SUMMARY

Until the equity market’s internal weakness stabilizes, tax loss selling is over, or strong demand for stocks occurs, take advantage of current price weakness and have a risk-managed investment strategy going into year-end and 2022.

MOVING PARTS

Rubik’s Cube became popular in the 80s. According to Wikipedia, “Although it is widely reported that the Cube was built as a teaching tool to help [inventor Ernő Rubik’s]students understand 3D objects, his actual purpose was solving the structural problem of moving the parts independently without the entire mechanism falling apart.” Following the negative non-confirmations, discussion of a “mini Q4 2018” scenario, and the suggestion to manage risk into year-end I’ve made since mid-November, Wall Street seems to be contending with its own Rubik’s Cube—solving the problem of moving the parts independently without the entire mechanism falling apart.

Based on what I’ve read, I interpret Wall Street’s definition of “moving parts” as 1) significant spread of the COVID variant and 2) Powell pivot/accelerating taper and interest rate hikes timeline. From my perspective, which some may consider myopic (I’m a slave to our indicators and models), the real moving parts are the internal weakness occurring within the domestic equity market over the past four to five weeks and the lack of equity market strength during a historically positive seasonal period starting in November, etc.

SANDWICHED

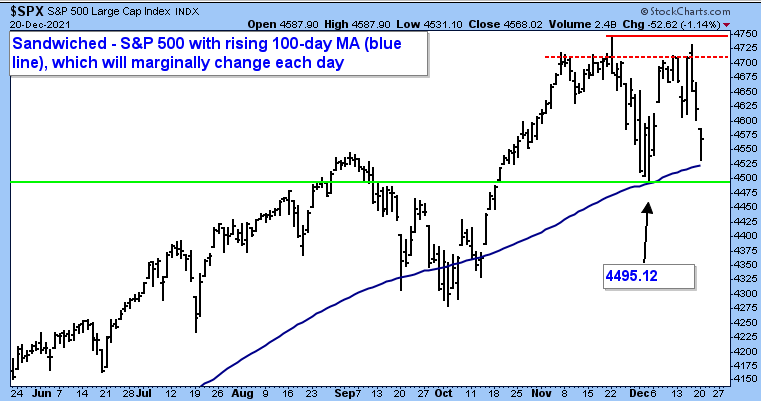

Figure 1: S&P 500 Large Cap Index Daily (SPX). | To paraphrase Callum Thomas, the SPX remains sandwiched between well-defined resistance and support levels. 4712.02 (all-time closing high—dashed horizontal red line) and 4743.83 (all-time intraday high—solid horizontal red line) are resistance levels, or the area where theoretical selling pressure exists. Support (area where theoretical buying interest exists) can be identified as 4523 (100-day MA, blue line) and 4495.12 (horizontal green line).

SLOPPY JOE

As discussed in my recent webinar, the current chart configuration of the Small Cap proxy shown in Figure 2 reminds me of a Sloppy Joe sandwich—it is a mess.

Figure 2: iShares Russell 2000 ETF (Small Cap proxy). | While holding onto support (blue arrows) by the “hair of my chinny chin chin,” the time for this to stabilize and rally is now!

Unless circumstances change, this will be the last Tech Talk report for 2021.

Day Hagan Asset Management appreciates being part of your business, either through our research efforts or investment strategies, and we wish you a very happy holiday season. Please let us know how we can further support you.

Art Huprich, CMT®

Chief Market Technician

Day Hagan Asset Management

—Written 12.20.2021. Chart and table source: Stockcharts.com unless otherwise noted.

UPCOMING EVENTS

-

Day Hagan Technical Analysis with Art Huprich, CMT, on January 18, 2022, at 4:15 p.m. ET.

-

Day Hagan Market Update with Don Hagan, CFA, on February 9, 2022, at 4:15 p.m. ET.

Originally published by Day Hagan on December 21, 2021.

For more news, information, and strategy, visit the ETF Strategist Channel.

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Asset Management (DHAM), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Asset Management literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHAM accounts that DHAM or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member NYSE, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management is a dba of Donald L. Hagan, LLC.