By John Eckstein

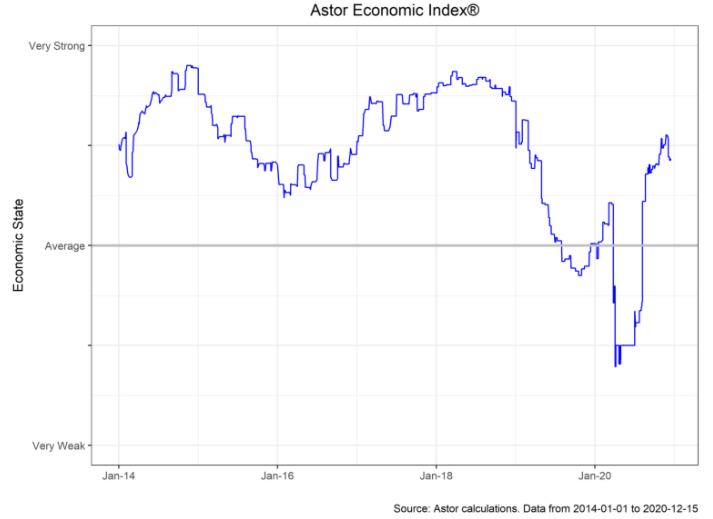

As we have said before in this blog, as goes the pandemic, so goes the U.S. economy. The Astor Economic Index reflects this reality, ticking down in November from its 2020 highs, although still in solid growth territory.

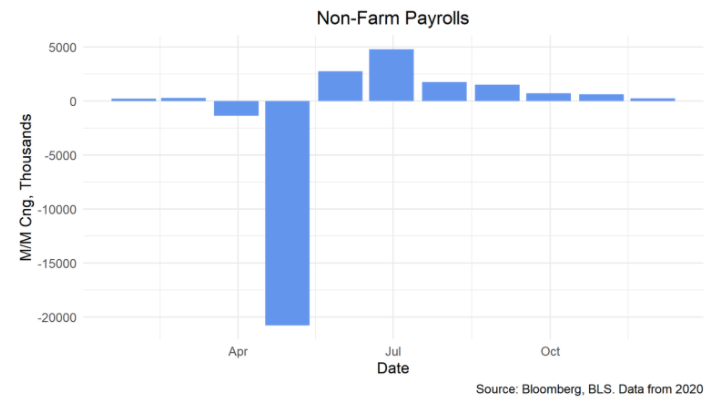

In November we noted that the impact of the second wave of COVID-19 and concomitant lockdowns would manifest most immediately in the labor market, and that prediction has begun to bear fruit. Non-farm payrolls improved by 250,000 m/m, a significant slowdown from months prior and indicative of a slowing trend towards full employment.

Moreover, much of the survey period took place prior to stay-at-home orders in California and elsewhere. The four-week moving average of initial jobless claims, a volatile but timely measure of labor trends, has begun to move upwards once again after previously stabilizing in the low 750,000s, suggesting that hiring conditions have turned adverse as coronavirus caseloads begin to match numbers seen earlier in the pandemic. Astor’s Consumer Sentiment Index tells a similar story, with spenders turning less positive about the near-term trajectory of the U.S. economy.

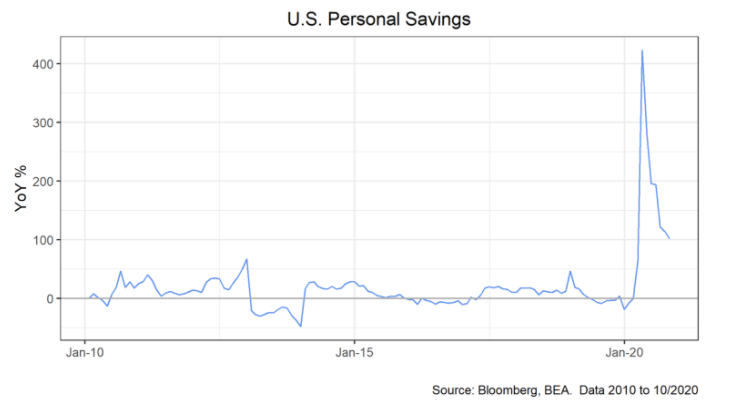

Thankfully, we now have a definitive light at the end of the tunnel with the approval of effective vaccines for the coronavirus, and so we pause here to take stock of the U.S economy with an eye towards full reopening. We noted in March that the long-term structural impacts to potential GDP could be prevented with adequate support for households and businesses. In the former category, high personal savings (partly a response to uncertainty around the virus, but also from government stimulus funds) indicate consumers ready to get off the sidelines.

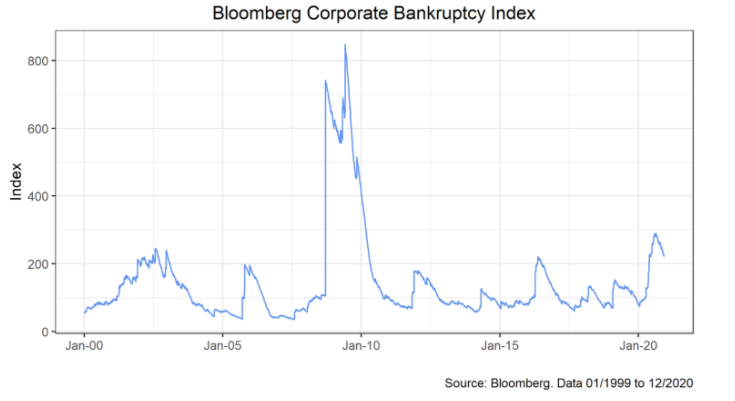

The Bloomberg Corporate Bankruptcy Index, meanwhile, shows more business filing for bankruptcy than in the 2001 recession, but well below Global Financial Crisis highs and consistent with solid purchasing manufacturing indexes for both services and manufacturing sectors. It seems likely that government loan facilities and Federal Reserve purchases in corporate debt markets have allowed many businesses to stay afloat for longer than they would have otherwise been able to.

Timely administration of the vaccine, additional government stimulus, a quick return to consumer spending and improved business hiring are all possible in Q2, although substantial risks remain in the current quarter as the economy moves further towards shutdown. In sum, the U.S. economy looks to have weathered the storm as well as can have been expected, but it is premature to speculate about the pace of future recovery.

The Astor Economic Index® is a proprietary index created by Astor Investment Management LLC. It represents an aggregation of various economic data points: including output and employment indicators. The Astor Economic Index® is designed to track the varying levels of growth within the U.S. economy by analyzing current trends against historical data. The Astor Economic Index® is not an investable product. When investing, there are multiple factors to consider. The Astor Economic Index® should not be used as the sole determining factor for your investment decisions. The Index is based on retroactive data points and may be subject to hindsight bias. There is no guarantee the Index will produce the same results in the future. The Astor Economic Index® is a tool created and used by Astor. All conclusions are those of Astor and are subject to change.

AIM-12/17/20-OP248

Originally published by Astor Investment Management, 12/18/20

All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. Astor and its affiliates are not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information. Please refer to Astor’s Form ADV Part 2 for additional information regarding fees, risks and services.