By Ryan O’Malley, Fixed Income Portfolio Strategist

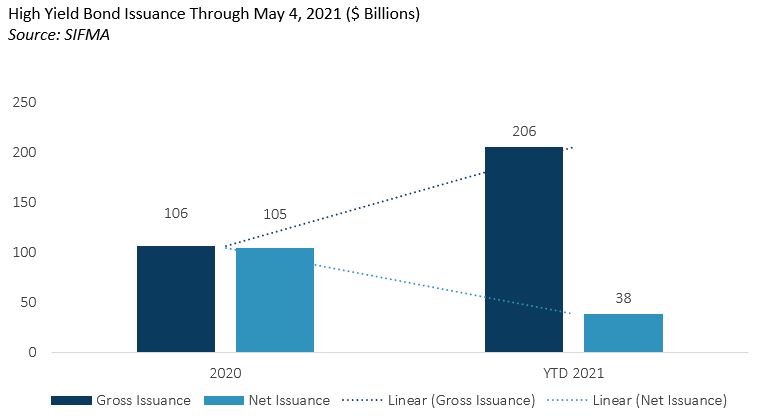

High yield corporate bond issuance is up 93% in 2021 – from $106 billion in 2020 to $206 billion year-to-date. Corporate bond investors typically view such large increases in high yield issuance as a negative for credit fundamentals, as it usually correlates with higher leverage. This cycle may prove to be very different, however, as the fundamentals of many high yield issuers are improving.

Despite the increase in gross issuance, net issuance in high yield bonds has increased only by about $38 billion, implying that 81% of new issues this year have been used to refinance older debt. High yield issuers have used the strong demand for spread product to repair their battered balance sheets rather than engaging in M&A or shareholder-friendly activities at the expense of bond holders.

The average coupon of the Bloomberg Barclay’s U.S. Corporate High Yield Index has decreased from 6.24% in February 2020 to 5.86%, while simultaneously increasing the average time to maturity of these bonds, from 6.06 years to 6.53 years. This means that the average high yield issuer just reorganized their debt to pay 0.40% less interest while getting an extra six months to pay back the debt, decreasing their interest expense and boosting their free cash flow. This is a particularly helpful phenomenon for the most vulnerable borrowers, and so we have seen CCC and “distressed” issuers post the best performance in the index YTD by a wide margin.

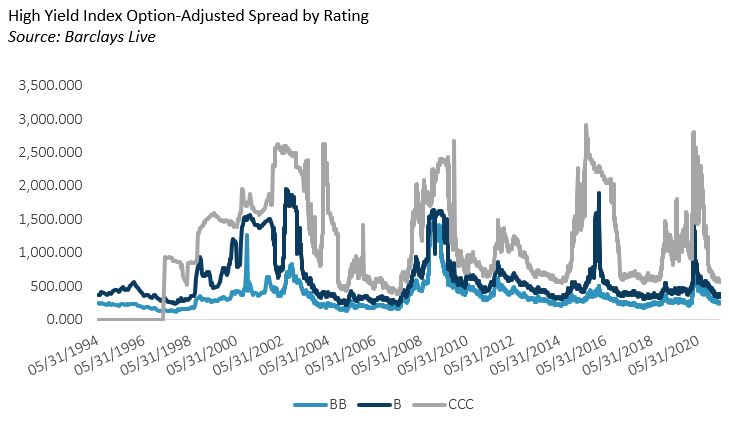

While valuations remain tight, they are still not quite to tightest levels of the past 20 years. The BB index still has about 100bps of room to tighten before reaching 2005 levels, and CCC spreads are over 200bps above their 2007 nadir.

Another point bolstering the case for high yield bonds in 2021 is the perceived ability for high yield bonds to outperform as compared to investment grade credits during times of increasing inflation expectations. Sage looked at the relationship between monthly High Yield Index performance and the breakeven rate for 10-year TIPS (generally considered a measure of inflation expectations over the following 10 years). We found that the month-over-month change in inflation has a positive covariance with monthly performance in the High Yield Index of 41% going back to 1999. In other words, high yield bonds tend to have positive performance in months where the breakeven rate on 10-year TIPS increases from the previous month.

In addition to holding high yield bonds, there are a couple other strategies Sage employs to position portfolios for increasing inflation; the first is to maintain a lower overall portfolio duration as compared to relevant benchmarks, and the second is to add to TIPS where appropriate. We prefer the 10-year part of the TIPS curve compared to shorter maturities, as we believe the yield curve inversion (3-year and 5-year TIPS have higher breakeven rates than 10-year TIPS) is unjustified because inflation is likely a longer-term proposition. This three-pronged approach should help portfolios outperform if inflation does indeed continue to rise.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.