Following the spike in volatility last Monday, the large cap equity markets rebounded back to the point where they closed the previous Friday. As we wrote in last week’s update:

“Most of the time, a spike in volatility coming from an extreme-low volatility level will go back to a normal bullish market environment. It is similar to a sleeping person getting hit with a cold glass of water: they awake startled and takes them a few moments to assess their surroundings. The market just got hit with a cold glass of water and will take some time to assess where it wants to go next.”

There may be an increase in volatility around the corner, no one can really predict it, but as of right now the market appears to be trying to return to normalcy following its singular outlier down day.

What has led the markets continues to lead

As of Friday’s close, Canterbury’s risk-adjusted sector ranking went as follows: Health Care, Real Estate, Technology, Discretionary, Communications. With the exception of Consumer Discretionary, which has fluctuated all over the rankings list thanks to the volatility of Amazon and Tesla (its two largest components), these rankings have remained consistent. Real Estate has been at the top of our lists all year long. Technology and Communications, as well as Health Care have been strong outside of the first few months of 2021.

How long will this continue? Canterbury’s rankings are risk-adjusted, not solely based on performance. The ranking indicator takes volatility into account. For example, if Sector A has a volatility of 80 and Sector B has a volatility of 40, then Sector A would have to perform twice as well as Sector B to hold the same position on the rankings list. On a broad basis, this allows for us to compare all asset classes on an even playing field.

Here is where the volatility of technology and related sectors may come into play. At the time of this writing on Monday, September 27th, there is a single day reversal in leadership. In other words, the longer-term leaders are lagging, and laggards are leading (again, this is only one day). If technology experiences a rise in volatility, particularly a rise that exceeds other market segments, it may start to drop down our risk-adjusted rankings as risk increases, especially if it is downside risk.

China

If you followed the news cycle at all last week, you may have noticed that the news about a Chinese company called Evergrande. Evergrande is a large Chinese real estate developer, one of the largest in the world, and is currently suffering underneath a large mountain of debt. One article on CNN Business had this to say on Sunday:

The property developer’s debt crisis is a major test for Beijing. Some analysts fear it could even turn into China’s Lehman Brothers moment, sending shockwaves across the world’s second biggest economy. Real estate — and related industries — account for as much as 30% of Chinese GDP.

This week, investors experienced whiplash as the firm met one crucial debt deadline, but then failed to address another. Shares shot up one day, and down the next.

—Michelle Toh, CNN Business

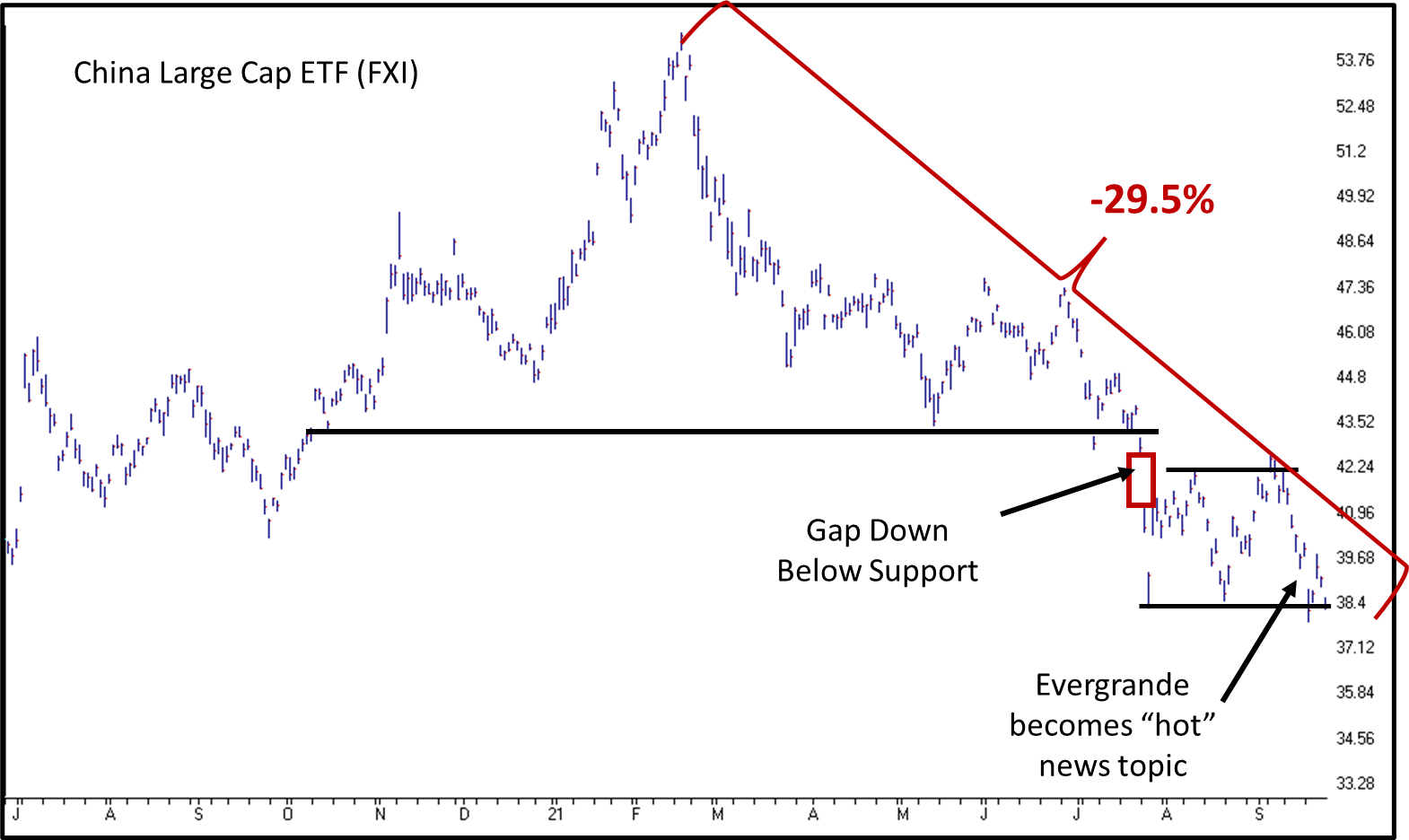

Evergrande may create a shockwave in the China’s economy, but in terms of liquid markets, the Chinese markets have been struggling long before Evergrande became a popular topic in the news last week. Remember, markets are driven by supply and demand and the emotions of investors. A chart of China’s large cap securities would indicate that supply has far exceeded demand in the last 7 months:

Given this chart and the volatility of Chinese Large-Cap securities, I would expect the Chinese markets to remain volatile. In other words, on a day-to-day basis, you will see trading days greater than +/-1.50%. That is what volatility brings. You will get very large down days, as well as large up days. Just because some days may have a “+” sign in front of them, increased volatility is a negative.

Bottom Line

Sectors will continue to rotate in terms of market strength. Canterbury will continue to keep an eye on the various risk levels of different market securities. An adaptive portfolio strategy, like the Canterbury Portfolio Thermostat will rotate between the various areas that have bullish characteristics.

For alternatives to equities, 1x inverse China is a good portfolio diversifier. From the chart shared, China has not been a good investment, but the inverse has been. As China continues to experience volatility, its inverse position acts as a good portfolio diversifier. The goal would be that if the US markets start to experience more volatility, an inverse position would mitigate portfolio fluctuations.