By Rebecca Felton, Senior Market Strategist

SUMMARY

- Recent volatility around earnings headlines obscures underlying earnings power, in our view.

- The US economy remains strong, giving us greater confidence in our expectations for mid-to-high single digit growth for S&P 500 earnings in 2022.

- We believe volatility will persist throughout 2022 but remain constructive on equities.

Memorable one-liners make for great commercials. One such commercial in financial services advertising dating back to the late 1970’s and early 1980’s ended with the esteemed actor John Houseman dropping the mic with the line “they make money the old-fashioned way… they earn it”. “Earning it” may be the key to which stocks or sectors are the performance leaders for 2022. We are over halfway through earnings reporting season for the fourth quarter of 2021, and just as in the past several reporting periods, most companies have exceeded Wall Street expectations.

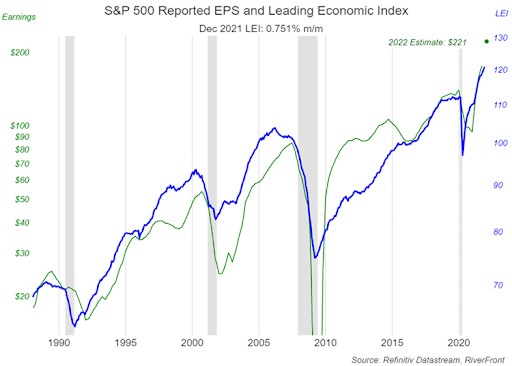

However, there have been some high-profile companies that have not met expectations and their share prices have been punished, in our opinion. Further, some of those disappointments have impacted overall market performance and added fuel to the volatility we have experienced in 2022. Compounding the worries over earnings is the fact that we have reached the point in the post-pandemic recovery where the change in year-over-year growth rates in corporate earnings is slowing. For the quarter just ended, it is estimated that earnings for companies in the S&P 500 grew at a rate of over 25% on a year over year basis. That is in sharp contrast to the single digit growth rates that are forecast for the next few quarters. To put it in perspective, Wall Street consensus expectations for calendar 2022 year over year earnings growth stands at approximately 9% compared to a growth rate of over 50% for 2021 (see chart, right). With the S&P 500 trading at an above average P/E multiple, 19.7x versus the 5-year average of 18.6x, this type of deceleration is attention-getting, but we do not believe it is cause for alarm.

Why Do We Care About Earnings?

Consistency and sustainability of earnings growth is a driver for security selection in our strategies in 2022. The reason we care so much about the current earnings reporting period is that it gives us an opportunity to look under the hood for those characteristics which we believe will separate the winners from the losers. As supply chain constraints, labor shortages, and cost pressures have increased, the commentary that accompanies the data released by publicly traded companies matters more than ever. Our equity selection strategy continues to favor those industries where companies are navigating through COVID-19 related disruptions through a combination of consistent earnings growth, strong margins, and pricing power.

Why Should You Care About Earnings?

Most investors have little need to know about specific forecasts for corporate earnings growth. While the details of earnings reporting season are likely too “in the weeds”, it is important to understand that these reports are one more factor contributing to the market volatility we referenced in last week’s Weekly View: All Aboard the Mechanical Bull: FAQ on Recent Market Volatility. It is also important to remember that the lower relative growth in 2022 when compared to 2021 is not new news. Current forecasts for S&P earnings for 2022 are at $220.06, compared to $202.20 for 2021. We believe single digit earnings growth is already factored in to share prices and the stock market’s weakness since the beginning of the year has served as a reset button, bringing valuations down to more reasonable levels. Market volatility can be unsettling, but we believe understanding the underlying reasons for it can help mitigate some of those anxieties.

Our Focus Remains on the Big Picture

Assigning values to stocks based on future earnings may be the most common valuation metric used by financial analysts, but it is important to view it in the context of a wide range of fundamentals that also give insight into the strength of a company’s prospects. Headlines discussing corporate earnings reports tend to focus on whether a company exceeded or fell short of expectations. The greater the magnitude of the difference, the greater the impact on a company’s share price. However, there are additional metrics that can give insight into the health of companies that deserve attention. For example, revenues are at record high levels meaning that companies have more financial flexibility. Record revenues generate significant cash which can be used towards dividends or share repurchases or can also go towards business expansion and wages. Additionally, while down from the record levels achieved during the second quarter of 2021, profit margins remain above average, even as companies have faced cost pressures in the form of both higher cost of goods and higher wages. Strong sales bode well for demand and above-average profit margins provide cushion as companies adjust to a higher cost structure. Finally, the December release of the Conference Board’s Leading Economic Index (LEI) confirmed that US economic activity remained strong as we ended 2021 despite challenges from the COVID-19 Omicron variant (see chart, above). As we wrote in our 2022 Outlook Summary-Riding the Recovery, we believe there is a correlation between the LEI and trends in US corporate earnings. The continued strength in the LEI gives us confidence that earnings can trend higher this year and achieve our base case expectations for mid to high single digit year over year growth.

Conclusion

Transitions can be uncomfortable. The transition from a market that was moving higher throughout 2020 and 2021 to the choppy volatility we have experienced over the past month has left investors feeling anxious and worried that they need to take action. An investment process anchored by a risk management discipline serves as a solution for these times. Thus far, 2022 has been an example of when process intersects with prediction. Predictions or expectations are evolving as economic conditions change, and we have enacted risk management responses across our strategies. We remain constructive because of our belief in the recovery, but we stand ready to make the necessary changes for investors – either lowering overall risk levels in the portfolios or reinvesting cash – depending on the signals we glean from our process.

Message for Investor Types:

We have the following recommendations for Accumulate, Sustain, and Distribute investors:

- Distribute and Sustain:

- Prepare for heightened volatility, but don’t lose sight of the big picture: The big picture being that equities need to remain prominent in portfolios since bonds and cash offer returns that are below inflation and thus represent a loss to purchasing power each year.

- Trust the process: Our portfolio managers have experience navigating volatile markets and have their ‘hands on the wheel’. Recognizing that our investment process is more important than our ability to always make accurate predictions, more regular ‘course corrections’ to the portfolios should be expected as volatility rises.

- Accumulate: Volatility is an Accumulate investor’s friend, in our view. Volatility provides an opportunity for Accumulate investors to potentially put their money to work at more opportune price levels. These better price levels can amplify returns if done correctly.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For each outcome category (accumulate, sustain, and distribute) RiverFront’s portfolio management team has assigned one or more RiverFront product(s) based on their assessment of the product’s investment objective as it relates to a typical client’s return and risk objectives when seeking investment outcomes of accumulating wealth, sustaining wealth and distributing wealth. The team has also designated RiverFront product alternatives for those clients looking to take more or less risk with the outcome category. The ‘more aggressive’ (or more risk) alternatives will generally have greater equity and international exposure as well as longer time horizon targets, while those designated as ‘more conservative’ (or less risk) will have fewer equities, a lower exposure to international and shorter time horizon targets. Since the risk assessments are dependent on the outcome category selected, RiverFront products may fall in multiple categories. All investments carry a risk of loss and there is no guarantee that an investment product or strategy will meet its stated objectives.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The Institutional Brokers’ Estimate System (IBES) is a database used by brokers and active investors to access the estimates made by stock analysts regarding the future earnings of publicly traded American companies.

The Composite Index of Leading Indicators, otherwise known as the Leading Economic Index (LEI), is an index published monthly by The Conference Board. It is used to predict the direction of global economic movements in future months.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In a rising interest rate environment, the value of fixed-income securities generally declines.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2026601