By Doug Sandler, CFA

There are few things more important to the American psyche and the American economy than a healthy housing market. We believe a healthy housing market signifies consumer confidence, catalyzes economic growth, and creates high-paying jobs. Here is why:

- Consumer Confidence: In our view, a home purchase is the ultimate sign of consumer confidence. We believe homebuyers only buy homes when they feel that their job is secure, their prospects for the future are positive, their personal balance sheets are relatively strong, and banks are willing to lend.

- Catalyst: A home purchase is often an economic accelerator. The purchase of a home is typically followed by additional purchases such as furniture, floor coverings, home goods, and lawn and garden equipment.

- Creator: Home construction and home remodeling create jobs and can help bridge the income divide. According to the Bureau of Labor Statistics (BLS), there are roughly 7.4 million construction-related jobs in the US and many of these jobs are high-paying. As of January 2021, the average hourly rate for a construction worker is over $32, which equates to approximately $60,000 to $65,000 per year (assuming a 40-hour workweek). Wages can be higher in the fastest growing areas of the country and for the more skilled positions such as carpentry, electrical, project management, and equipment operation. This makes home construction one of the few industries where workers can earn an above average income without a college degree.

The Opportunity: Pent-up Demand for Homes

Over the long-term, the demand for housing is driven by factors including demographics (household formation), interest rates, the state of the economy, and other exogenous factors. The demand for homes has recently accelerated, and we believe that demand will remain strong for the foreseeable future for the following reasons.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

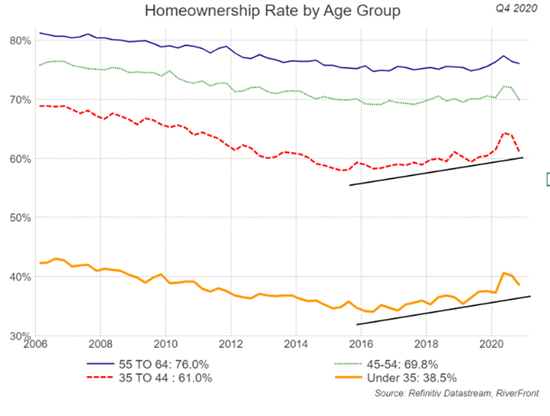

Demographics: A new generation of homebuyers is descending on the housing market in force: The Millennials. Nielsen Media Research defines Millennials as those born between 1981 and 1996, meaning they are somewhere between 24 and 40 years of age. From the chart on the right, one can see home ownership beginning to increase in the Under 35 category (bottom solid line) and the 35 to 44 category (dotted line). From this data it would appear that the Millennials are not permanent renters, but homebuyers that were delayed by high levels of student debt and the subsequent recession that followed the Financial Crisis. This may explain why home ownership has declined since 2005 from 69% to 66% (US Census Bureau). Interestingly, the generation following the Millennials (Gen Z) may be even more enthusiastic about home ownership than the Millennials. A recent poll by Freddie Mac found that 86% of those aged 14-23 intended to purchase a home someday. These positive demographics will cause homeownership levels to increase in coming years perhaps even eclipsing the 2005 highs, in our view.

Economy and Interest Rates: We believe that the economy and interest rates are supportive of continued housing strength. In our opinion, the economy can only get better from here as vaccines get distributed and businesses re-open. Interest rates also remain relatively low and although rates have risen recently, nationwide mortgage rates for a 30-year conforming mortgage are around 3 to 3.5%, well-below historical averages.

Exogenous Factors: With many people likely to continue to work from home, the desire to live in as nice an environment as possible will continue to grow well beyond COVID-19, supporting both housing demand and remodeling. Thus, while some of these exogenous factors like COVID-19 itself may fade, we believe that many will remain and create enduring demand for housing.

The Problem: Housing is in Short Supply

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

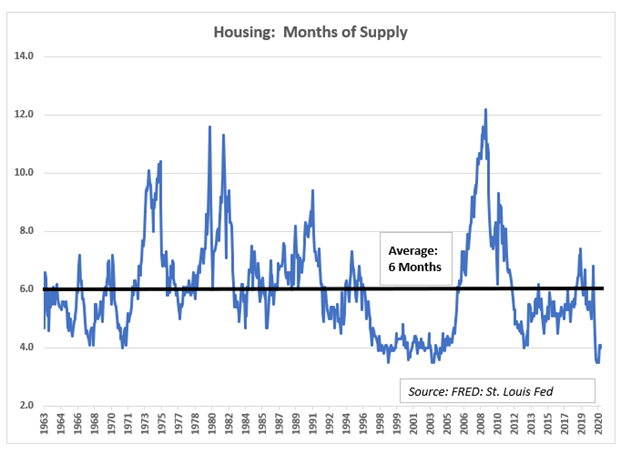

Today, there is only a 4-month supply of homes available, which is near the all-time lows in the late 1990s/early 2000s (right chart). This level of inventory is well below the long-term average of 6 months. Supply indicates how long current inventory would last if no new homes were built.

Currently, there is a combination of decreased availability from existing homes and a lack of availability for new construction. According to Realtor.com, 2012-2019 experienced sustained levels of underbuilding leaving a gap of 3.84 million new homes.

A 2018 Freddie Mac report estimated that the demand for new homes in the US was approximately 1.6 million per year. This is comprised of about 300,000 homes to replace homes that have deteriorated, 1.1 million homes needed by new households, 100,000 as second homes and 120,000 to be in inventory.

Conclusion

The housing market can be an important precursor of future economic activity. Today, the US housing market is healthy. January new home sales were up 19% year/year (US Census Bureau), January existing home sales were up nearly 24% year/year (National Association of Realtors) and home prices were up 10% in 2020 (S&P CoreLogic Case-Shiller). We expect the housing market to remain healthy as demand remains strong and supply remains tight.

In our opinion, a healthy housing market is supportive of increased earnings, a stronger economy and higher stock prices. This is one of the reasons we currently favor stocks over bonds in our Advantage portfolios. Sectors and industries that we believe will benefit the most from housing strength include consumer discretionary, banking, engineering and construction, home improvement, and building materials.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

The Advantage portfolios may be invested in stocks, bonds and exchange-traded products (exchange-traded funds (ETFs) and exchange-traded notes (ETNs)). Advantage is offered through separately managed accounts or on model delivery platforms, depending on the Sponsor Firm.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1554966