About Boston Properties, Inc.

Boston Properties (BXP) is a real estate investment trust (REIT) that owns and manages 196 properties, including office, retail, residential and mixed-use spaces. It is the largest publicly held developer of high-end Class A office space in the United States, and its building portfolio is concentrated in five markets: Boston, Los Angeles, New York, San Francisco, and Washington, DC.

Financially Material Factors

E – energy management, water management, management of tenant sustainability impacts, climate change adaptation

S – employee engagement, diversity and inclusion, community relations

G – business ethics and transparency

Environmental

The U.S. Green Building Council (USGBC) has been setting the standard for eco-friendly building in the U.S. for almost three decades. Its point-based Leadership in Energy and Environmental Design (LEED) certification is the most widely used building rating system in the world, with tiers ranging from Certified (40-49 points earned) to Platinum (80+ points earned). In addition to environmental benefits, green buildings are also more attractive to investors and tenants alike, yielding higher occupancy rates and rental income than traditional buildings. BXP currently has 24.3 million square feet of LEED-certified buildings — about half of its portfolio — and the company has made it a requirement for all new developments to be LEED-certified at the Silver level or higher, outperforming its industry peers.

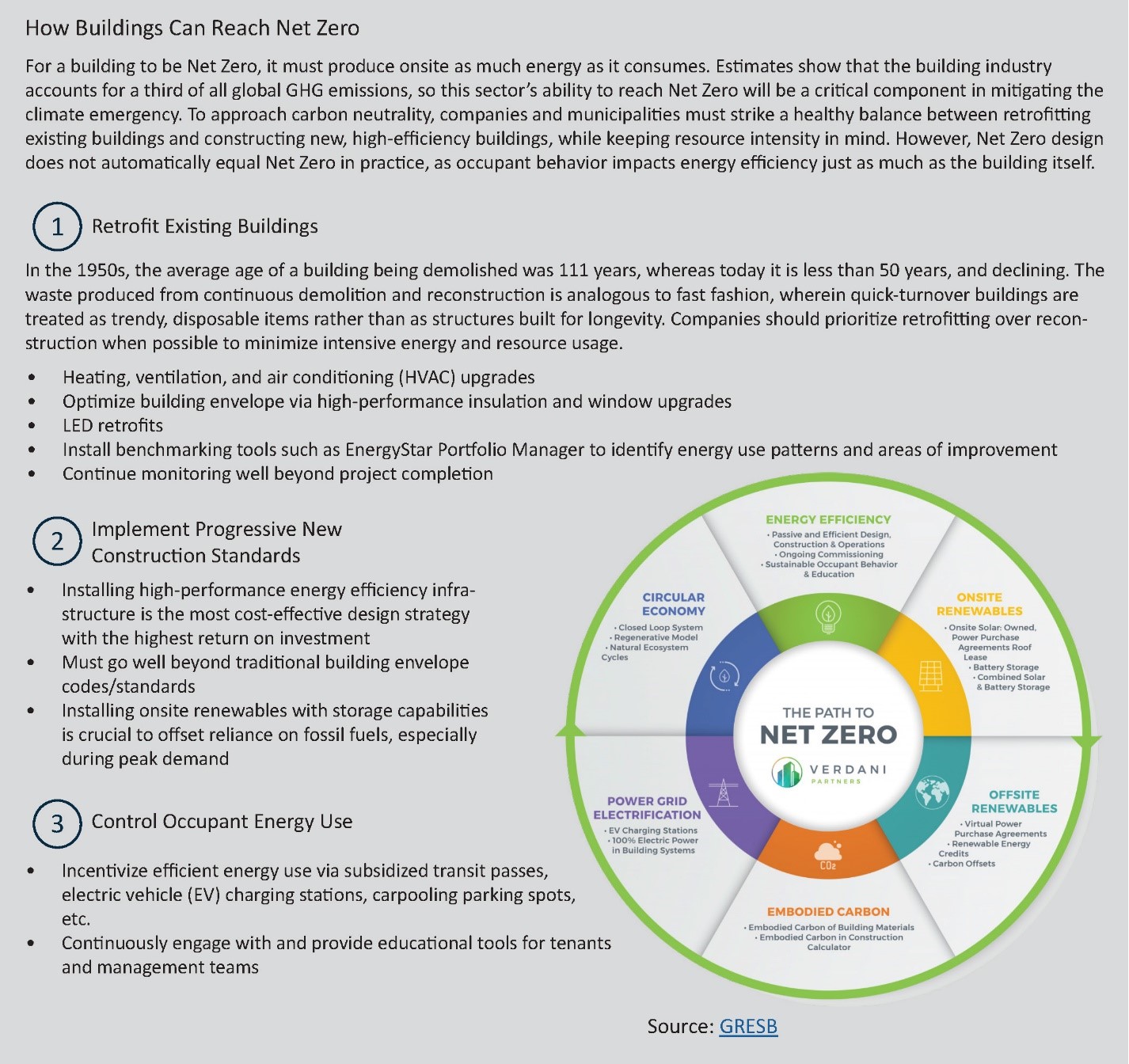

One way the company could take its accreditations a step further is by striving for LEED Zero certification, which is the premiere certification for carbon-neutral buildings. BXP has achieved several Net Zero design feats across its portfolio, including 6 MW of onsite solar power under construction, which would increase its onsite solar capacity by over 400%, and its new 3.7 MWh lithium-ion battery storage system at the Colorado Center in Santa Monica. Additionally, in 2019, BXP generated more than 1,000 MW of renewable energy at peak capacity onsite.

Criticisms against LEED certifications often include accusations of “green-washing,” and BXP combats this with strict policies on building supply procurement that limit toxicity of materials, waste output, and supply shipping distances. REITs can help their communities significantly reduce waste output by improving waste management during building construction and operation, two areas which account for an estimated 40% of global waste. BXP aims for a 75% waste diversion rate (recycling waste versus incineration or landfill) on construction and demolition debris for all new construction and renovation projects. Its other environmental targets include 32% energy use reduction by 2025, 39% reduction on scopes 1 and 2 greenhouse gas (GHG) emissions by 2024, and 30% water use reduction by 2025. As a member of the Science-Based Targets initiative, BXP’s GHG reduction goals are in line with a 1.5°C global warming trajectory, which is currently the gold standard for science-aligned Net Zero strategies.

Heating, ventilation, and air conditioning (HVAC) upgrades can help buildings significantly reduce their carbon footprints, and BXP is making headwinds in this area, employing boiler retrofits, heat exchangers, and improved filtration on cooling towers. Since 2018, BXP has issued $2.7 billion in green bonds, which have been fully allocated to the company’s Salesforce Tower development project, bringing it up to LEED Platinum certification. Thorough reporting on the project’s environmental impacts show that its associated savings are akin to removing 1,300 cars from the road and filling almost five Olympic-sized swimming pools annually. The company also recently announced an additional $850 million in green bond offerings that are expected to mature in 2032.

Occupant behavior can be a make-or-break component of REITs’ overall environmental successes, and BXP manages this risk by having trained property management professionals engage directly with tenants to educate them on efficient energy use and proper utilization of single stream recycling systems. BXP also continuously monitors electricity, gas, and steam usage via a host of environmental management software programs and energy audits, allowing it to track progress and identify areas of improvement in real time.

Managing properties coast to coast means BXP must tailor its environmental adaptation strategies to a wide range of geographies and climate-related risks. BXP meets these challenges by installing environmental infrastructure enhancements at suitable properties, including waterproofing of subgrade infrastructure, floodable first floors, and onsite energy storage systems, making its buildings and their occupants more resilient to adverse weather events.

Social

REITs like Boston Properties have the opportunity to achieve impact in the social sphere by offering favorable lease conditions to positive social actors, such as non-profits, small local businesses, and charities; however, many of BXP’s largest tenants by square footage include large tech companies, high-revenue law firms, and the U.S. government. Of the 2,852 housing units offered in BXP’s portfolio, 412 units qualify as “affordable” housing. The need for investment in affordable housing cannot be understated given its catastrophic shortage in many major U.S. cities — especially in cities BXP operates in, such as Los Angeles and San Francisco, where housing costs and homelessness have skyrocketed in recent years. While residential properties make up only a small portion of BXP’s portfolio, this is a potential area of opportunity where BXP could use its expertise to play an integral role in helping shape the long-term economic success of the communities it is a part of (BXP’s five major markets all have affordable housing problems).

REITs are a major determinant of communities’ infrastructure and can further enrich their social impacts by being active members of the places they operate in. The $124.7 million BXP invested in public realm improvements in 2019 included roadway improvements, public art installations, and 32 public amenity additions across its portfolio, going beyond merely serving its paying customers. Mixed-use, public transit-oriented developments like BXP’s The Hub on Causeway in Boston showcase the company’s commitment to creating spaces that people from all walks of life can enjoy, with retail amenities, restaurants, theaters, and other entertainment venues all in one place. REITs can ensure long-term growth by considering sociodemographic developments in their building design, and mixed-use spaces like The Hub are especially attractive to younger generations who prefer more walkable cities.

Green roofs are a relatively low-cost way for buildings to deliver both environmental and social impacts in one fell swoop. Obvious benefits include added green space and enhanced access to healthy foods, while less visible environmental impacts include reducing storm water runoff, lowering cooling/heating demand, and curbing the negative effects of urban “heat islands.” BXP’s rooftop gardens in Washington, DC provide fresh and affordable produce to low-income families, and its six onsite apiaries make the company a leader in urban beekeeping.

Human capital development is an area of growing material concern in the ESG world. Employees at BXP enjoy a vast array of benefits, including subsidized gym passes, medical benefits, public transit pass subsidies, and a host of programs aimed at supporting a healthy work-life balance. BXP employees have the option of taking a paid volunteer day each year, helping the company accrue over 2,000 community service hours to more than 200 organizations in 2019. The company publicly discloses employee demographic data, which is good from a transparency perspective; however, data shows that only 31% of total employment and 30% of new hires identify as ethnic minorities. Females comprise 36% of its board of directors, which is high compared to an average of 23% for the top 100 REITs by market cap.

For occupants, BXP recently added 12.4 million square feet of Fitwel-certified buildings, which support healthier workspace environments to improve occupant well-being and productivity. Features of these buildings include gyms, mothers’ rooms, quiet rooms, and biophilic elements, which foster visual and non-visual connections with nature. Fitwel sets the standard for indoor air quality, requiring heightened ventilation and filtration, which are effective strategies in curbing Covid-19 transmission.

Governance

Board structure is an important hallmark of sustainable corporate governance. The majority, or 82%, of BXP’s board of directors is independent, which is similar to its peer companies. Board committees that oversee audit, nomination, and remuneration are fully independent. The company’s CEO earns about 103.4 times its median employee’s compensation, which is better than its industry peers. BXP is an outperformer in stakeholder engagement, and the company’s open dialogue with tenants, investors, and other stakeholders allows it to identify and mediate gaps in its ESG disclosures. ESG targets are communicated to senior management on a weekly basis, followed by weekly and monthly progress reports. This rigorous management helped BXP accomplish all of its sustainability goals in 2019.

Employee training is crucial in preventing ethical violations, and BXP ensures that all employees receive annual training that is tailored to their individual obligations under the Code of Ethics. Employees who work directly with the government receive in-person training specific to these dealings. A 24-hour whistleblower hotline is also available for employees to anonymously report code infractions.

In terms of transparency, BXP’s disclosures show that major political donations were made by members of the executive management and board of directors in recent years, but details about specific amounts and who received the donations were omitted. While it is not a widespread practice, transparency in political activities is an ESG issue, and it is paramount for a company like Boston Properties to disclose political contributions since its largest client is the federal government.

Risk & Outlook

REITs generally occupy a low-risk industry with much potential for ESG success. While the office REITs sector struggled during the pandemic — as many tenants opted for a work-from-home (WFH) settings — BXP appears unscathed, collecting 99% of its rentals throughout the pandemic. It is unclear what the post-Covid office of the future will look like, but we believe that BXP is well positioned with state-of-the-art buildings that prioritize environmental impact and occupant health. The company has shown its competitive edge for building innovation through its Fitwel and LEED projects, and we look forward to seeing how these and other innovations will shape the post-Covid office model. Additionally, BXP has had no major recent controversies, which can be indicative of a company’s effective management of key ESG issues. Sage continues to hold BXP as a 4-leaf company with a positive outlook.

Sage ESG Leaf Score Methodology

No two companies are alike. This is exceptionally apparent from an ESG perspective, where the challenge lies not only in assessing the differences between companies, but also in the differences across industries. Although a company may be a leader among its peer group, the industry in which it operates may expose it to risks that cannot be mitigated through company management. By combining an ESG macro industry risk analysis with a company-level sustainability evaluation, the Sage Leaf Score bridges this gap, enabling investors to quickly assess companies across industries. Our Sage Leaf Score, which is based on a 1 to 5 scale (with 5 leaves representing ESG leaders), makes it easy for investors to compare a company in, for example, the energy industry to a company in the technology industry, and to understand that all 5-leaf companies are leaders based on their individual company management and the level of industry risk that they face.

For more information on Sage’s Leaf Score, click here.

Sources:

- 2020 Annual Report. Boston Properties.

- Sustainability Reporting. Boston Properties

- Companies Taking Action. Science-Based Targets. April 2021.

- REIT Industry ESG Report-2020.

- Burns, Richard. How Whole Communities Benefit From Affordable Housing. Forbes. January 2020.

- Capps, Kriston. The High Cost of Clearing Tent Cities. Bloomberg City Lab. April 2021.

- Campbell, Dollaghan, Kelsey. The Strange Beauty of Brutalist Architecture, Mid-Demolition. Fast Company. April 2018.

- Top 10 Retrofit Methods for Sustainable Buildings. Senseware Blog.

- Leung, Jessica. Decarbonizing U.S Buildings. Center for Climate and Energy Solutions. July 2018.

- Dolan, Chelsea. 6 Ways Affordable Housing Can Boost Local Economies. Commonbond Communities. September 2020.

Disclosures

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. The information included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. This report is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sustainable investing limits the types and number of investment opportunities available, this may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other strategies screened for sustainable investing standards. No part of this Material may be produced in any form, or referred to in any other publication, without our express written permission. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.