- Resilient economic data is likely to keep rates elevated for some time and push out the Fed’s timeline for rate cuts.

- Equities have yet to price in the increasing headwinds faced from economic risks, a recent hawkish Fed tone, technical pressure from outflows, and elevated geopolitical risks.

- The risk/reward for fixed income is favorable. With more attractive fixed income yields and above-average valuations in equities, rebalancing flows toward fixed income could be significant.

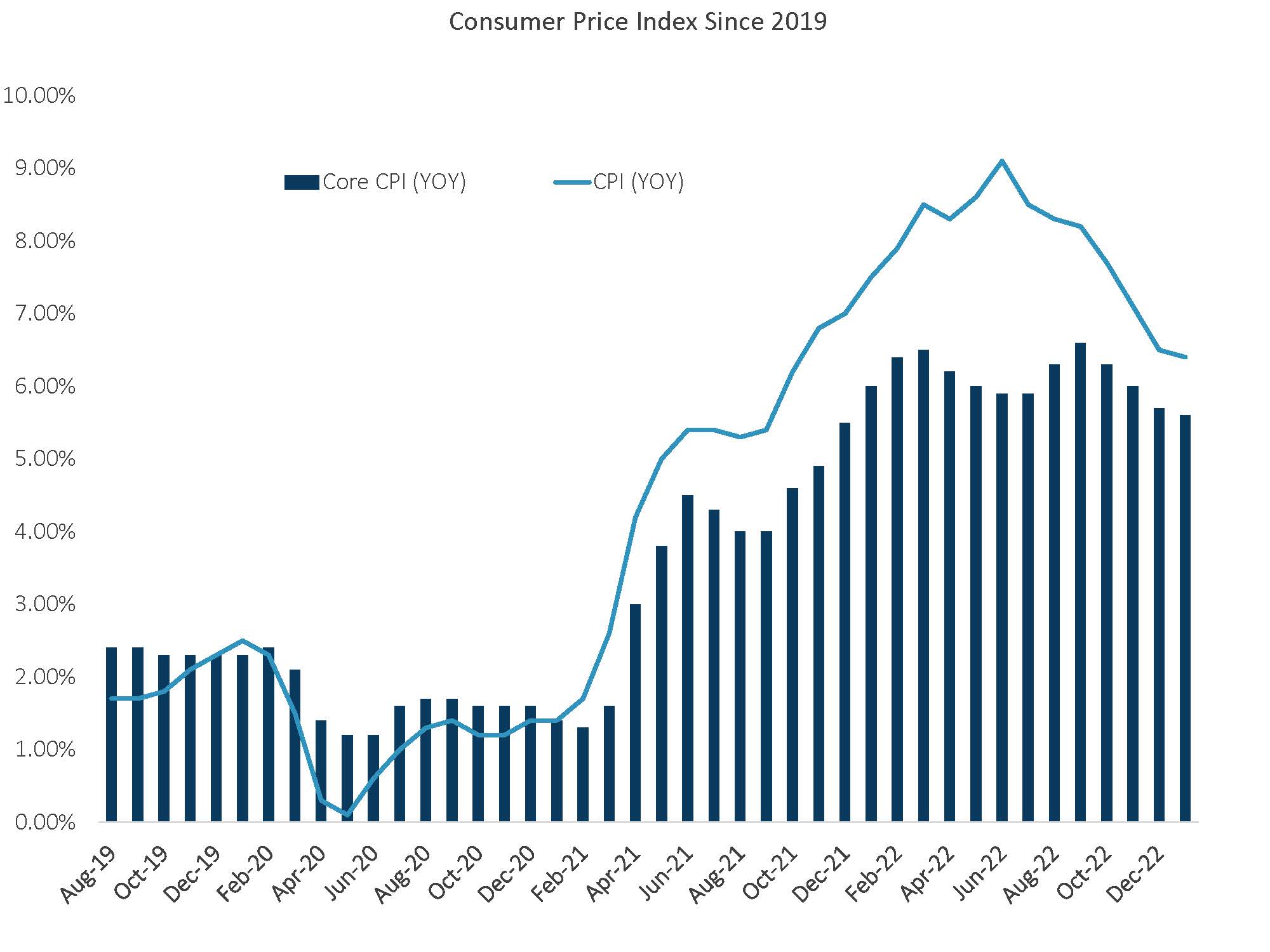

1. Inflation Continues its Downtrend, Slowly . . .

The most recent CPI measures confirm that inflation continues to decline even though it’s still well above the Fed’s target of 2%. Additionally, near-term inflation expectation surveys are moving lower while longer-term measures remain anchored.

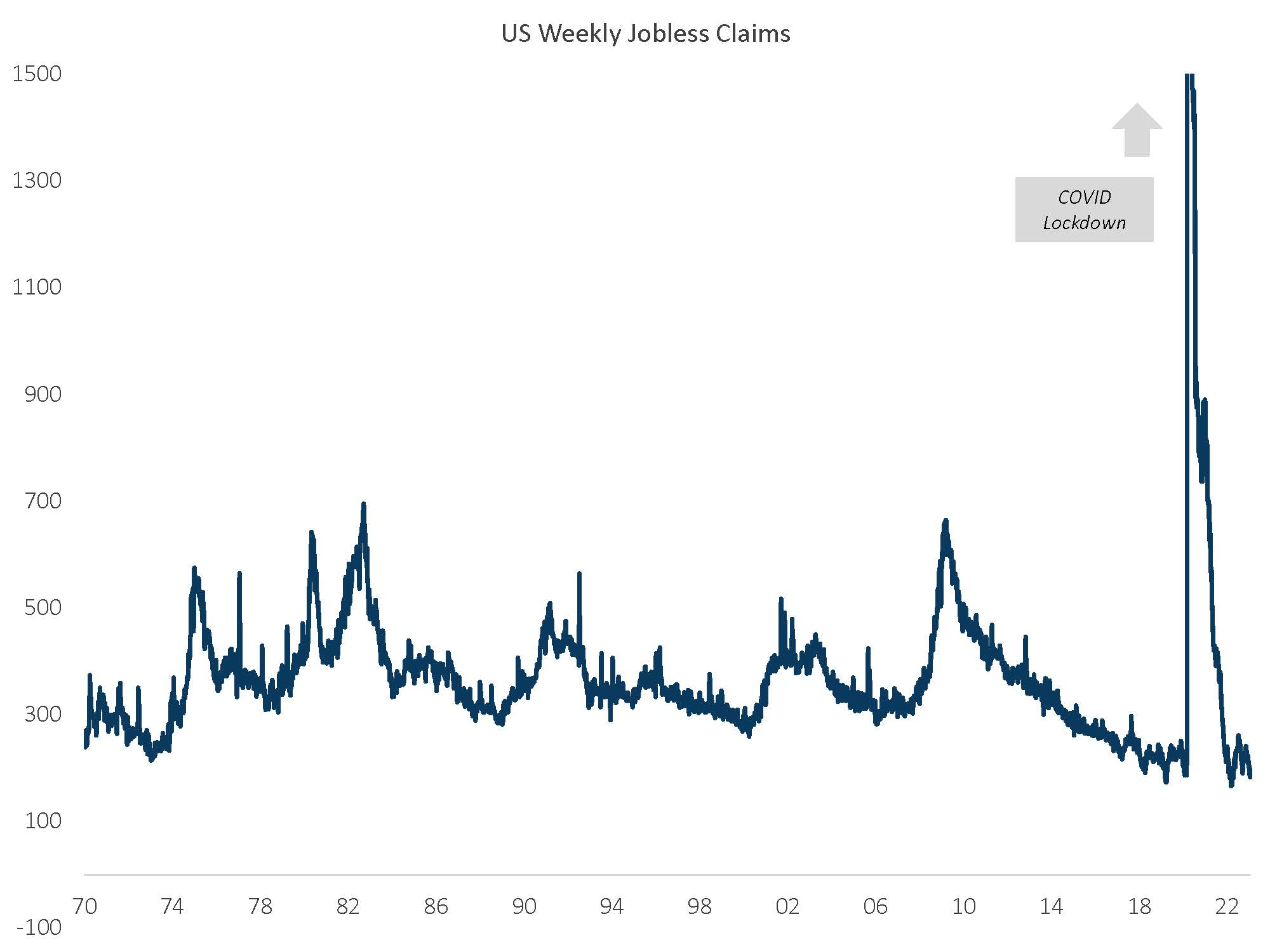

2. While the US Labor Market Remains Strong

The US labor market remains secularly strong with jobless claims still near 50-year lows.

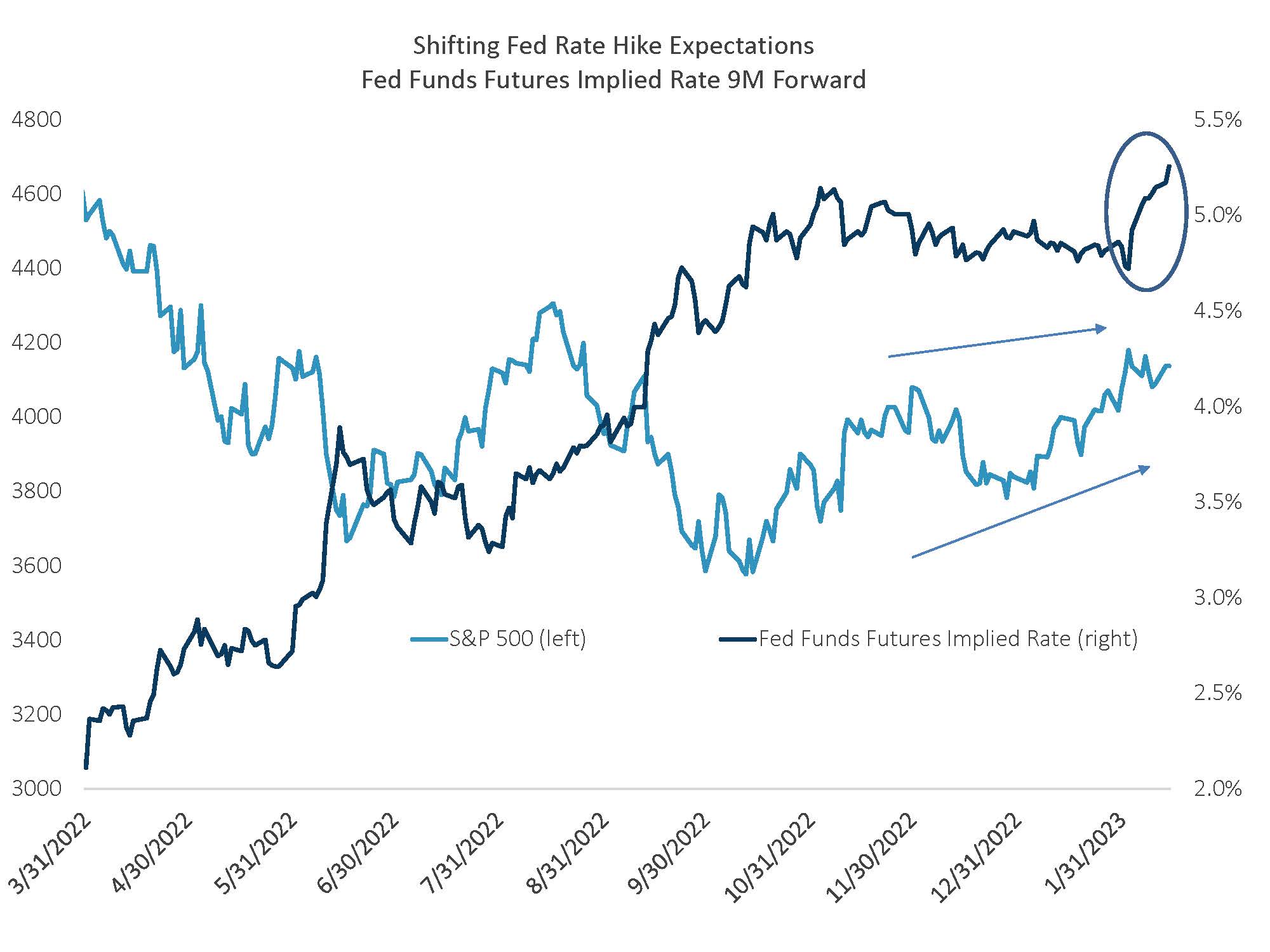

3. Pivot Optimism is Fading

More resilient data and hawkish commentary from the Fed have increased future rate expectations and pushed out the timeline for rate cuts. Equities have not yet priced in this reality; coupled with high valuations and economic risks, equities look increasingly vulnerable to a reversal.

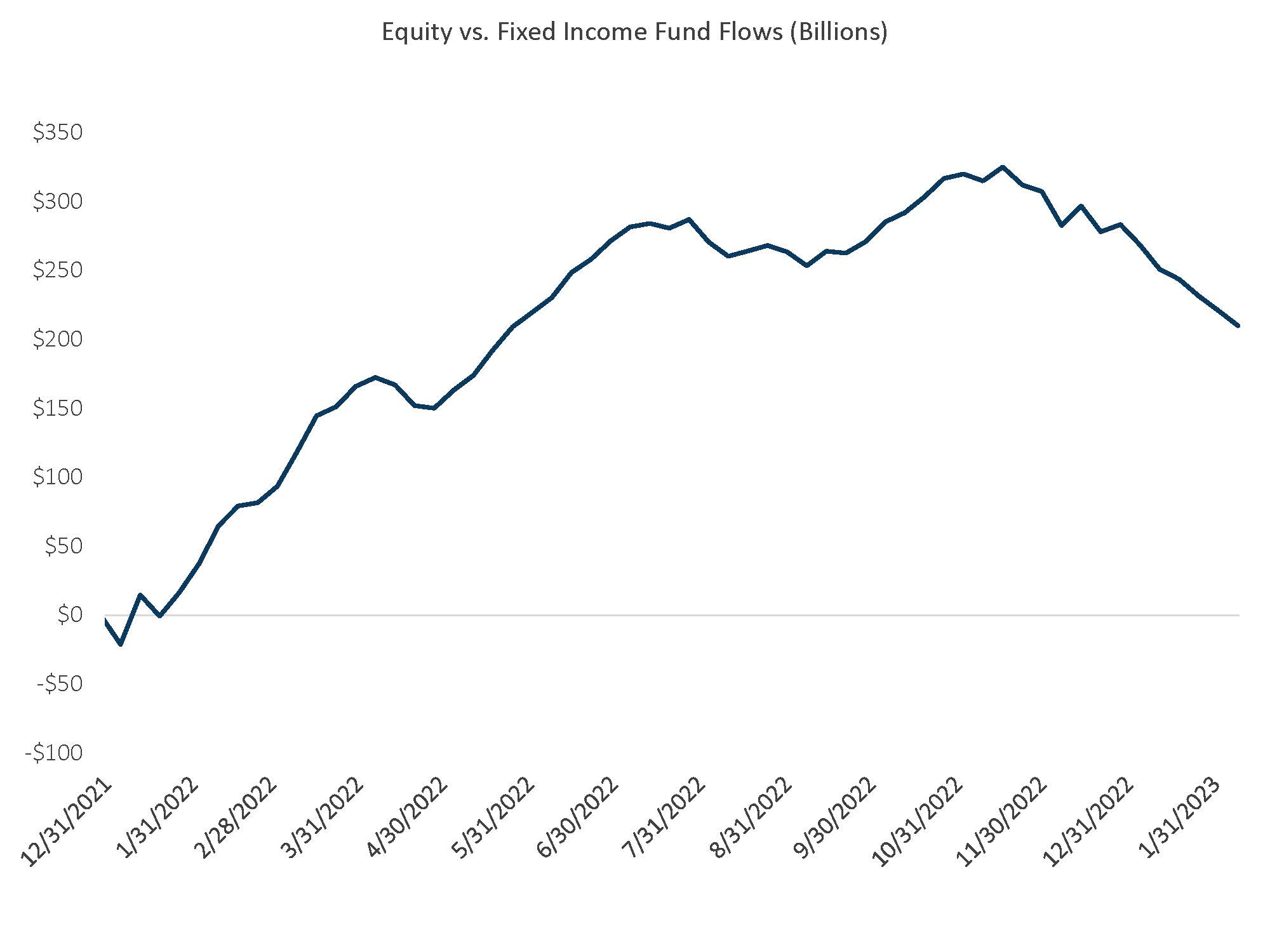

4. Flows Are Starting to Favor Fixed Income

After a historically poor year for bonds, flows are starting to move back toward fixed income. Combining funds and ETFs shows equities drew in more than $300 billion vs. fixed income in 2022. We expect multi-asset managers and pensions to drive rebalancing flows by increasing fixed income allocations.

5. Getting Income from Fixed Income

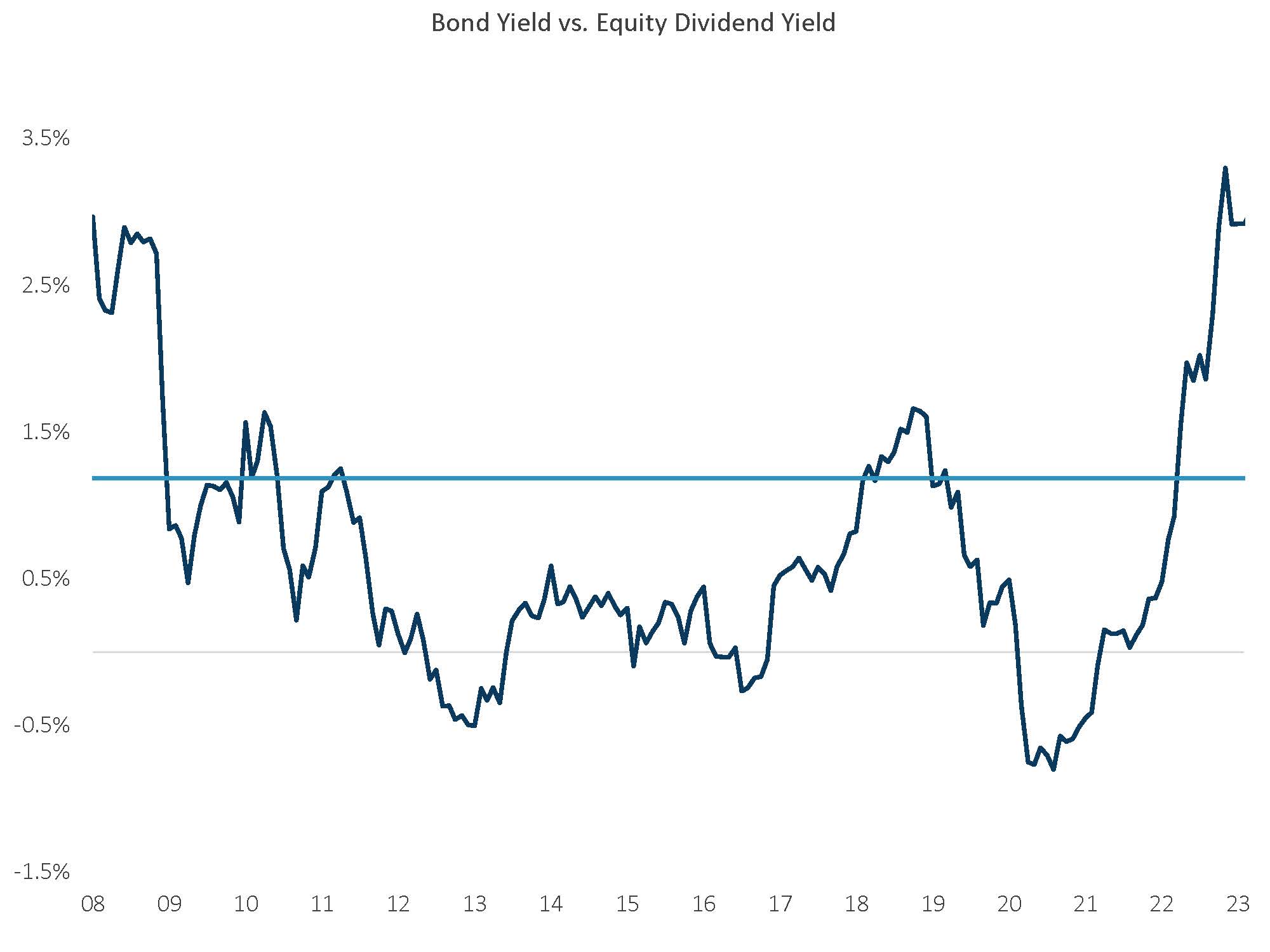

A lack of yield has made dividend stocks and other alternative options for income more attractive over the last several years; however, lower-volatility core fixed income has an attractive risk/reward profile and is now generating 3% excess income.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.