As we write this, the stock/bond mix of RiverFront’s Advantage portfolios are roughly in-line with their asset allocation targets. This is not always typical for RiverFront’s portfolios. Typically, our investment team has favored one asset class over another, expressing that view through meaningful ‘overweights’ and ‘underweights’. While ‘neutral’ positioning has been relatively rare since our firm’s founding in 2008, we anticipate it may be more common in the future because bonds now offer reasonably attractive yields relative to our return expectations for stocks.

Importantly, ‘neutral’ portfolio positioning is not bearish… but rather a reflection that both asset classes (stocks and bonds) offer attractive risk/return potential, in our view. However, given the strong start to the year for global equities, a natural question might be…. ‘What would it take for RiverFront to get more bullish on stocks and to increase allocations in the balanced portfolios?’ In our view, there would be a few things that would need to happen:

Earnings Confirmation: Ultimately, when an investor is buying a stock, they are buying a ‘right’ to the future earnings of that company. Given this reality, we believe that the two most important factors an investor should consider are 1. the level and direction of a company’s future earnings, and 2. the discount rate that should be applied to those earnings.

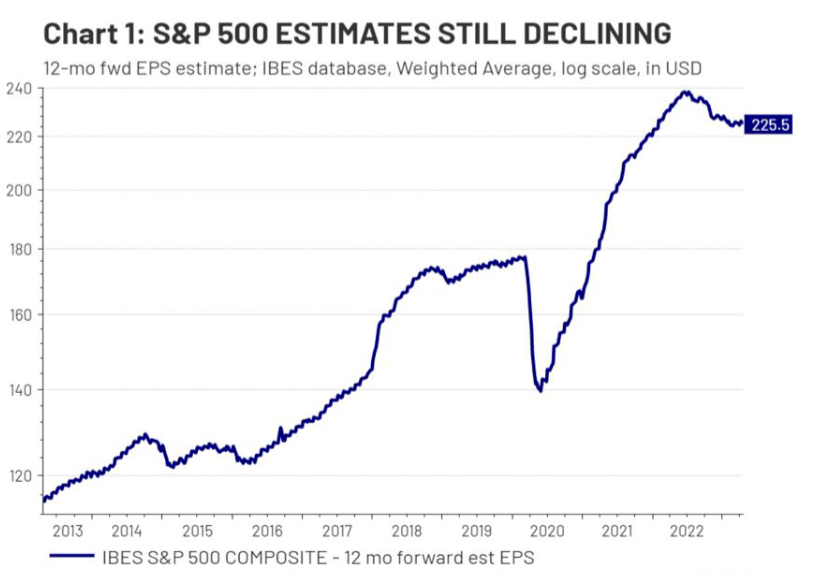

Earnings level and direction: To estimate the level and direction of earnings, we look at analyst earning revisions and the level of earnings surprises. Earnings estimates are published by Wall Street analysts for every company in the S&P 500. Analysts derive these estimates by monitoring industry trends, reviewing data and guidance furnished by company management, and through conversations with employees, suppliers, and customers. Analyst earnings estimates are regularly revised and then aggregated into a measure called ‘earnings revisions.’ ‘Earnings’ Momentum’ measures the direction and magnitude of the most recent revisions. By combining ‘earnings revisions’ with ‘earnings’ momentum’ investors can glean a real-time view into the health of corporate America and the future return prospects for its shareholders.

Source: Refinitiv Datastream, RiverFront. Data weekly as of April 21, 2023.

Unfortunately, over the past twelve-months, 2023 earnings revisions for the S&P 500 2023 have steadily fallen from roughly $233 per share last April, to $225 per share (Chart 1). Earnings’ momentum, on the other hand, may be sending a more positive signal, as analyst estimates are declining at a lesser rate.

Discount Rate: One dollar ten years from now is worth less than one dollar today. How much less is a function of the ‘discount rate’. The prevailing level of interest rates is a key driver of the discount rate. For example, a future dollar of earnings is worth far less in a 10% interest rate environment than it would be in a 2% interest rate environment. This helps explain why technology companies, whose earnings tend to be more back-end loaded, are typically more sensitive to rising interest rates than other companies.

In the US, the Federal Reserve sets short-term interest rates, which has a ripple effect on interest rates at longer maturities. Today, the Fed is in the midst of an interest-hiking cycle, having raised rates nearly 5 percentage points in less than a year. We anticipate the Fed raising rates at least once or twice more in the spring/early summer. In our view, the Fed has made it clear that they care more about stamping out inflation than they do in protecting the economy. Therefore, until the Fed indicates that they will pause rate hikes, we are hesitant to move from our neutral positioning.

Market Confirmation: For nearly a year, the S&P 500 has oscillated within a narrow band of 3,800 – 4,200 (see black horizontal lines, Chart 2). When stocks have reached the top-end of the band, as they are now, a news event or data point has caused them to trade back down toward the bottom-end of that range. A definitive break-out above 4,200 would be a signal, in our view, that the worst may be over and better times are ahead.

Source: Refinitiv Datastream, RiverFront. Data daily as of April 24, 2023.

We see two characteristics that make a break-out ‘definitive’: magnitude and duration. Magnitude means that a break-out must be significant, which we believe is 1-2% above that range. Therefore, a level of 4,242 to 4,284 would need to be reached to satisfy the ‘magnitude’ characteristic. To meet the duration requirement, we believe the S&P 500 must stay above the 4,200 level for a sustained period of time, which we generally define as 7-10 days. While waiting on these two characteristics before calling a break-out ‘definitive’ may cause us to miss some potential upside, it significantly lowers the potential for being whipsawed, in our view.

Conclusion:

In a world where stocks and bonds offer similar risk/reward potential, we believe a ‘neutral’ strategic positioning relative to an investor’s long-term target allocation will be more common. There will always be tactical opportunities to favor stocks or bonds in the future under varying short-term conditions. RiverFront’s investment team will utilize their ‘process over prediction’ philosophy when determining whether a tactical tilt should be considered. Currently, our investment team would need to see a combination of earnings confirmation (rising earnings revisions/surprises and a less aggressive Fed) and market confirmation (definitive upside break-out on the S&P 500) to become more bullish on stocks. Given that neither confirmation signal has registered, we remain comfortable with the neutral positioning of our balanced portfolios.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Definitions:

The Federal Reserve System (FRS) is the central bank of the United States. Often simply called the Fed, it is arguably the most powerful financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system. The Fed has a board that is comprised of seven members. There are also 12 Federal Reserve banks with their own presidents that represent a separate district.

Advantage: These portfolios may be invested in stocks, bonds and exchange-traded products (exchange-traded funds (ETFs) and exchange-traded notes (ETNs)). Advantage is offered through separately managed accounts or on model delivery platforms, depending on the Sponsor Firm.

The term discount rate refers to the interest rate charged to commercial banks and other financial institutions for short-term loans they take from the Federal Reserve Bank. The discount rate is applied at the Fed’s lending facility, which is called the discount window. A discount rate can also refer to the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows. In this case, the discount rate can be used by investors and businesses for potential investments.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit riverfrontig.com or contact your Financial Advisor.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2863377