Readers of TETF.Index Weekly know that at Toroso we are obsessed with ETF statistics about the ETF Ecosystem, but sometimes it is more about the “Who than the What” that makes an ecosystem successful; especially when it is the people who are the core asset.

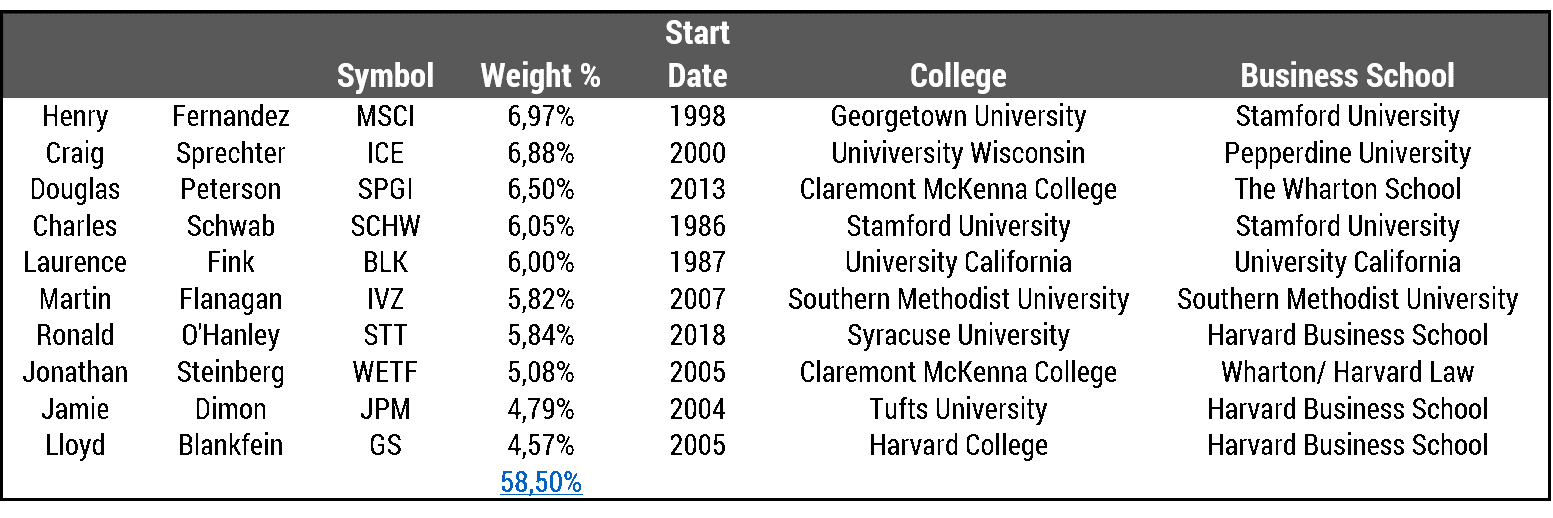

It is somewhat ironic that the ETF industry is an “asset light business model” – meaning that dollars invested are in people and products and not in hard assets. Arguably this may be part of the reason why the financial services industry attracts aggressive, innovative entrepreneurial thinkers who apparently are mostly well educated. Of the 12 Founders, Chairmen, and CEOs in the ETF ecosystem, there are 5 degrees from Harvard and 3 degrees from Stamford. Moreover, a quick review of the potential second in command include an additional 4 degrees from Harvard, i.e. Mary Erdoes at JP Morgan, Robert Kapito from Blackrock and 2 from Mortimer Buckley at Vanguard.

In our review, we also note that the tenure of these key players is unusually long and empowered the cultures of these firms to think long term. Founders Charles Schwab (SCHW), Larry Fink (BLK) and Jonathan Steinberg (WETF) date back over 30 years. Henry Fernandez (MSCI) and Craig Spechter (ICE) built their businesses in 20 and 18 years, respectively. From glancing at the chart below, most have spent at least 10 years at the firm they lead, including Jamie Dimon (JPM), Lloyd Blankfein (GS), and Martin Flanagan (IVZ).

![]()

These leaders are clearly committed to driving the success of the profitability of their firms and capitalizing on the ETF ecosystem. Moreover, while they have different degrees of exposure to the ETF industry, their market share gains in the ETF ecosystem has been a result of a core belief in growth in the industry as it provides a value client proposition that is meaningfully better than antiquated alternatives.