By Rob Williams, Sage Advisory Director of Research

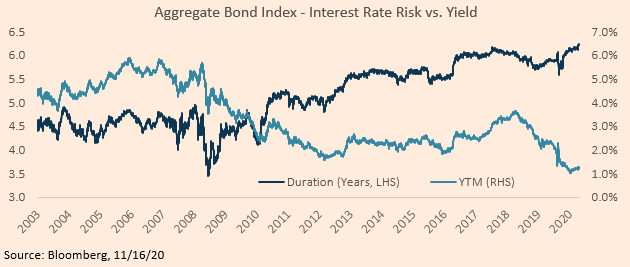

Fixed income investors have benefitted from falling rates and a recovery in spreads, which has generated attractive returns thus far in 2020. As we approach the end of this unexpected year, a more prudent and active approach is necessary as the backdrop has become more challenging – valuations are less compelling; yields are low and are expected to remain so; and, as illustrated in the chart below, the duration (or interest rate sensitivity) of fixed income indices is high for the slim cushion of yield they provide.

As active fixed income managers, we are focused on three C’s – curve management, (yield) carry, and the consumer-led recovery.

1. Curve Management – While the economic recovery and increasing Treasury issuance have kept upward pressure on longer rates, the unknown size and scope of a fiscal package and the notion that the Fed may target specific segments of the curve add enormous uncertainty to the direction and degree of curve movement.

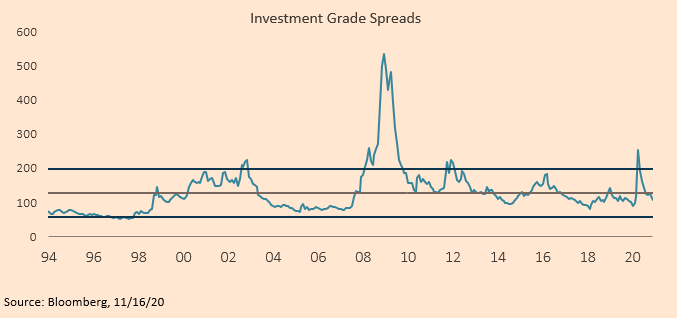

2. (Yield) Carry – Interest rates have less room to fall and spreads have less room to tighten, making yield difficult to come by. While spreads are not as attractive as they were earlier in 2020, we continue to see a positive tone for spread sectors, as long-term valuations are near average levels and have the support of Fed policy and a strengthening economic picture.

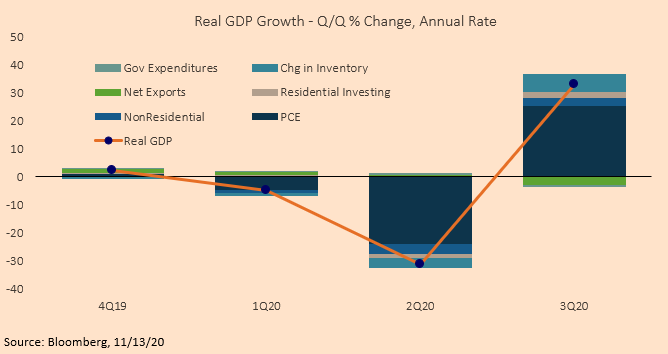

3. Consumer-Led Recovery – The consumer is the biggest part of the economy, and the consumer continues to recover, which is supported by trends data from housing, retail sales, the savings rate, and consumer confidence indicators. A focus should be on areas that are tied to and will benefit from a continued consumer-led recovery, including cyclicals and REITs, increased exposure to higher-yielding markets (BBBs); and select names in such sectors as energy and basic materials that offer attractive yield pick-up.

Originally published by Sage Advisory

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.