Our work suggests that the U.S. will face significant economic challenges in the near-term. While we do expect a recession in 2023, we also look forward to the beginning of the next business cycle which should be fundamentally stronger than anything we have seen in recent decades.

Our near-term concerns are centered on the Fed’s policy response to inflation. In our view, excess fiscal and monetary stimulus have been the primary drivers of the current bout of inflation.

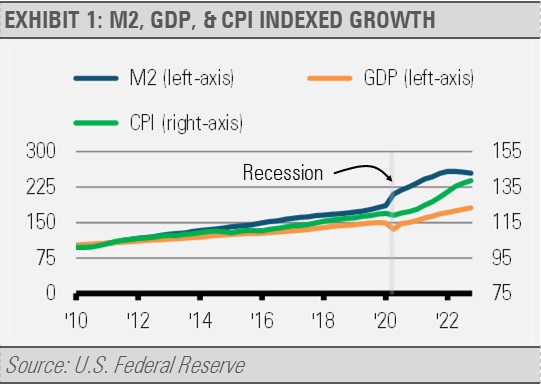

Stimulus increased the amount of money, as measured by M2, in our economic system. The economy does need money growth in order to function properly, but our work suggests that government stimulus accelerated M2 growth to approximately $4.5 trillion more than was necessary. Changes in monetary policy impact the economy with about a 12-month lag. This excess liquidity injected into the U.S. financial system propelled nominal GDP at a much faster rate than the previous business cycle.

Importantly, the excess liquidity eventually resulted in a higher rate of inflation that was definitely not transitory. As a comparison, during the previous business cycle from the third quarter of 2009 through the first quarter of 2020, M2 grew on average 1.48% per quarter with nominal GDP growth averaging 0.96% and inflation running at 0.53% per quarter on average. Government stimulus pushed M2 growth up to 2.99% on average per quarter during the current business cycle until going negative in the second quarter of 2022. In turn, the average quarterly NGDP growth rate jumped to 1.54% on average per quarter with the average rate of inflation nearly tripling to 1.53% on average per quarter. These are massive increases for such a large economy.

As a result, the Fed’s reversal of these policies has been equally as aggressive and their patience similarly lacking. The Fed’s need to continue to tighten monetary policy in response to heightened inflationary pressures has resulted in the growth rate of money falling into negative territory. There is less money in the U.S. financial system today than there was a year ago. With the Fed continuing to tighten despite weakening economic measures, such as negative money growth and declining leading economic indicators, we expect a recession this year.

However, we remain optimistic and excited about the longer-term prospects for the U.S. economy and financial markets. The U.S. private sector financial conditions and demographics point to a bright future for the U.S. economy over the coming decade. Household and corporate balance sheets overall are in excellent shape relative to history.

INVESTMENT IMPLICATIONS

The private sector will be challenged and look worse if a recession comes as we expect, but the data suggests that the private sector is better prepared for challenges this time. Furthermore, demographic trends that have been building for decades leave the U.S. as one of the best positioned economies in the world with ample labor force potential and innovation-driven productivity potential. Labor force growth and productivity growth are the primary drivers of long-term economic growth, and the U.S. is poised to benefit from both factors.

Though we expect near-term challenges to financial markets, our expectations for future returns are bright. We are finding compelling valuations that can lead to impressive long-term investment results, especially in Treasury bonds, which we think are more attractive than at any other time since 2007, and equities longer term.

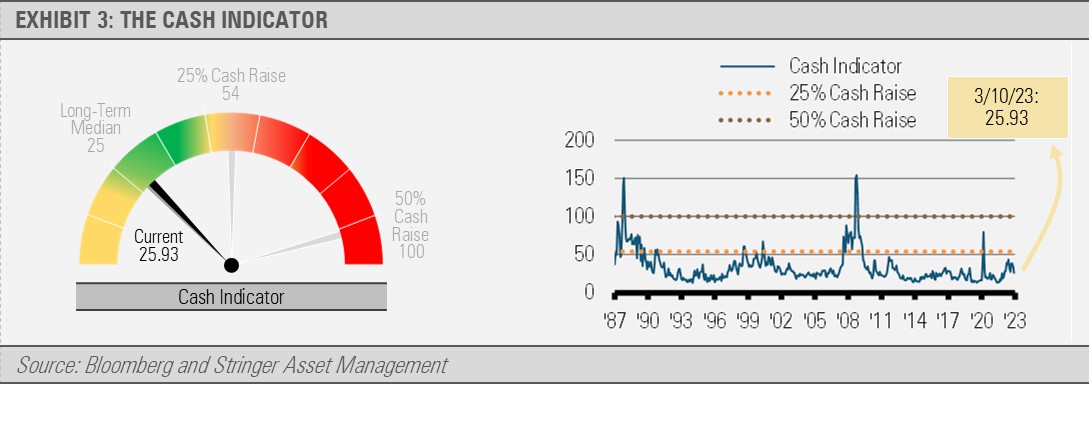

THE CASH INDICATOR

Reflecting the recent market stress, the Cash Indicator (CI) has elevated back to its long-term median level. We had expected a shock coming given how the previously low CI levels had reflected market complacency. While our fundamental works suggests that we should expect more economic market challenges over the coming months, the CI tells us that we are not likely to experience a market crash in the near-term.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.