SUMMARY

- Inflation has risen to such high levels due to a ‘Perfect Storm’ of events, in our view.

- We believe there are mixed signals as to whether it is peaking.

- While we are currently cautious, we believe the long-term case for stocks is compelling.

FOR THE CLOUDS TO CLEAR, THE RAIN MUST STOP

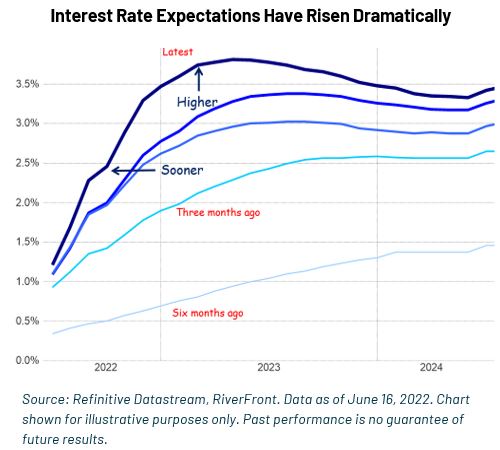

We believe the declines in stock and bond prices this year are dramatic but not illogical… and the two are interrelated. Bond prices are falling because inflation keeps surprising to the upside, in our view, leading investors to continually raise their expectations of the amount by which the Federal Reserve (Fed) will have to raise interest rates (see chart, below). We believe, stock investors, in addition to worrying about rising interest rates, are concerned by a fundamental change in Fed priorities and the risk of a recession. We think it is too early to say that inflation is clearly peaking, and that the Fed’s tightening monetary policy will soon change. This week we outline what we are monitoring and explain that, while many of our internal indicators show no signs of improvement, some are starting to suggest that supply chain pressures are easing.

From the housing price collapse and recession of 2008 until recently, the Fed’s main concern has been preventing deflation and encouraging growth, in our view. In practice, this has meant that any sign of economic weakness has been met with stimulus in the form of lower short-term interest rates and the expansion of its balance sheet; achieved by buying Treasury and Mortgage bonds to drive down long-term interest rates. Short-term interest rates have been kept below the rate of inflation, a policy we and others have called ‘financial repression’, as savers have been unable to earn much, if any interest, on their cash balances. This has created a great environment for financial assets like stocks, bonds, and real estate, in our view. In other words, rarely in the last 15 years have investors been ‘fighting the Fed’. Indeed, we would argue that keeping financial markets happy has been part of Fed policy in the last 15 years.

The Perfect Storm

We believe that era is over for now. A ’perfect storm’ of inflationary conditions have sprung up all at the same time, in our view. These include:

- Supply chain shortages because of the COVID-19 pandemic.

- A massive boost to incomes from the Coronavirus Tax Relief stimulus checks, creating demand for the goods that have been in short supply.

- A surge in energy prices due partly to post-COVID-19 pandemic demand, but mostly due to a supply shortage from a lack of investment in new capacity and sanctions on Russian oil due to aggression against Ukraine.

- A surge in food prices, also affected by the war in Ukraine which is known as the ‘breadbasket’ of Europe since it grows so much of the world’s agricultural crops.

- A shortage of labor in service sector jobs, leading to rising wages- resulting in a self-reenforcing feedback loop of higher prices being passed on in both goods and services.

Inflation can be a mindset as well as a data set. The Fed has seriously misjudged the magnitude and persistency of inflation, in our view. What they thought would be ‘transitory’ and manageable, has become self-perpetuating and has accelerated well beyond what is acceptable. The Fed is not alone in misjudging inflation, investors (including RiverFront) and most forecasters have also been caught by surprise. At the beginning of this year, market expectations for short-term (3 month) interest rates were for a gradual move to around 1.5% by mid-2024, shown by the lowest line on the chart to the left. This was consistent with the Fed’s guidance. By March, expectations were just over 2.5% by late 2023 (the second line from the bottom), and as of June 16, 2022, they are 3.50% by year end.

Inflation can be a mindset as well as a data set. The Fed has seriously misjudged the magnitude and persistency of inflation, in our view. What they thought would be ‘transitory’ and manageable, has become self-perpetuating and has accelerated well beyond what is acceptable. The Fed is not alone in misjudging inflation, investors (including RiverFront) and most forecasters have also been caught by surprise. At the beginning of this year, market expectations for short-term (3 month) interest rates were for a gradual move to around 1.5% by mid-2024, shown by the lowest line on the chart to the left. This was consistent with the Fed’s guidance. By March, expectations were just over 2.5% by late 2023 (the second line from the bottom), and as of June 16, 2022, they are 3.50% by year end.

This is a dramatic change in expectations to say the least. We think it goes a long way to explaining financial market weakness. It is no surprise that the recent weakness in stocks and bonds followed inflation numbers released on June 10th that were higher than the highest estimates.

Expectations of future interest rate levels have risen dramatically this year. What are signs of the clouds clearing?

Since we believe higher inflation and interest rates led the markets down, we think they also hold the key to a bottoming process. Here’s what we are looking for categorized by color in terms of what level of improvement, or lack thereof, we are seeing:

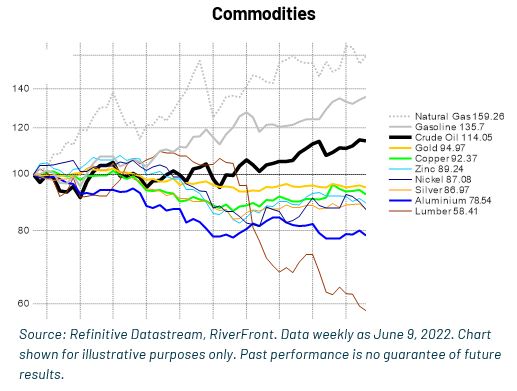

Oil prices must stop rising. Since oil finds its way into so many parts of the economy. The price of Brent crude oil has not surpassed its March highs so far, but gasoline prices have. We would like to see oil prices settle into a lower range below $100/barrel. Ultimately, high prices should bring in new supply and cause consumers to cut back, but there is no significant evidence of that so far.

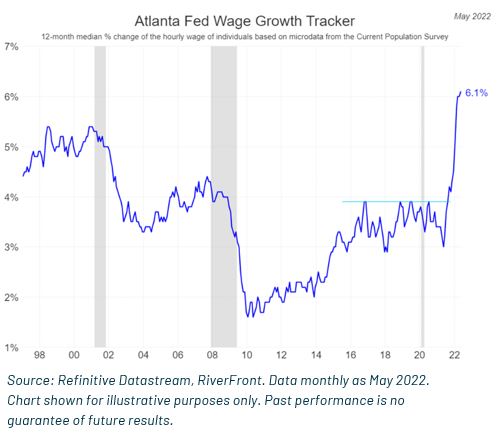

Oil prices must stop rising. Since oil finds its way into so many parts of the economy. The price of Brent crude oil has not surpassed its March highs so far, but gasoline prices have. We would like to see oil prices settle into a lower range below $100/barrel. Ultimately, high prices should bring in new supply and cause consumers to cut back, but there is no significant evidence of that so far.- Signs of the labor market easing. We like to watch the Atlanta Fed’s wage tracker index which is currently rising at a 6% annual rate, the highest since the late 1990s. (Chart, right). What we are also looking at is rising weekly claims for unemployment and lower readings form surveys of wages.

- Lower Bond Yields. The bond market is a reflection of investors’ assessment of the relative risk of higher inflation versus lower growth, in our view. As of June 17th, 2022 bond yields are still rising with the 10-Year Treasury note yielding 3.23%.

An easing of supply chain pressures. The New York Fed produces a barometer of supply chain pressure, including data items such as various global shipping costs and supply-chain related responses to PMI surveys. This ‘Global Supply Chain Pressures Index’ has fallen from its year-end high. We believe it is likely to continue to do so, given how high the index reached relative to its normal range (Chart, right).

An easing of supply chain pressures. The New York Fed produces a barometer of supply chain pressure, including data items such as various global shipping costs and supply-chain related responses to PMI surveys. This ‘Global Supply Chain Pressures Index’ has fallen from its year-end high. We believe it is likely to continue to do so, given how high the index reached relative to its normal range (Chart, right).- Increased Chinese export volumes. As Shanghai continues to reopen from its recent COVID-19 lockdown, China’s exports are increasing which is an encouraging sign.

- Increased auto production. We believe this would be a good sign if the semiconductor chip shortage is easing. We hear anecdotal evidence that production is ramping up but there is no sign so far in the data.

- Falling commodity prices (Excluding Oil). Industrial metals are somewhat lower this quarter and lumber prices have plummeted recently (Chart, below).

Mixed signals on inflation peaking, bonds to lead the way

Mixed signals on inflation peaking, bonds to lead the way

As you can see from what we are watching, it is too early to call for an imminent peaking of inflation pressures. However, we believe there are some signs that the worst is nearly over. The Fed is very positive about inflation falling, estimating Core CPI at 4.3% by year end and 2.7% by end 2023. Given their forecasting record, we don’t put much stock in this. However, they believe it and if the figures start to fall in line with their projections, they may slow their monetary tightening.

Markets are forward looking and will likely be sensitive to changes at the margin, so incremental improvements should lead to stock and bond prices starting a bottoming process with the bond market leading the way. We believe bond prices will continue to rally into a slowing economy whereas stocks will continue to worry about the possibilities of a recession.

Conclusion

Should you sell?

By the time it is abundantly clear that this inflation cycle has peaked, we believe a new cyclical bull market in stocks will be well underway. In fact, the best leading indicator of a peak in inflation and interest rates is likely to be the stock and bond markets themselves. After all, US stock and bond prices peaked in January, well before the now-clear evidence of a significant inflation problem. Things could get worse before they get better, but assuming you are a long-term investor you have to get two timing decisions right – when to get out and when to get back in.

Both decisions can be difficult. Assuming you sell now because things look bad, you may be right for a while, but we believe prices will probably be higher by the time it is clear the clouds have lifted, and the storm is over. At RiverFront we have a disciplined process for raising cash and for reinvesting it. Last week we further reduced risk and raised cash in our balanced portfolios because we see further downside in the short-term, but we are also currently building a watch list of what we see as attractive securities to buy when we believe a more durable bottoming process has taken shape in the markets.

Betting on American ingenuity

For the last 30 years or so global companies -and especially ones based in the U.S. – built a highly efficient supply chain which has allowed them to grow their earnings faster than their sales and deliver a secular increase in margins (see chart, left). Profit margins for US companies produced by the Bureau of Economic Research (which looks at a much broader group of companies than just those publicly quoted) fell in the 1970’s and 80’s and has been rising higher in each economic cycle since the mid-1990s. We believe this has a lot to do with the efficiency of global supply chains.

For the last 30 years or so global companies -and especially ones based in the U.S. – built a highly efficient supply chain which has allowed them to grow their earnings faster than their sales and deliver a secular increase in margins (see chart, left). Profit margins for US companies produced by the Bureau of Economic Research (which looks at a much broader group of companies than just those publicly quoted) fell in the 1970’s and 80’s and has been rising higher in each economic cycle since the mid-1990s. We believe this has a lot to do with the efficiency of global supply chains.

A secular rise in profit margins since the mid 1990’s

Storms eventually pass and this one will too. Life beyond COVID-19 may involve more onshoring, higher inventories, and higher labor costs, and thus margins have likely peaked for now, in our view. However, it has been a mistake to bet against American ingenuity over time as evidenced by the secular rise in US stock prices. We believe the best global companies will continue to adapt and will figure out a way to build new, more automated, and efficient supply chains in the years to come. We would not bet against Corporate America.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Brent blend is the name of one of two internationally-recognized types of crude oil that are used as benchmarks for prices of crude oil. Brent Blend comes from the North Sea and is considered a light, sweet crude oil. Brent blend is more than half of the crude oil traded internationally, so it is a logical choice to be the benchmark for crude oil pricing.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The U.S. Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2254168