Our work suggests that U.S. economic prospects continue to brighten. Higher long-term interest rates currently reflect the market’s expectations for faster economic growth and somewhat higher inflation. We expect this trend towards higher interest rates to continue in fits and starts.

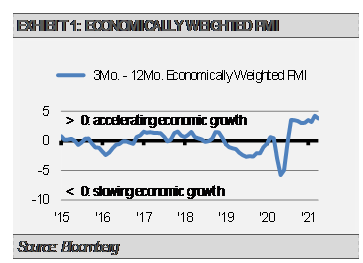

Overall monetary conditions in the U.S. continue to look strong as do many measures of fundamental economic health, such as purchasing manager indices (PMIs). The following graph shows the 3-month moving average PMI minus the 12-month moving average PMI. When the 12-month is higher than the 3-month, the pace of economic growth is expected to be slowing. Conversely, when the 3-month is higher than the 12-month, as is the case today, we expect the pace of economic growth to be accelerating.

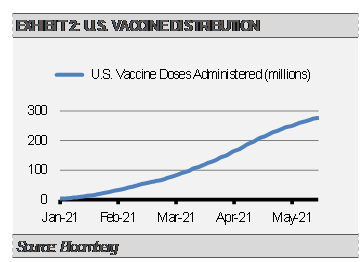

The economy is building momentum as it reopens with broader vaccine distribution as a key driver. According to recent Bloomberg estimates, with U.S. citizens getting roughly 2,000,000 vaccine doses per day on average, we should reach herd immunity in approximately three to four months.

We expect jobs creation to accelerate in the coming months as businesses improve and the economy reopens. Employment in the worst hit areas, such as leisure and hospitality, should rebound strongly. Though the leisure and hospitality sector makes up only 9% of U.S. employment, the industry accounts for roughly 35% of the remaining job losses since last year. We expect strong jobs numbers in the near-term to narrow this gap. According to the Bureau of Labor Statistics, the U.S. economy created 1.617 million jobs in the first quarter of 2021, which was primarily led by 647,000 in the leisure and hospitality sector. As vaccine distribution broadens, economic restrictions will be lifted and many of the remaining unemployed will soon find work.

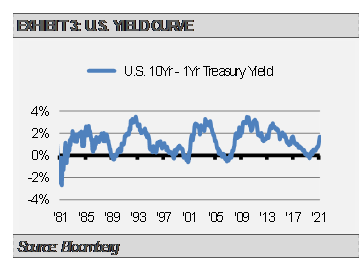

This all adds up to a speedy economic recovery in our view, which has implications for inflation, bond prices, and stock prices. After a near-term spike in inflationary measures due to base effects (i.e., going from deflation a year ago to reopening economic inflation), longer-term inflationary conditions should build over the coming months. We expect improved real economic growth combined with higher inflation expectations to push long-term interest rates higher in fits and starts.

The difference between long-term and short-term interest rates increases to about 3% during an economic recovery. Given today’s interest rate environment, that equates to the 10-year Treasury yield moving closer to 3% over the next 12 to 18 months.

On the fixed income side, our Strategies are underweight interest rate sensitivity and U.S. Treasuries in favor of shorter-duration asset-backed and mortgage-backed securities along with Treasury Inflation Protected Securities (TIPS) and bank loans. This positioning allows us to offset equity market risk with low-volatility fixed income holdings, while still not taking excessive interest rate risk.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.