The past six months has been a trying time as the pandemic has impacted so many facets of our lives. Working from home has become the norm rather than the exception for many professions, education is delivered virtually, and many Americans worry about paying their bills due to elevated unemployment rates.

Americans are right to worry; our belief is growing that the current economic recovery may continue for a while without significant job creation. This ‘job-light’ recovery is an example of how the stock market and the economy may maintain different trajectories for some time for two reasons:

- Corporate America has learned through prior crises how to effectively grow earnings through a downturn by right-sizing costs…including employment costs.

- A ‘job-light’ recovery is likely to keep policymakers highly accommodative, which drives the value of financial assets such as stocks higher, in our opinion.

PAYROLLS WILL RECOVER MORE SLOWLY AS CORPORATIONS FOCUS ON PROFITS

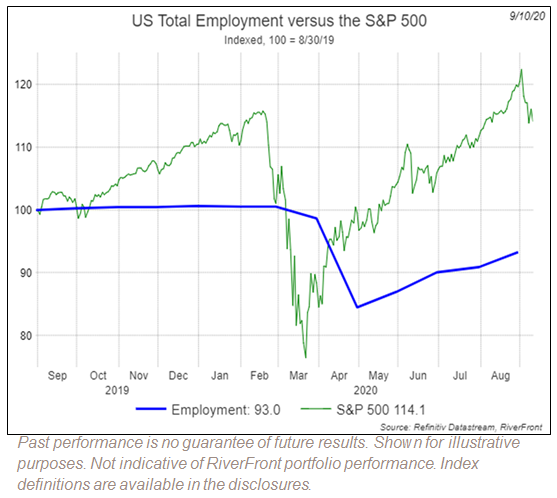

In April, unemployment peaked at 22.16 million workers. In the four months since, 10.6 million US workers have gone back to work. Many of these were furloughed workers returning to their old jobs as the economy reopened. However, most of the recovery occurred in May and June as our chart below shows. Since then, the pace of hiring has slowed as evidenced in last week’s stagnant initial and continuing unemployment claims.

Our chart (right) shows very clearly the different trajectories of employment and stocks. We believe the S&P 500 is at all-time highs in part because companies are focused on profits not hiring. This explains why the economy and the market can seem disconnected at the early stages of an economic recovery.

While the stock market focuses on profits one year out, the economy is measured by GDP (Gross Domestic Product), which consists of consumption, investment, government spending, and net trade. A sizeable move in one of the four components could have a significant impact on the economy. If our thesis of a job-light recovery plays out, further government spending will be required to fill the hole. Hence, we believe that policymakers in Washington, D.C. recognize this and will ultimately provide further assistance rather than let the economy experience another setback. This will help both the economy and stocks, in our view.

Another reason for the disconnect between the economy and the stock market is that the economy is driven by small and medium-sized companies, which comprise roughly 50% of overall employment and account for nearly 44% of GDP. Now many of these companies are in a battle to survive as larger competitors have thrived during the pandemic. The stock market as represented by the S&P 500, is made up of larger and more global companies –the top-50 companies make up 55% of its value.

INCREASING COSTS MAY FURTHER LIMIT JOB CREATION

A recent ISM Survey showed that ‘prices paid’ rose, meaning that it has been more expensive to do business during the pandemic. Therefore, companies will be looking for ways to offset higher costs. Traditionally, companies have cut costs through headcount reductions, however some reductions have been delayed by companies who promised not to lay-off workers during the pandemic (known as the “Pandemic Pledge”). As COVID-19’s grip on the economy fades, traditional cost savings measures are likely to return and hiring will begin when companies have right sized their businesses. We believe investors will reward companies that maintain or increase profitability. Therefore, in our opinion, profitability will rule the market’s path, while employment will drive the economy.

PORTFOLIO IMPLICATIONS:

We remain slightly overweight stocks because as we have argued a ‘job-light’ recovery tends to be a positive backdrop for stocks, even as it may remain a trying time for many American workers. That said, we recognize that stocks are now grappling with the uncertainties of the upcoming election and there has been a significant rise in stock prices since March. In our shorter-horizon portfolios we have been more focused on risk management and last week reduced our stock weighting slightly.

From a selection perspective, we think a ‘job-light’ recovery would favor US companies. Additionally, we like companies able to demonstrate an ability to grow in a growth-constrained economy. On the other hand, we are more cautious toward companies with less flexibility to cut costs or companies that are highly exposed to pandemic-sensitive consumer markets.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1329929