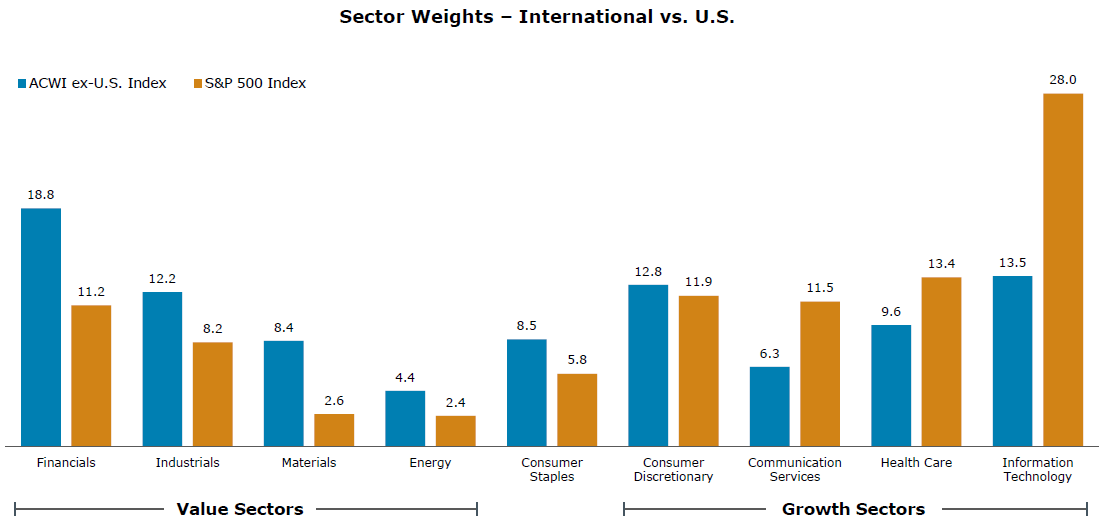

The sector composition differences between the US indexes and abroad are one of the main contributing reasons why we believe an active approach to international investing is critical. As you can see below, the MSCI ACWI ex-US international index is significantly overweight traditional “value” sectors facing long-term structural and macroeconomic headwinds, while it is underweight “growth” sectors relative to the S&P 500. The MSCI ACWI ex-US index’s underweight to information technology, health care, and communication services accounts for a large portion of the index’s underperformance versus the S&P 500 index over the past several years.

Source: MSCI, Standard & Poor’s. Sector exposure (%) provided as of 08.31.2021. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

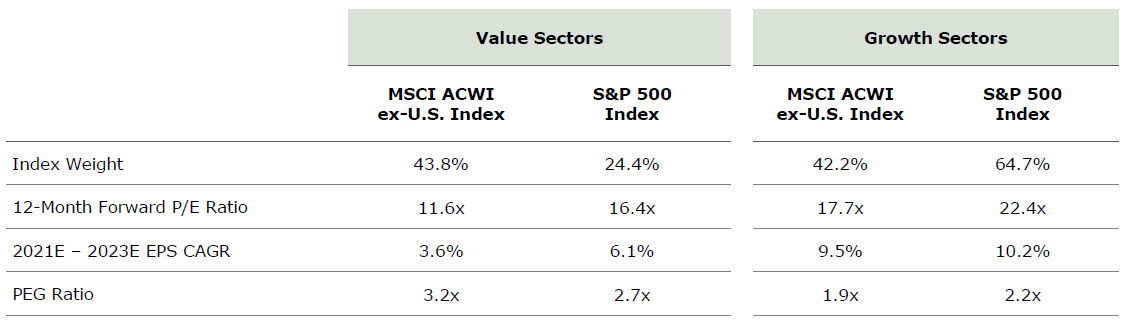

Drilling down and looking at relative valuations within the value and growth sectors yields some interesting observations. First, international growth is cheaper than US growth on both an absolute PE and a growth-adjusted basis. Second, international and US value sectors are cheaper than their growth counterparts on PE, but more expensive on a growth-adjusted basis.

Source: Bloomberg. Sector index weights are as of 08.31.2021 and index pricing and consensus EPS estimates are as of 10.04.2021. Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Can you talk to what the opportunity set for investing looks like outside of the US? I find that there’s some general misconceptions here among investors who feel that the US has an ironclad monopoly on great companies.

One important reason to broaden your portfolio and to invest internationally is the expanded opportunity set that worldwide investing offers. Approximately 96% of the world’s population, 85% of the world’s economic activity (75% based on nominal GDP), and 66% of public companies with market capitalizations greater than $5 billion are outside the US – yet most US investors are under-invested in international companies. On top of that, if you look at the top performing 50 stocks in the MSCI All Country World Index (ACWI), each of the past 11 years, on average, 77% of the time these companies are found outside the US.

*YTD as of 09.30.2021. Source: FactSet, eVestment. Top performing 50 stocks based on companies in the MSCI All Country World Index. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Said another way, the US does not have a monopoly on competitively advantaged companies with long growth runways ahead of them. By adding international exposure, investors can gain exposure to these companies, many of which do not have a US comparable and often can be purchased at more attractive valuations relative to their growth potential and profitability than can be had in the US.

Do you believe there are diversification benefits to international investing for US-centric investors?

Absolutely. Despite higher correlations since the late 1990s, an allocation to international equities is still an effective diversifier and thus deserves a place in client portfolios. Studies have shown that international allocations up to 40%, can reduce volatility by up to 5% versus an all-US equity portfolio. After all, the most efficient portfolio (one that has the highest risk-adjusted return) is not necessarily the one with the highest return.

I think your efficiency comment is a point that is often not well understood by investors.

One could make the case that globalization and US/international correlations may have peaked as evidenced by Brexit, trade wars, the associated rise of economic nationalism, and corresponding barriers to cross-border movement of capital, labor, and fragmentation of global supply chains. If these trends continue then the diversification argument for higher international allocations will be even stronger going forward.

Anything else you’d want to make US investors aware of when investing internationally?

There is a perception that international companies are “riskier”. But just because a company is headquartered outside the US doesn’t make it riskier, particularly in an actively managed portfolio. The risk of losing money in an investment is a function of a company’s financial strength, growth outlook, competitive positioning, and valuation. If you dig one layer deeper, you will find many international companies that dominate their respective industries that have superior growth outlooks, stronger balance sheets, and can be purchased at lower valuations than their US counterparts.

About Chautauqua Capital Management:

Formed in January 2009, Chautauqua Capital Management offers insightful, focused International Growth and Global Growth Equity investment strategies to help investors achieve their financial goals.

In January 2016, Chautauqua Capital Management became a division of Baird, an employee-owned global financial services firm with a demonstrated commitment to asset management. Baird is nationally recognized as a great place to work and fosters a culture based on one powerful principle: keeping clients first.

This combination, while enabling Chautauqua Capital Management to remain an autonomous investment boutique, provides Chautauqua with the strength and security of a leading financial partner. The partnership has allowed Chautauqua to hire and retain talent, create mutual fund vehicles for our strategies, and most importantly, by joining Baird, Chautauqua Capital investment team members are better able to focus on investing.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

A state-owned enterprise (SOE) is a legal entity that is created by a government in order to partake in commercial activities on the government’s behalf.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 27 emerging markets (EM) countries.

MSCI ACWI (All Country World Index) captures all sources of equity returns in 23 developed and 27 emerging markets.

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront has entered into a Model Provider agreement with Chautauqua Capital Management (“CCM”), a division of Robert W. Baird & Co., Inc. (“Baird”) whereby CCM provides an investment model that is used to make the investment selections for the RiverFront Chautauqua International ADR (“RCIADR”) portfolio. Baird Financial Corporation (“BFC”) is the parent company of Baird, a registered broker/dealer and investment adviser. CCM and Baird are affiliates of RiverFront via their common ownership under BFC. CCM and Baird are operationally independent from RiverFront.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1880703