By Doug Sandler, CFA, Head of Global Strategy

SUMMARY

- Falling stocks, stubborn inflation and worsening geo-politics have made investors fearful.

- Long-term positives like more attractive valuations and persistent earnings offset the short-term negatives, in our view.

- We are avoiding undue risk, holding extra cash, and focusing on security selection.

The Good, The Bad, and Our Strategy

The Bad

Stocks are testing investors’ patience: The S&P 500 violated its initial support level of 4200 and is approaching the next level of support at 4000 (for more on technical levels see last week’s Weekly View). If the index definitively breaks below that level, we anticipate additional market downside over the coming weeks.

Inflation has not slowed, and the Fed is now very hawkish: Unfortunately, recent datapoints suggest that high levels of inflation will be present in the economy for longer than many expected. Ultimately, this means that the Fed can no longer wait and needs to catch up. Rapid rate hikes and other significant tightening measures raise the chance of a policy misstep that forces a hard landing for the US economy (recession).

External factors are getting worse: Geo-politics and other macro-economic factors are worsening as well. Russia’s aggression in the Ukraine has not abated, as evidenced by their decision last week to cut natural gas exports to Poland and Bulgaria. Worries are also building that the invasion could extend into regions of Moldova. Additionally, China’s COVID-19 lockdowns have grown, placing further pressures on the global supply chain.

The Good:

Valuations are more reasonable: The S&P 500 is down roughly 13% through April 29th. We believe that stocks have fallen to levels where valuations should provide support and a possible entry level for new cash. Given that high valuations were one of our primary concerns entering 2022, the sell-off is a welcome respite from the frothy conditions of four months ago, in our view. Currently, the S&P 500 is trading at a price-to-earnings (P/E) multiple of 17.5x and the NASDAQ-100 is at 22x. These are 2 and 6 multiple points below their January highs, respectively.

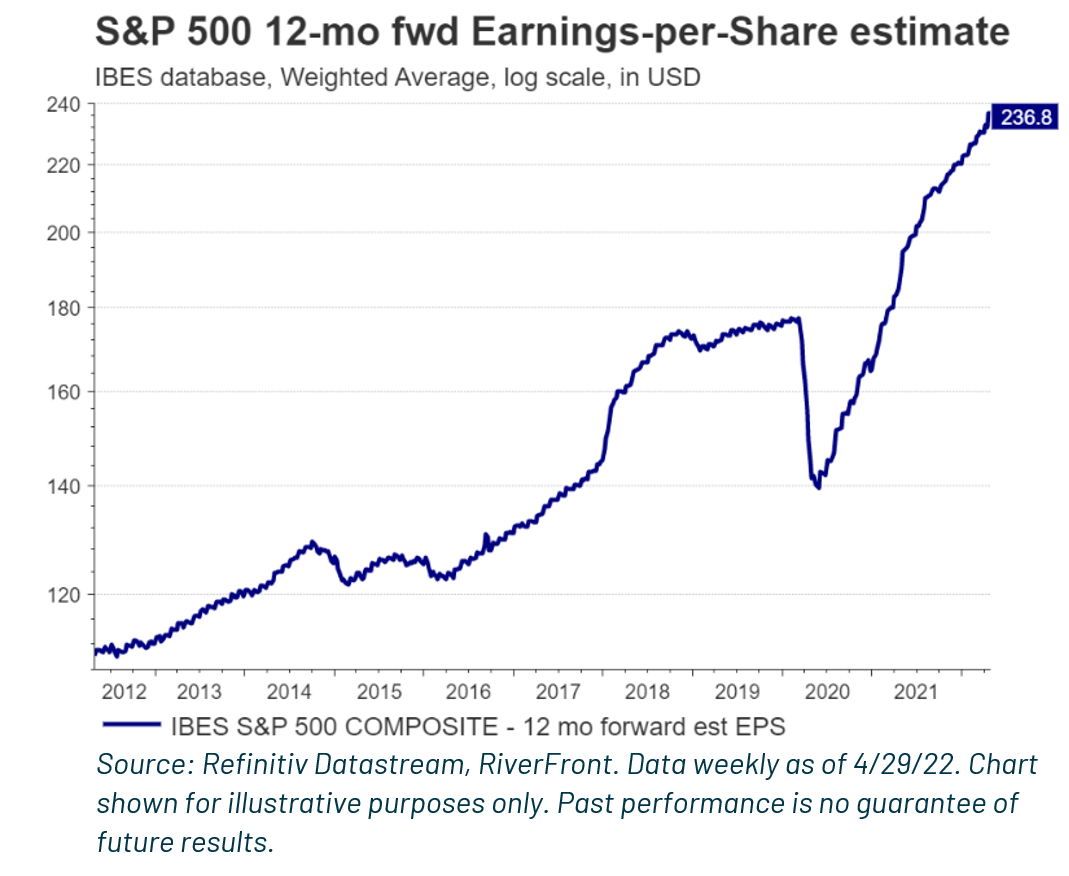

Earnings slowing but still positive: Cheap valuations only matter if earnings do not collapse. Thus far, earnings forecasts have stayed robust, and in fact have increased since the beginning of the year. Currently, analysts estimate the S&P 500 12-month forward earnings at over $230 a share, a meaningful increase over the last year (see chart, next page).

US consumer is healthy: The unemployment rate is low, wages are up, and the labor participation rate is rising as Americans return to work. Combine that with the fact that many took the opportunity to pay down debt during the shutdown and one can draw an encouraging outlook for US consumption. Going forward, spending in the US will likely be led by maturing Millennials, who are hitting their prime spending years as they pass through life’s important milestones. Each of these milestones, like getting married, purchasing a home and having children, have historically been economic accelerators and provided a tailwind to GDP.

Bonds more compelling to us with rise in rates: We believe that fixed income investors have been taking short-term pain to start the year, for long-term gain in the coming years. With yields rising quickly, we believe that the time has come to consider adding fixed income to our asset allocation model portfolios. The 120 bp (bp = 1/100th of 1%) increase in 10-year interest rates this year have made bonds more competitive with other asset classes and will serve to re-instill some of the protective qualities of bonds in balanced portfolios, in our view. (For more on our long-term capital market assumptions, check out our recently published Strategic View)

Slowing growth may help the supply chain catch-up: Normally, slowing growth is a bad thing. However, an economy that is growing too quickly places undue pressures on the supply chain leading to inflation and restrictive monetary policy. Thus, some slowing of the economy should be welcomed at times like this. Last week, the Advanced Q1 GDP report was significantly softer than expected registering -1.4% vs an expectation of +1.1%. While one weak data point is unlikely to change the Fed’s singular focus on inflation, a corresponding rise in unemployment will put the ‘dual’ in the Fed’s ‘dual mandate’ back into play.

Our Strategy:

Expect the unexpected: A key theme in our 2022 Outlook was rising volatility. The best way to endure volatility is to dull your senses to it. Watching the market and one’s portfolio less frequently is one tactic; recognizing that forecasts need to be flexible is another. These are the times when we believe ‘playing the cards you are dealt’ trumps even the best crystal balls. Russia’s attack on Ukraine is a good example of this. While we did not predict it, we had to react and lower our allocation to stocks across our balanced portfolios. Our mantra of ‘Process over Prediction’ relieves the pressure on trying to predict the unpredictable and instead appropriately shifts our focus to what we can control… which is our reaction.

Avoid swinging for the fence: When the unexpected should be expected, we believe it is not the time to ‘swing for the fences’ with one’s investments. In line with this view, over the last year, we have lowered our overall equity weighting as well as the underlying risk of the securities we hold in our balanced portfolios.

A little cash can provide a lot of peace of mind: Each of our balanced portfolios carry more cash than normal; this is especially apparent in the more risk averse, shorter-horizon portfolios. In addition to higher cash levels, these portfolios are also overweight short-term fixed income vehicles like bank loans and/or short-term high yield bonds. The extra cash dampens market volatility and can be used opportunistically to take advantage of pullbacks in stocks or bonds that we would like to add to the portfolio.

Ebbing tide makes security selection paramount: The tide rises when more money is flowing into the markets than coming out of it. Since the financial crisis, low interest rates, monetary stimulus (‘money printing’) and fiscal stimulus created a quickly rising tide. When the tide is rising, all boats are lifted and broad indices like the S&P 500 or NASDAQ often perform best. Going forward the tide appears to be ebbing as rates rise, fiscal and monetary stimulus is withdrawn, and quantitative tightening (QT) begins. In this environment, we think security selection can be expected to perform better than broad index strategies. Over the past 24 months our Advantage portfolios have adapted their selection strategy to reflect this belief by increasing exposure to more granular ETFs and individual stocks while reducing exposure to broad passive indexes.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

NASDAQ 100 Index includes 100 of the largest domestic and international non-financial securities listed on the Nasdaq Stock Market based on market capitalization.

Definitions:

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security.

Principal Risks:

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

In a rising interest rate environment, the value of fixed-income securities generally declines.

High-yield securities (including junk bonds) are subject to greater risk of loss of principal and interest, including default risk, than higher-rated securities.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2180774