The housing industry has been a bright spot in the post-pandemic economic recovery, and we expect strength in that space to endure. Housing demand should continue to outpace supply for some time, especially given recent supply chain disruptions in raw materials and labor. As these disruptions work themselves out, we expect housing starts and completions to outpace demand as the gap is filled.

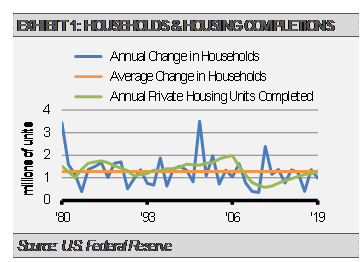

As the graph below illustrates, the annual number of completed housing units significantly outpaced the average change in households during the housing boom that peaked in the mid-2000s. However, housing completions lagged the average growth in household formation from 2007 to 2019 as the economy digested the repercussions of more than a decade of excess supply, among other factors. In fact, annual new home completions only increased to meet the average annual pace of household formation just prior to the pandemic in 2019. Simply keeping up with the average pace of household formation should create strong tailwinds for the housing industry, but there is still more pent-up demand in the housing system.

Over time, the annual pace of completed new housing should exceed household formation due to the number of replacement houses required each year as older homes are destroyed or converted to other uses. These lost homes need to be replaced to keep up with demand for housing. However, recent housing industry dynamics led to a decline in the construction of replacement housing during the 2009-2019 period, and this trend led to some startling results. The National Association of Homebuilders (NAHB) noted in their 2018 review of housing trends from 2014-2017 that homes would have to last longer due to the lack of new housing construction^. While it is possible to keep homes built before the late 1980s or even before 1960 habitable for some time, the assumed loss rates stand at 0.75% and 2.98% currently per year^. Those low loss rates are unsustainable over the long run, especially considering the advancement of technological requirements in housing and the improvements in local housing codes. Additionally, NAHB projections using 2017 starts and loss rates published by the U.S. Census Bureau stated that 45% of U.S. housing stock was built prior to 1970^.

Clearly these trends of underbuilding new homes relative to natural demand is unsustainable. We think that the combination of strong demand and limited supply will ultimately power the housing industry through the volatility caused by current supply chain constrains as a new equilibrium is reached in the coming years. Despite supply chain headwinds, the housing industry should remain a bright spot in the U.S. economy.

^Emrath, Paul. “More New Homes Needed to Replace Older Stock.” Special Studies, NAHB Economics and Housing Policy Group, August 2, 2018. https://www.nahbclassic.org/generic.aspx?sectionID=734&genericContentID=263243

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.