By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

We think that the initial shock to the markets stemming from coronavirus and the related government and private sector responses are behind us. However, that doesn’t mean smooth sailing from here. Importantly, our blend of strategic and tactical allocations in our Strategies means that nervous investors can take comfort in our ability and willingness to act and see protection from our defensive positions, including our relatively large cash allocations, while still participating in market gains. We began to tactically raise cash in early March by reducing our more volatile exposures. As a result, the additional cash we raised once our Cash Indicator signaled that the markets were not functioning properly required just an incremental shift. Now that the recession is here, we expect to see a deeper global economic drawdown than we saw during the Global Financial Crisis of 2007-2009, though we do not expect the economic disruption to last nearly as long. Reliable data from Europe and the U.S. is suggesting tentative signs that the spread of the virus is being brought under control.

Still, we are cautious of the unknowns and the potential for resurgent outbreaks. Clearly, the economic damage brought on by containment measures will be significant. So long as the damage does not become a financial crisis, the recovery should be brisk and begin soon after containment measures are relaxed. With massive government interventions, the most devastating potential economic effects may have been staved off. Economic recessions, except those involving a financial crisis, and the associated recoveries tend to be V-shaped. The current recession and recovery will likely also be V-shaped. Once restrictions begin to be lifted, we expect to see a strong resumption of economic growth. However, it will likely take some time for the economy to fully recover and some industries may see longer-term damage. We think it will be important for investors to focus on areas that are more likely to participate fully in the recovery and shy away from areas that are likely to continue to struggle. We are watching our indicators closely and will adjust quickly. That flexibility is one of the benefits of having a tactical allocation where we can manage risk in real time.

A Sample of Recent Additions

As a result of the coronavirus and economic downturn, we made many changes over the course of the quarter. Most notably, we raised our cash levels to more than 20% in all of our Strategies.

On the equity side, we increased our exposure in high quality companies with stable business, high profit margins, and solid balance sheets with lower debt that we think are now trading at attractive valuations.

The fixed income changes added to short-term U.S. Treasury bonds as well as maintaining our bias to high-quality bonds and decreasing our exposure to corporate bonds.

This material is for informational purpose only. Investments discussed may not be suitable for all investors. No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific views contained in this report. Information provided is obtained from sources deemed to be reliable; but is not represented as complete, and its accuracy is not guaranteed. The information and opinions given are subject to change at any time, based on market and other conditions, and are not recommendations of or solicitations to buy or sell any security. Opinions and forecasts expressed herein may not actually occur. Past performance is not indicative of future results. The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

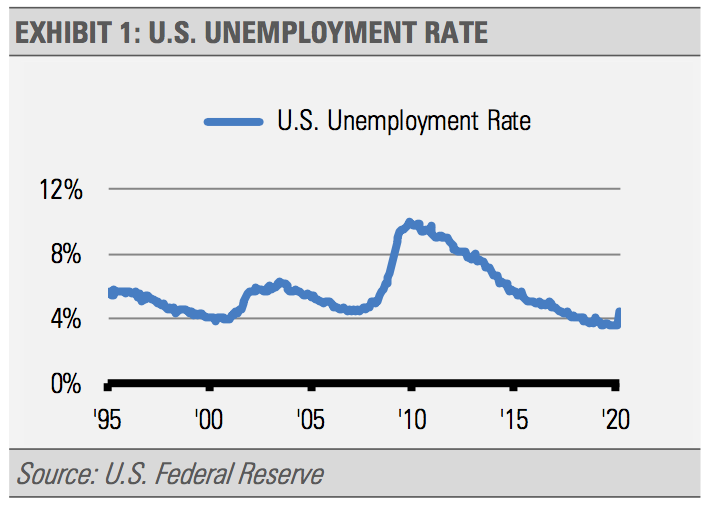

We think that the initial shock to the markets stemming from coronavirus and the related government and private sector responses are behind us. However, that doesn’t mean smooth sailing from here. Some of our work that caused us to get defensive quickly is suggesting that many areas have gotten better, but not good enough. Importantly, the blend of strategic and tactical allocations in our Strategies means that nervous investors can take comfort in our ability and willingness to act and see protection from our defensive positions, including our relatively large cash allocations, while still participating in market gains. We would like to emphasize that investing doesn’t have to be all in or out, one or the other. In this way, investors can have both protection and participation. We began tactically raising cash in early March by reducing our more volatile exposures. As a result, the additional cash we raised once our Cash Indicator signaled that the markets were not functioning properly was just an incremental shift. We are following our process, and should we feel the need to tactically shift to a more aggressive or conservative stance, we have the flexibility to do so. In addition, we have plenty of dry powder to invest in attractive opportunities should our work suggest that conditions are improving. Now that the recession is here, we expect to see a deeper global economic drawdown than we saw during the Global Financial Crisis (GFC) of 2007-2009, though we do not expect the economic disruption to last nearly as long. The jump in weekly jobless claims (layoffs) has dwarfed the previous record, and that might be just the start. We will likely see unemployment well over 10% accompanied by a double -digit decline in economic activity. Still, with strong consumer and banking balance sheets going into this crisis, we do not forecast a repeat of the housing and banking crisis that we saw during the GFC, at least not domestically.

Reliable data from Europe and the U.S. suggests tentative signs that the spread of the virus is being brought under control. Still, we are cautious of the unknowns and the potential for resurgent outbreaks. Clearly, the economic damage brought on by containment measures will be significant. So long as the damage does not become a financial crisis, the recovery should be brisk and begin soon after containment measures are relaxed, and people become more comfortable social interactions.

Both monetary and fiscal government support are big positives in our view. With these massive government interventions, the most devastating potential economic effects may have been staved off. However, these support systems will take time to work their way through the economy. With this as a backdrop, we think it makes little sense to be fully invested at this time, which is why our Strategies are holding significant levels of cash.

Making a market call, be it a market top or a bottom, and committing to an all-in or all-out scenario is not a risk management strategy that we are comfortable with using for a core allocation. We prefer to consider the environment using leading indicators, valuations, and probabilities to determine how optimistic or cautious we should be and invest accordingly. Additionally, we like to think in terms of risk and reward probabilities rather than absolutes. We would rather be generally correct than risk being precisely wrong.

We find that if we can limit downside risk, the time to breakeven from a drawdown can be reduced significantly. It is equally important to consider the behavioral aspects of investing. We think that rational investment decisions can help keep investors on track if they can participate in the market while also protecting and keeping some dry powder as fundamentals start to come into focus.

The U.S. Federal Reserve (Fed) was quick to act with several measures including decreasing short-term interest rates and expanding their balance sheet through a series of purchases and lending facilities. As opposed to the relatively sluggish response to deteriorating conditions during the GFC, these actions helped to quickly offset some of the liquidity shock that we saw in March.

While we are not out of the woods yet, we think that the Fed’s policy responses are having a positive impact in helping markets function. Furthermore, there is more that the Fed can do to help stabilize credit markets and monetary conditions as they are not out of bullets. Fiscal measures can also aid the recovery along with automatic stabilizers like unemployment insurance. Programs being launched to help consumers and businesses weather this crisis will be helpful, but also take time to enact. Additionally, we expect to see more policy responses to assist in other areas, including more help for municipalities who are likely to see tax revenues plummet.

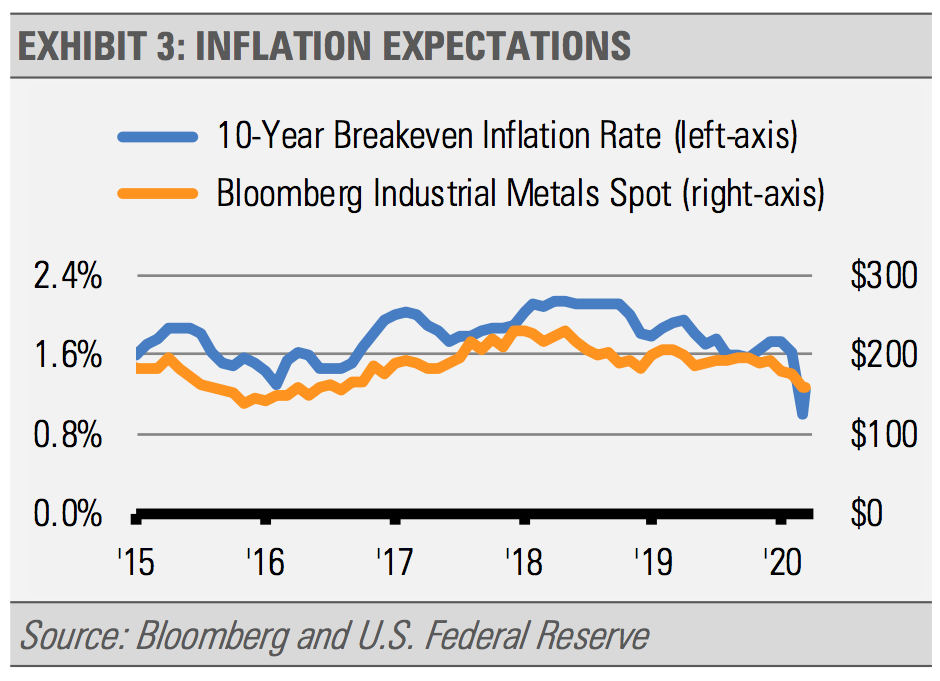

The recent economic shock is moving so quickly that business survey readings likely underestimate the size of the economic downturn. Instead, we are more focused on high frequency indicators, such as inflation expectations, credit spreads, industrial metals’ prices, and weekly initial jobless claims (layoffs). Each of these indicators are suggesting stress of varying degrees.

For example, Treasury Inflation Protected Securities (TIPS) spreads and industrial metals’ prices provide useful insights for inflation trends. Both measures have recovered from their lows but are still far below their 2018 highs when U.S. economic growth was accelerating. A move from these indicators in one direction or another would be important.

Both high yield and investment grade credit spreads, which are the differences in interest rates between U.S. Treasury bonds and corporate bonds, suggest that companies are having a difficult time finding funding as investors are demanding a high return on capital. Still, credit spreads remain well below the levels experienced during the GFC and are more reflective of levels during the March 2001 to November 2001 recession. Decisive Fed action that eased market liquidity is at least part of the reason that spreads are not higher today. Even so, investors are demanding a premium to offset the risk of a default. Additionally, weekly initial jobless claims are spiking as never before experienced and suggest an abrupt economic decline.

We expect to see high levels of unemployment reflected in the more widely followed monthly jobs report for some time to come. Even when the economy does begin to recover, unemployment rolls are likely to remain elevated for months.

INVESTMENT IMPLICATIONS

Equity valuations look more attractive following the recent market declines. We cautioned in February that U.S. equities may be vulnerable due to stretched valuations at that time. As the following exhibit shows, equity valuations are currently much more appealing. Meanwhile, with interest rates falling since the beginning of the year, future expected returns for investment grade bonds should decline as well.

Economic recessions, except those involving a financial crisis, and the associated recoveries tend to be V-shaped. The current recession will likely also be V-shaped when the virus crisis passes. Once restrictions begin to be lifted, we expect to see a strong resumption of economic growth. Still, it will likely take some time for the economy to fully recover and some industries may see longer-term damage.

We think it will be important for investors to focus on areas that are more likely to participate fully in the recovery and shy away from areas that are likely to continue to struggle. Our tactical choices allow us to accomplish that in this environment. We are watching our indicators closely and will adjust quickly if we sense problems or opportunities ahead. That flexibility is one of the benefits of having a tactical allocation where we can manage risk in real time.

THE CASH INDICATOR

Our proprietary Cash Indicator (CI) spiked into the red zone when the credit markets broke down during the second and third weeks of March. The CI is designed to reflect periods when the markets themselves breakdown in such a way that traditional asset allocation does not work as expected. During this March period, almost every corner of the bond market saw stress levels that we have not seen since 2008. Additionally, the prices of equities, gold, and high- quality bonds fell as well. In times like this, we think that holding excess cash and short-term Treasuries is the most beneficial manner to protect capital. The CI level has since declined but is still elevated and reflective of continued market stress.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 stocks. The Index is designed to measure performance of a broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.