We received a lot of questions regarding last week’s ‘Recession Fears Overblown’ report.

How many people have a good track record of predicting recessions? Raise your hand if you predicted and traded the 2008 recession well.

There are 3 pillars to our bullish portfolio tilt:

- Inflation is low.

- The Fed is on hold and U.S. rates are low (for now).

- There are pockets of equities globally where valuations are attractive relative to their equity risk premiums.

We certainly don’t think the S&P 500 Index’s 70% annualized return for 2019 is sustainable. Now is a good time to trim stocks where valuations are expensive, and positioning is crowded. Given the low levels of implied volatilities, adding portfolio hedges make sense to us.

We feel compelled to say that in 2018 we were quite skeptical (and flat out bearish at certain points) on equities. We turned bullish in late December 2018 and re-risked our portfolios in mid-January 2019. At the time, we felt the risk/reward for stocks was attractive for three reasons.

- U.S. stocks were priced for a recession in Q4 2018 (S&P 500 troughed at approximately 15x earnings). At one point in December, the S&P 500 fell 15%. This reminded us of the price action during the depths of the 2008 recession, although the similarities end there.

- There was panic in the marketplace (that’s usually when you want to buy stocks).

- Per our models, we didn’t think an economic recession was imminent.

For the rest of this piece, we address the types of questions that clients have asked. We look forward to hearing more of your feedback.

- Can this bull market last longer? Yes. There are no expirations on bull markets. Every cycle is different. We’ve had an extraordinary monetary policy ($15 trillion of central bank balance sheet expansion) which is part of the reason why this cycle has lasted so long and can continue further. The Fed just massively pivoted, and their rhetoric is a complete 360-degree turnaround from 2018. If you are uncomfortable with the length of the bull market, then you probably have too much risk in your portfolio.

- How worried should we be with an inverted yield curve? Let’s be careful here. According to JP Morgan Research, over the past 40 years, an inversion happened on 5 occasions and the curve was inverted for 10% of the time. In Astoria’s view, it’s quite difficult to extrapolate on 5 data points. A yield curve that stays inverted for a few days or weeks is not alarming. We would be a lot more worried if an inversion lasted for 1-2 quarters.

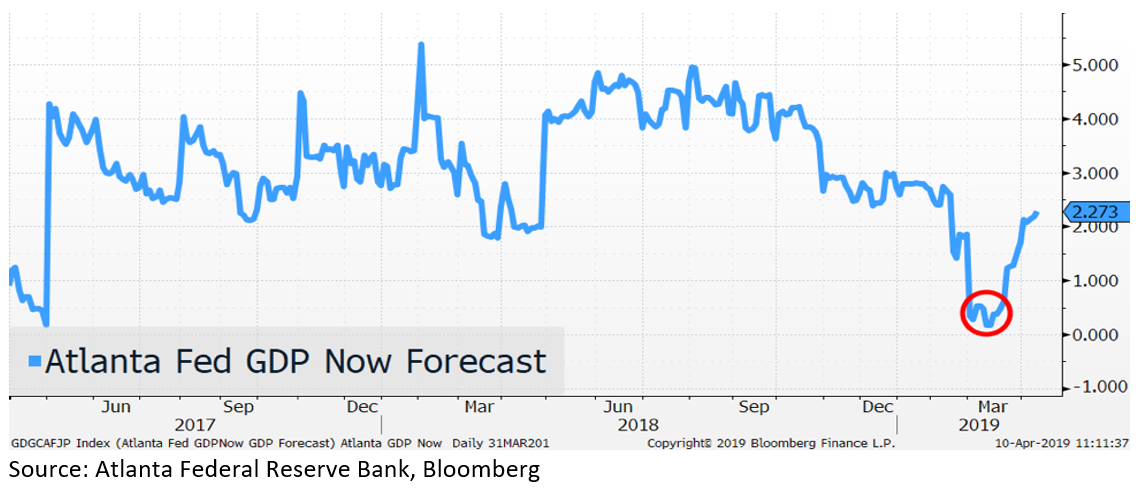

- When will the global growth slowdown trough? We believe there is a reasonable probability that the first half of 2019 will be the trough. The Atlanta Fed GDPNow Forecast is currently 2.2%, which is up from a cycle low of 0.17% on Mar 11, 2019.

- Is positioning extended? Are investors too bullish? The year to date price action doesn’t reflect positioning or sentiment. Investors should not look solely at ETF or mutual fund flows to judge sentiment. Doing so would exclude institutional clients who are crucial to the analysis. Based on a variety of sell-side reports, our interpretation is that positioning is not overly bullish. It is worth pointing out that the State Street’s Investor Confidence for the North American Institutional Investor Index continues to trend lower (see chart below).

- What has led the market in 2019? Growth, size, technology, U.S. equities, and China have been the leaders in 2019. Keep in mind at the start of 2018, the call from most buy-side and sell-side firms was either to own 1) defensives 2) high quality 3) staples/utilities/healthcare 4) OW Emerging Markets and UW the U.S. market. Pretty much the opposite has occurred so far in 2019.

Source: Bloomberg, Standard & Poor’s

From a long only ETF factor perspective, Size and Quality have outperformed the most thus far.

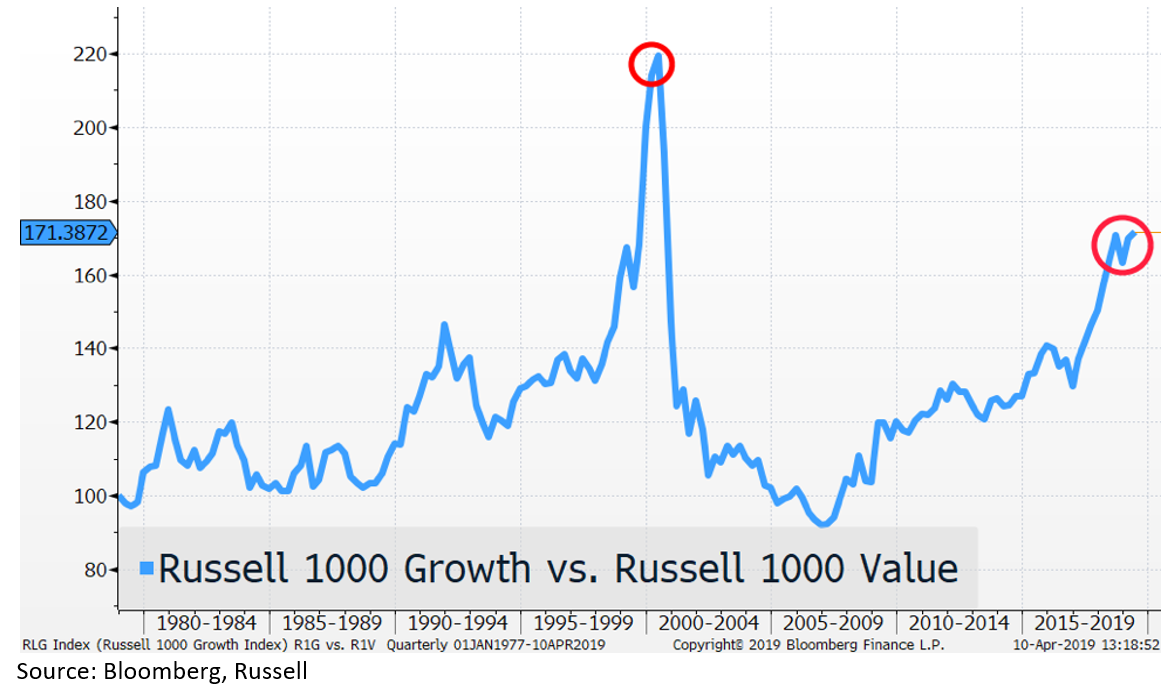

- You have been vocal about owning quality. Can you update us? To be clear, we’ve been vocal about owning quality plus growth stocks via DGRW. DGRW’s methodology is a 50/50 split between quality metrics (ROE/ROA) and growth (long term growth expectations). Given that the U.S. earnings environment is expected to deteriorate in 2019, wouldn’t you want to own stocks with above average growth? Historically, when 1) earnings decline 2) growth slows 3) yield curve flattens growth stocks outperform value. This is exactly what we are seeing in 2019. The Russell 1000 Growth Index has outperformed the Value Index by 400bps in 2019.

- Why do you like DGRW and not QUAL? We are not opposed to QUAL. To its credit, QUAL has outperformed DGRW by 315bps year to date. Per ETFAction.com, DGRW trades nearly 3 valuation turns cheaper (15.53x) than QUAL (18.29x) and DGRW has higher 2019 EPS growth estimates (3.88%) than QUAL (3.22%). To be clear, both ETFs are quite different as there is only a 30% constituent overlap. We simply prefer to own high quality stocks with above average growth.

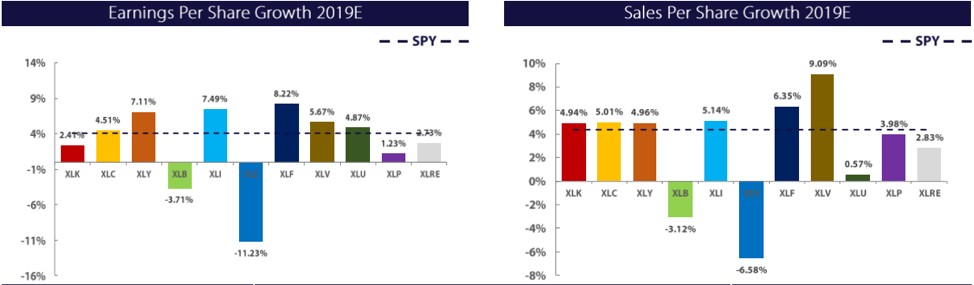

- Should we stick with defensives given that the global economy is slowing? We would rotate out of Staples, Utilities, as well as Minimum Volatility ETFs which have gotten expensive and are crowded. In Astoria’s U.S. Thematic ETF portfolio, Industrials and Health Care are our biggest OWs. As the chart below from ETFAction.com shows, XLI and XLV are both expected to produce higher earnings and sales growth compared to the S&P 500 in 2019.

Source: ETFAction.com. Data as of April 5, 2019.

- Should we continue to own bonds? Astoria lengthened our bond duration in early January (another risk on tilt) but we remain focused on higher quality US bonds. Mortgage-backed securities and high-quality U.S. munis remain our preferred bond sectors. Over 70% of our bonds are either AA or AAA rated throughout our portfolios. The yield curve is flat, so investors aren’t being compensated for going far out the curve. We wouldn’t go down the credit curve either given where credit spreads are trading.

- Should I hedge my portfolio or include alternatives? Yes. This is a no brainer. The S&P 500 is currently annualizing a 70% total return for 2019. How on earth can this be sustained? We have been vocal on owning MNA which provides equity-like returns with fixed income like volatility. In 2019, we added BTAL which has consistently been negatively correlated to stocks. BTAL goes long stocks with below average betas and shorts stocks with high betas. In 2018, BTAL was up 15% while the S&P 500 down 4%. Year to date, BTAL is down 4% while the S&P 500 is up 15%. If you can trade options, take advantage of the low levels of volatility across stock, bond, and the interest rate market.

- Should we be concerned with a rate cut? The Fed funds futures market is pricing in approximately 56% probability of a rate cut in December. A rate cut would be bad in Astoria’s view. This would imply that the global economy is weak. We’re not sure why bond investors are pricing this into the market.

- Should we invest in international markets? There are a lot of charts floating around that show the valuation spread between the U.S. and International stocks are at multi-decade highs. When starting valuations are high, future returns tend to be lower. There’s no magic formula there. Investing in EM equities is our highest conviction view. See our CNBC interview from February and April where we provided our thesis for owning China.

- What’s the bull case for owning EM/Chinese stocks? There are several reasons:

- Valuations are significantly cheaper. EEM, MCHI, and EMMF are trading at 9x to 12x earnings compared to 17x for the S&P 500.

- China is injecting massive amounts of liquidity into the system.

- Investors seemingly continue to dislike China/EM (this is good from a contrarian perspective) and are biased to owning the U.S. market.

- There have been positive steps towards US/China trade resolution.

- MCHI has triple the earnings growth based on 2019 estimates compared to the S&P 500.

- The exposure of Chinese stocks is increasing in EM indices. Whether you like it or not, your exposure to China will increase if you own EM index products.

- What makes Astoria Portfolio Advisors nervous? There are 3 things:

- Tight labor markets

- Corporate buyback activity has been a huge driver of stock demand in recent years (what happens when that bid goes away?)

- Europe has significant macro and micro problems.

- Conclusion: Astoria runs globally diversified multi factor ETF portfolios across stocks and bonds. We utilize alternatives (that carry well) to soften our portfolio volatility. Our goal is to outperform our benchmarks on a risk-adjusted basis across varying economic cycles. Everyone looks like a hero when the S&P 500 produces exorbitant Sharpe Ratios and when there is rampant QE. Investment firms need to be judged by performance across both bull and bear markets.

For more information on our model portfolios, please click here.

To see how you can access Astoria’s strategies, click here.

Finally, to discuss our model portfolios with one of our team members, you can reach out to us here:

Telephone: 212.381.6185

Twitter: @AstoriaAdvisors

Best, John Davi

Founder & CIO of Astoria