By Komson Silapachai and David Luria, Sage Advisory

As summer draws to a close, the U.S. economy continues to stage a dramatic recovery. While equities have responded by powering through all-time highs, corporate credit spreads flatlined in August. The level of spreads tells only one part of the story in credit, however, and they are not reflective of the high level of dispersion that persists within the corporate bond universe, namely among cyclical and non-cyclical sectors. This leads us to believe there are opportunities among select issuers that could lead to additional return over the coming months. Breaking out the corporate universe into cyclicals and non-cyclicals reveals a more nascent recovery in names that were the most adversely affected by COVID-19 in August. Given our macro outlook of continued recovery, we believe credit spreads of consumer cyclical sectors, such as autos and logistics companies, have room to compress toward the overall index spread.

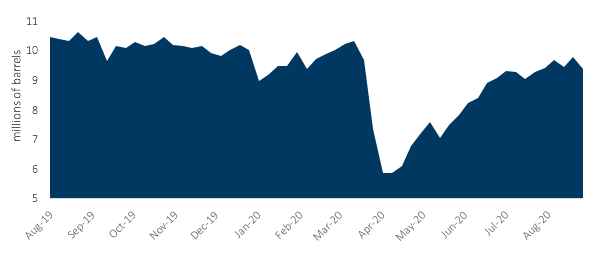

The most recent slate of economic data paints a picture of a V-shaped recovery as supply chains come back online, particularly in the consumer goods sector. Manufacturing PMIs have recovered above pre-COVID-19 levels and new orders are at a 16-year high. Additionally, gasoline demand has recovered to pre-COVID-19 levels, signaling a return to mobility after widespread lockdown and an increase in the flow of goods in the economy. These data points along with several others, including housing, autos, and trade activity, supports our view of a continued recovery in the coming months.

Manufacturing PMI/New Orders

Source: Bloomberg

Gasoline Demand

Source: Department of Energy, Bloomberg

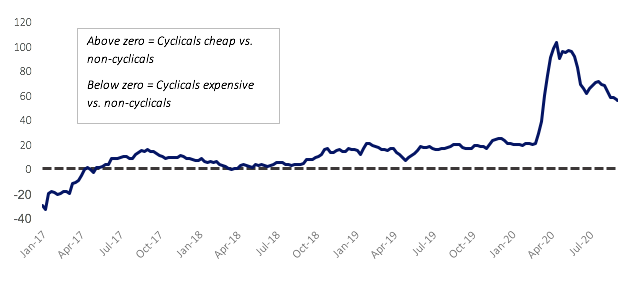

Turning to credit valuations, we believe a strong rebound in economic data will create a tailwind for the consumer cyclical sectors within the corporate bond universe. The current spread differential of consumer cyclical versus non-cyclical sectors recently touched a multi-year high and has only recently displayed signs of compressing tighter after pausing in mid-June due to fears of a COVID-19 second wave.

Spread Differential, Consumer Cyclicals vs. Non-Cyclical Corporate Bonds

Source: Sage, Bloomberg

Although overall valuations of the corporate bond universe have rebounded from March lows, we believe that when one looks “under the hood,” select consumer cyclical sectors, such as autos and logistics companies, have room to rally on an absolute basis and relative to non-cyclical sectors. To that end, we have initiated overweight positions in issuers within those industries.

This article was contributed by the team at Sage Advisory, a participant in the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.