Inflation and the Fed’s Response Took Center Stage; Markets Now Fear Inflation and Recession

We believe continued high inflation readings in the second quarter of 2022 put the Federal Reserve (Fed) in a precarious position; they can either let inflation damage the economy or get more aggressive with monetary policy and potentially put the economy into a recession. The Fed has chosen the latter path of raising interest rates aggressively and hoping the economy can prove resilient. The Fed increased interest rates by 50 basis points at their May meeting and ratcheted that up an additional 75 basis points at their June meeting. The Fed Funds rate is now 150-175 basis points, with an additional 75 basis points expected at the next Fed Funds meeting planned for July 26th and another expected 50 basis point increase at the September 20th meeting, according to Fed Funds futures markets.

Equity markets have continued to grapple with higher inflation rates, driven in part by continued supply chain issues, COVID-19 overhang, and the ongoing conflict between Russia and Ukraine, in our view. Towards the end of the quarter, the market began to reflect fears of recession in asset prices, pummeling equities and credit spreads, and lowering commodity prices. We think it is too early to tell whether the Fed would consider changing policy if the market’s view proves right, and economic data continues to slow.

Currently, we believe the challenge for equity investors is that, so far, expectations for corporate earnings have not been terribly impacted, and actual earnings, with some exceptions, were strong in Q1. This could mean either the companies will weather this slowdown, or we have yet to see the worst impacts on earnings from inflation and higher interest rates. While we are beginning to see slowdowns in the retail industry and mortgage applications, which tend to be leading indicators of a slowdown, we are not yet at a point where “bad news is good news”, and we can count on the Fed to relent.

Our response to this unfavorable set of economic circumstances has been to reduce equity weightings and to seek out places where yields are higher or where we think the market has overreacted (‘beware of the crowd at the extremes’). We call this strategy P.A.T.T.Y. (Pay Attention to The Yield), because we expect volatility to be elevated for an extended period of time, and we believe there’s potential for investors who take these market risks to be rewarded.

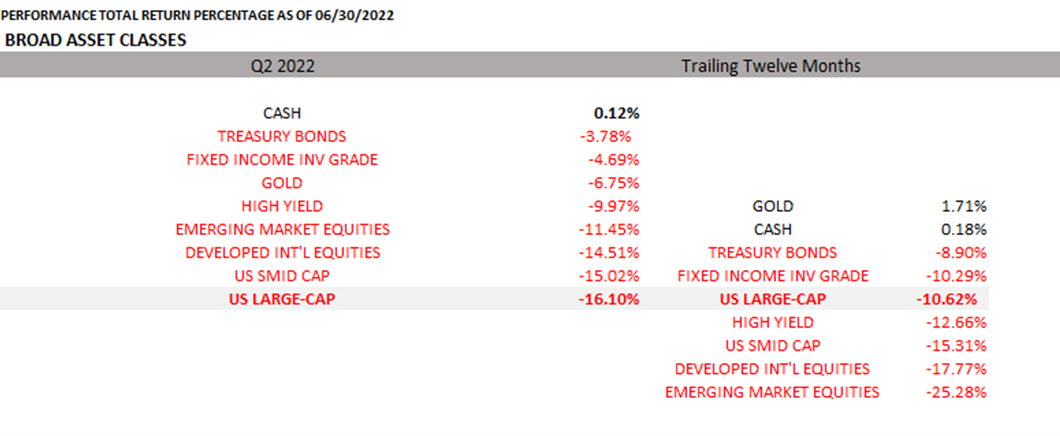

Performance: A Closer Look

The second quarter of 2022 proved to be even more challenging than the first quarter. The only haven from a broad asset class perspective in Q2 was cash, and the further deterioration in returns in the second quarter turned the performance of all non-cash asset classes negative by (See chart, below). While developed markets and emerging markets struggled in this environment, US equities performed the worst of all, largely due to the US’ relatively high weighting to growth-oriented stocks.

Growth stocks had their price-to-earnings (P/E) multiples severely impacted in the quarter, as fear of higher interest rates slowed investor appetite for companies and sectors in the more speculative areas of the S&P 500 and small-and-mid-capitalization indices. High yield bonds declined meaningfully as well, consistent with their historical correlation with equities in negative markets, as fear of recession increased the perceived risk of defaults.

Source: Morningstar, RiverFront. Chart shown for illustrative purposes only. Data as of 6.30.22. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance.

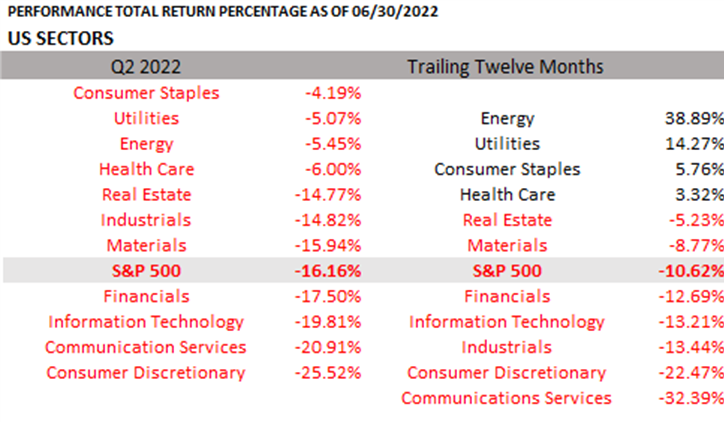

Sector Returns: All Sectors Negative, Growth-Oriented Struggled Most of All

Not a single sector in the S&P 500 had positive returns for Q2 (Chart, below). Energy and defensives continued to be the safest investments, Industrials, Materials, and Real Estate declined by double digit percentages but were still better than the S&P 500. Financials, Technology, Communications, and Consumer Discretionary performed the worst (Chart, below). The fact that ‘defensive sectors’ held up better reflects both strong earnings from those companies and a view that their future earnings may prove more resilient in a recession, in our view. We believe weakness in the more cyclical growth sectors was attributable to negative guidance from several bellwether companies, as well as fears associated with rising interest rates and their impact on the sector’s future growth prospects.

Source: Factset, RiverFront. Chart shown for illustrative purposes only. Data as of 6.30.22. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance.

Going forward, one of the things we will be watching is revisions to earnings in the sectors that have seen major P/E multiple contraction. So far, many of the losses are more reflective of multiple compression than of expected earnings compression, in our view. We anticipate the coming quarters will indicate that either the market has overreacted (if earnings do not come down), or that the market has correctly predicted major earnings decline in these companies. Our future selection efforts will focus on areas where we see an overreaction in price and stability in earnings.

International Returns also related to Inflation, Rates, and Geopolitics

International markets mostly struggled during Q2 (Chart, below). Even the commodity-sensitive countries (such as Canada, Brazil, Norway, and Australia) that were able to buck the negative trend in Q1 were pulled down as well. China ended up being one of the strongest markets internationally in Q2 after a negative Q1 and had a positive 3.52% return for the quarter. We believe this strength was driven by China’s major technology and consumer positions, which had underperformed international indices in Q1. Outside of China, most other regions struggled, and losses in their markets were compounded by losses in currencies of those countries versus the dollar.

Conclusion:

The first quarter of 2022 was challenging for investors, and the second quarter was no different. At RiverFront, we believe maintaining a focus on long-term plans is critical in these market environments. In our view, impatient investors who panic, could lose more money to inflation through lost purchasing power if they step out of the market or deviate too far from their long-term plans. We believe that our ability to make tactical shifts in positioning will be important, as the market generally overreacts to some themes as it processes rate increases and Fed actions. Just as we reduced risk and raised cash across our portfolios throughout the quarter, we will be looking for signs of a shift in Fed policy to potentially put some capital to work. For example, crowd sentiment is already at a negative extreme, so signs of the Fed becoming less restrictive or additional market weakness may cause us to become more opportunistic. Aside from meaningful changes in our tactical indicators, we will likely remain underweight equities to protect the portfolio through this challenging market environment.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Index Definitions

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

S&P 500 Indices shown in the chart on page 2 comprises those companies included in the S&P 500 that are classified as members of the applicable GICS® sector.

In a rising interest rate environment, the value of fixed-income securities generally declines.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

P/E Ratio (TTM): The Price/Earnings Ratio or P/E Ratio is a valuation metric that assesses how many dollars investors are willing to pay for one dollar of a company’s earnings. It’s calculated by dividing a stock’s price by the company’s trailing 12-month earnings per share from continuous operations.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

There are special risks associated with an investment in real estate and Real Estate Investment Trusts (REITs), including credit risk, interest rate fluctuations and the impact of varied economic conditions.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2271397