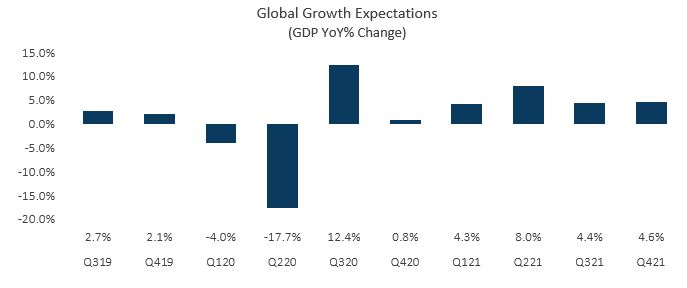

1. Growth: Expect robust 2021 growth as conditions continue to normalize post-vaccine and policy remains accommodative.

- Key point: Larger fiscal stimulus expectations have begun to raise forecasts for growth.

- Bottom line for fixed income investors: Expect growth to keep upward pressure on rates, but also support spread levels.

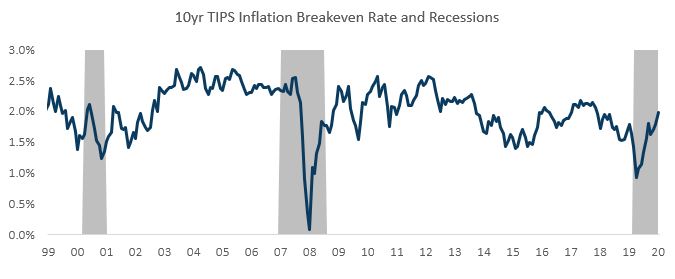

- Key point: Inflation expectations have moved higher, as evidenced by TIPS, but the move is in-line with previous recoveries.

- Bottom line for fixed income investors: Inflation expectations will continue to drive further gains in TIPS near-term, but we don’t see an inflation scare causing rates to move beyond a tight range during the first half of 2021.

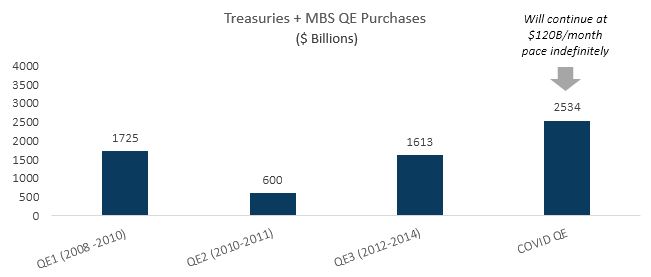

3. Policy: The Fed has made it clear that it will remain accommodative in 2021, and expectations are for quantitative easing (QE) purchases to remain on pace until late 2021.

- Key point: Tightening and tapering are different things, and we don’t expect any form of tightening in 2021 (balance sheet shrinkage, rate hikes); tapering the pace of purchases in the face of a robust recovery is a scenario for late 2021, but would be gradual and well telegraphed by the Fed.

- Bottom line for fixed income investors: Vaccines and the economic recovery have moved long rates into a higher range than in mid-2020, but we expect limited increases in the first half and all the pressure to be on the back end of the curve.

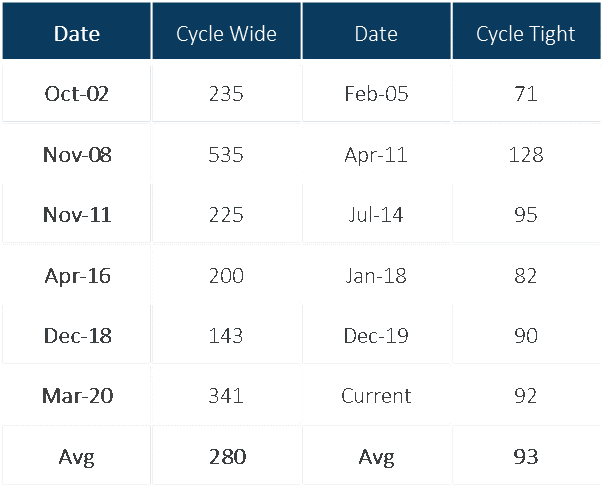

4. Valuations: Low yields and tight spreads will be constraining factors to returns in 2021.

- Key point: Credit spreads are sitting near typical cycle lows to begin the year.

- Bottom line for fixed income investors: As with all investment decisions, timing is key; a more aggressive, excess yield-driven posture may make more sense for the first half, giving way to a more defensive approach later in the 2021.

Credit Valuations Near Average Cycle Tights (valuations are option-adjusted spreads in bps)

5. Active management is key in a low-return environment.

- Key point: Expect above-index returns to be driven by generating excess yield with spread sector overweight, active curve management, and security selection.

- Bottom line for fixed income investors: 2021 is not an environment to be passive with fixed income allocations given index durations and yield levels.

*Source for all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.