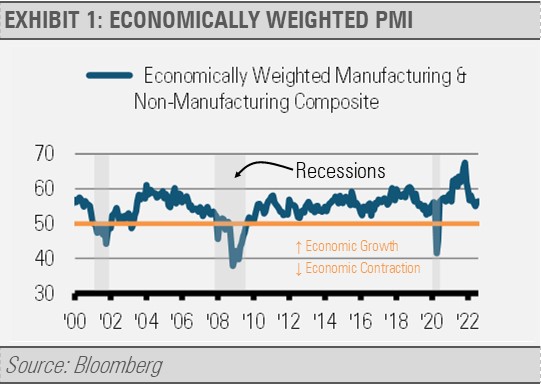

Our work along with recent economic activity measures indicate that the economy continues to grow, and the U.S. will likely avoid a recession in the near-term. For example, coincidental economic surveys maintain characteristics of economic growth. Our economically weighted purchasing manager indices indicate that while business activity has slowed from last year’s blistering pace, growth still continues. In the following graph, readings below 50 note economic contraction, while readings above 50 suggest economic growth month over month. In the U.S., economic growth has been driven by the resilient services sector, which makes up the vast majority of our economic activity.

Meanwhile, the leading edge of inflationary pressures are subsiding. One of the primary drivers of inflation over time is the amount of money in the economy relative to economic output, or as economist Milton Freidman put it, too much money chasing too few goods. As the following graph illustrates, broad money relative to economic output steadily increased during the previous business cycle, and inflation held at about 2% per year. Approximately thirteen months after the influx of government stimulus increased the level of broad money relative to output, inflation suddenly shot higher. This is a good example of the time lag between policy changes and their effects on the real economy.

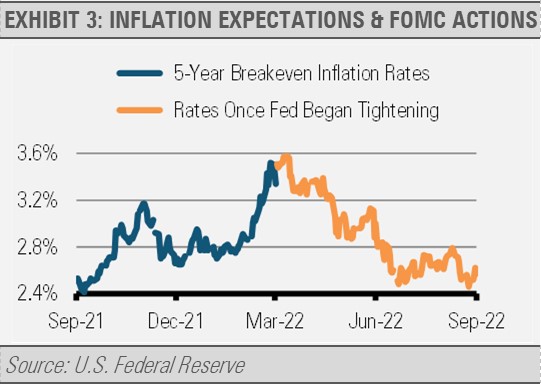

However, the growth rate of money relative to output has stalled recently. This environment combined with other factors indicates to us that inflationary pressures will be easing in the coming months. In fact, a wide range of inflationary pressures, such as the growth rate of broad money, price increases for new apartment leases and used cars, as well as survey data tracking wholesale prices paid and the number of businesses planning price increases, all suggest that inflationary pressures are beginning to ease. This easing can be seen in market-based inflation expectations as measured by inflation breakeven spreads that have recently come back down. Inflation is now expected to average 2.5% over the next 5 years.

If inflationary pressures ebb as we expect, real, inflation-adjusted incomes and retail spending should accelerate, which would be good news for the economy and U.S. households. Still, the Fed’s hawkish tone suggests continued tightening as they attempt to bring inflationary pressure down further and faster.

While we think that the Fed should take a wait and see attitude after already hiking interest rates at a very fast pace and beginning to reduce the size of its balance sheet, we do not think they will show that kind of patience. Tighter monetary policy in this environment puts the business cycle at risk in our view.

While our work suggests that the U.S. economy has successfully avoided a recession so far, the risks to future growth are increasing. In addition to our expectations for Fed policy tightening going forward, we note that the Conference Board’s Index of Leading Economic Indicators (LEI) has been trending lower since March. While not necessarily predicting a recession, the current LEI trend is indicative of economic slowing in future months and quarters ahead.

INVESTMENT IMPLICATIONS

Looking at these factors in combination, we think it is prudent for investors to utilize strategies that incorporate a tactical component to overweight defensive measures where appropriate. In recent weeks, we have increased our allocations to defensive equity sectors and alternative investments, such as multi-sector income strategies and managed futures. Additionally, we added exposure to intermediate duration U.S. Treasuries. We continue to watch for signs of a potential recession and will take further steps to manage the risks accordingly.

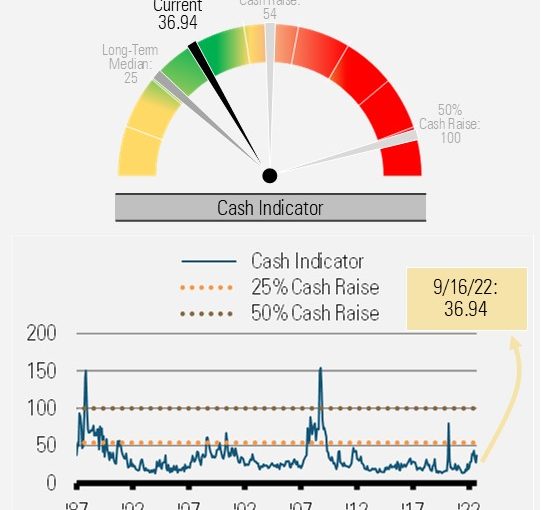

THE CASH INDICATOR

The Cash Indicator (CI) has been useful for helping us judge potential volatility. While the CI remains in a normal range, we note that the CI has been trending higher again recently. We intentionally designed this measure to be more sensitive to market dislocations and systematic market breakdowns rather than the market revaluation we are likely experiencing this year. We are following the CI closely and will adhere to our process accordingly.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.