While a further rally in risk assets and compression in credit spread will require a follow-through by the Fed as a well as cooling of trade tensions, the Fed has done its part to quell market volatility to start off 2019. One sector that has had a particularly strong rebound is Energy.

Atlas Shrugged, Powell Paused

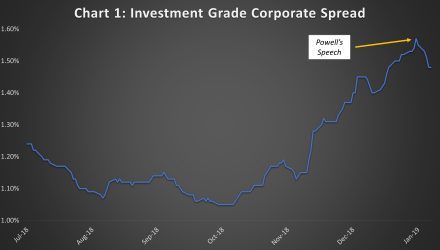

In his December press conference, Federal Reserve Chairman Jerome Powell dismissed market concerns over further interest rate hikes, roiling an already troubled equity market. The result was one of the worst months for risk assets in recent memory – the S&P 500 suffered the worst December since the Great Depression. Credit markets also experienced a massive negative turn in sentiment and price performance. Investment grade credit spreads closed the year at 153 basis points, nearly 50 basis points higher than the closing level on September 30.

Just a few weeks later, on January 4, Powell spoke on a panel with former Fed Chairs Janet Yellen and Ben Bernanke at the American Economic Association conference. His remarks reflected an about-face from his December press conference.

Related: 5 Reasons to Favor Core Fixed Income in 2019

Notably, Powell stressed flexibility in Fed policy: “We’re always prepared to shift the stance of policy and to shift it significantly if necessary;” and, we’re: “Listening sensitively to the message that markets are sending;” and on the potential to pause its rate hike as well as balance sheet runoff, he said: “We will be prepared to adjust policy quickly and flexibly and to use all of our tools to support the economy.” The Fed then bolstered its messaging around a hiking pause this week when speeches from Fed officials Charles Evans, Loretta Meester, and Eric Rosengren echoed a similar tone.

Financial stability and markets are now squarely and explicitly in the Fed’s crosshairs, and a dour market mood turned around on a dime. Credit markets have snapped back. Investment grade corporate spreads, which peaked on January 3, the day before Powell’s speech, have compressed by 9 basis points (Chart 1). More notably, high-yield credit spreads have fallen by 92 basis points, which retraces most of December’s move (Chart 2)!

Energy Leads the Charge Higher

The Energy sector has seen a particularly strong rebound in both spreads and sentiment, bolstered by a rebound in the benchmark West Texas Intermediate Crude Oil price from a low of $42.53 on December 24, 2018 to $52.02 on January 11, 2019.