While the quarterly FOMC meeting undoubtedly deserves attention, we suspect that investors are missing the forest for the trees. When has US Federal Reserve EVER prevented a recession? The Fed, by design, is not meant to be proactive. The big picture trends that are impacting risk assets have been brewing for some time. The fed funds futures market is now pricing in several interest cuts this year and unfortunately history shows that by the time the Fed cuts, it will be too late – economic data will have already weakened, and stocks will have fallen.

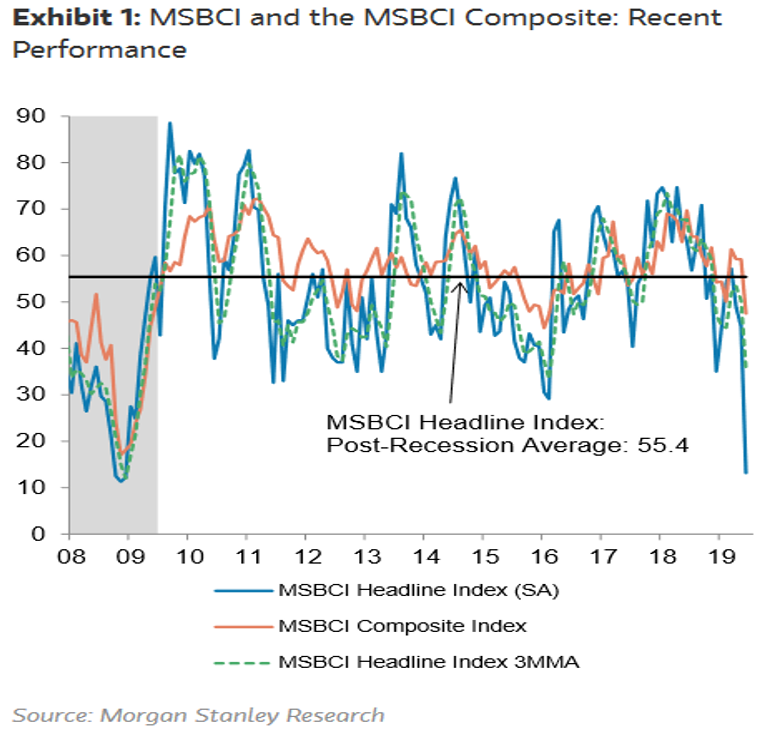

There is no shortage of bad economic data. Morgan Stanley’s Business Conditions Index recently had its largest one-month decline since 2002 and is near its 2008 Great Financial Crisis level (see chart below). We have seen weakness across manufacturing surveys, capital spending, durable goods orders, payroll data, inventories, commodity prices, and oil demand. The earnings picture globally is also poor.

At one point in December 2018, the S&P 500 had fallen as much as 20% and earnings troughed at around 14x. At Astoria, we felt as though the risk/reward to buy equities back then was attractive. In early Q1, we were one of the first firms to advocate buying high quality and minimum volatility stocks in the US. Read here and here. Unfortunately, after a 25% rally off the December lows, US stocks aren’t providing an overly attractive risk reward. Investors should now proceed with caution.

In fact, when we look across all public and private markets, most asset classes are fully valued. Private equity firms which historically were able to buy assets at 7-8x cash flows are now buying businesses at 12-13x. Real estate has skyrocketed across the country and ROIs have been driven to low levels. What’s cheap? US value, US cyclicals, all international markets, commodities, and digital assets are cheap. However, most investors and portfolio managers aren’t willing to ensure the risk of investing in these assets.

At Astoria, our dynamic portfolios largely have factored a weakening macro environment as we’ve been reducing equities, increasing cash, utilizing more bonds, and raising our alternatives exposure for the past 2 months.

Broadly speaking, our dynamic portfolios have the following tilts.

- Stocks: we remain focused on high quality US companies along with emerging market equities that have strong balance sheets with the ability to grow earnings and dividends.

- Bonds: we prefer the highest quality securities such as mortgage backed securities, US Treasuries, and municipal bonds.

- Alternatives: alternatives tend to get a bad reputation but there are ETFs that provide negative correlations to stocks. Our portfolios utilize gold, gold equities, merger arbitrage, and long/short market neutral strategies.

- Multi-Factor ETFs: Astoria has been vocal about using multi-factor ETFs rather than being outright long beta. The research clearly shows that investors can get higher up on the efficient frontier if they were to harvest a basket of factors and hold them for the long run.

Remember, markets are forward-looking, and the rate of change is what ultimately drives financial assets on the margin. Unfortunately, most investors are backward looking which is precisely why they fall short of their investment goals and why active managers underperform their benchmark.

Now is not the time in the cycle to take excessive risk. If you are sitting on gains, take some profits and be patient. Mr. Market will give you another opportunity to get involved. After all, patience is a virtue.

Best, John Davi

Founder & CIO of Astoria

For full disclosure, please refer to our website: