Written by: Michael J. Skrzypczyk, CFA

Although I may lack the life experience of many of the presumed readers of this blog, I hope I can offer some fresh perspective and advice for people in their early stages of their career. As a member of the younger range of the “Millennial” age group, I find humor in the numerous articles trying to group together the financial motivations and lifestyles of tens of millions of people with an age gap as wide as 15 years that are labeled “Millennials”. I hope to avoid any easy characterizations and try to provide some proven advice that can be relevant to a wide array of people. This article may be more useful for people early in their career (or in school and preparing for a career), but people with decades of experience of being invested in the markets can also help share their lessons with younger generations.

The values and goals of Millennials and Gen Z may have changed from their older counterparts but sound financial planning should still be part of their life. Marriage and home buying are being put off until later in life but creating a budget and saving for the future should start as soon as possible.

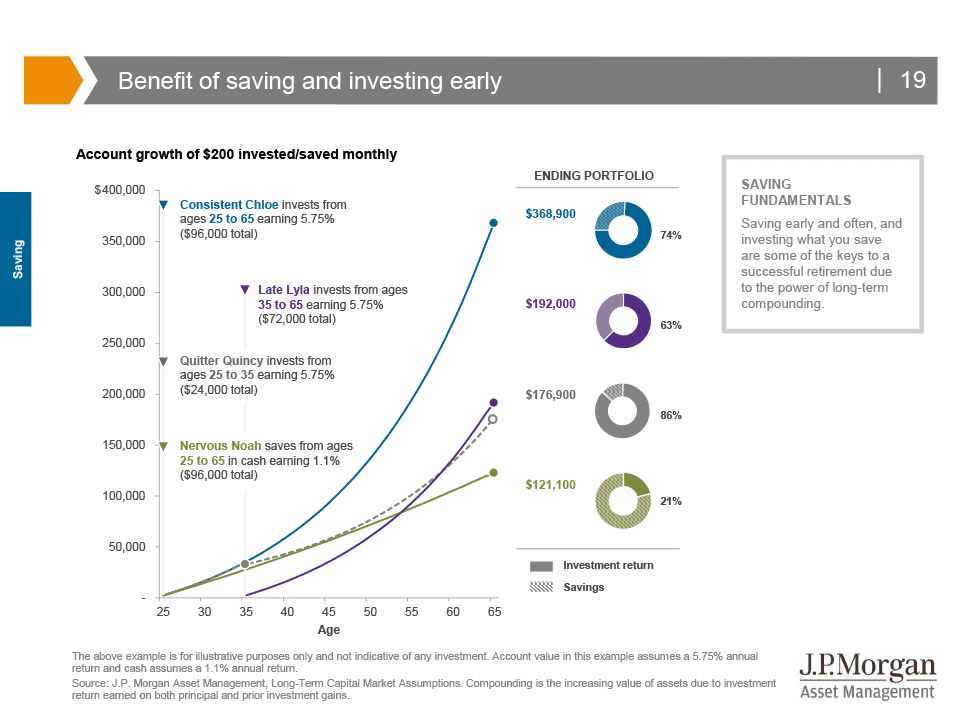

Investing for the future may not be a primary concern for young people given rising rent/home prices, student loans, and general day-to-day expenses. However, beginning to invest at a young age if possible is crucial to getting ahead and setting themselves up for financial success later in life. Per the chart below from JP Morgan, someone can contribute much less overall (Quitter Quincy) and still have a similar result to someone that invests a greater overall amount but that starts later in life (Late Lyla). The ideal saver (Consistent Chloe), will steadily contribute throughout their lifetime and should be in great financial shape by the time retirement comes. Furthermore, Nervous Noah demonstrates the potential pitfalls of leaving one’s savings in cash. The overall return will most likely be lower than his peers who invest in other asset classes and he will be negatively affected even further if inflation is higher than the return on cash (resulting in a negative real return).

Source: JP Morgan’s “Guide to Retirement”, 2021

Compound interest may be the single most important concept to learn for financial literacy and the key to letting money do the work for you. Einstein referred to it as the eighth wonder of the world and it has an exponential benefit. The “Rule of 72” is a related concept that allows you to estimate the time it takes to double your investment given a fixed annual rate of interest. Divide 72 by the expected annual rate of return to determine the number of years until your account doubles. For example, a person that expects a 7% annual return (which is not a given according to some longer term capital markets assumptions), can expect to see their account balance double in about 10 years without any additional contributions (72/7% = 10.3 years).

Additionally, the amount of time on a young person’s side increases the ability to take risk in search of larger gains with years of earning ahead of them. While usually having lower financial capital, younger age groups have much higher human capital (ie, the present value of future earnings) typically allowing them to invest more aggressively.

There are strategic ways to invest that can make returns potentially more attractive on an after-tax basis. Retirement investment vehicles can be preferable to taxable personal accounts for younger investors in many cases. Contributing to a 401k, if offered by your employer, is a great option especially if the company offers a contribution match. Another common option is the Roth IRA which is a very powerful tool I would recommend any new investor to explore. Roth IRAs allow one to contribute after-tax dollars and the investments within can grow tax-free.

While we usually recommend you seek individual tax advice from a qualified tax professional, we understand many young investors may not always have a dedicated tax professional as a resource. We have heard the following themes from tax professionals we engage with that we think are worth considering. Although impossible to predict the exact level of taxes going forward and one’s future tax bracket, taxes will most likely increase in the future. We are in a period of historically low tax rates and government obligations should continue to rise in the future. An aging population may lead to an increase in spending on government-supported programs such as Social Security and Medicare that will need to be funded using tax revenue. In addition, most young people will expect to make more as they get closer to retirement potentially putting them in a higher tax bracket. Tax-free growth potential, tax-free withdrawals, no minimum required distributions, and the ability to hedge against future tax hikes are all impressive benefits of the Roth IRA. Roth IRAs can also provide additional flexibility compared to traditional IRAs or 401ks with some ability to withdraw your contributions before retirement without penalty.

Absent a wider adoption of financial literacy classes in high school or college, family members, financial advisors, and digital advice can help fill the gap. It is never too early to begin what should be a lifelong journey in financial education.

At Nottingham, our passion is helping people save for the future and achieve their individual goals. If you know a young investor that might have questions, we would happily be a resource.

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client.

For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

For more news, information, and strategy, visit the ETF Strategist Channel.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.