It is becoming widely accepted that ESG data can provide material insight during the investment analysis process. Often, the investment that comes to mind happens to be a stock or the equity markets in general. That is entirely appropriate and applicable, but ESG integration applies beyond the stock market.

Investment-grade fixed income investments are typically considered safer than equities and may offer lower returns due to the traditional risk/reward tradeoff. The safety offered by a bond portfolio can quickly erode if the undue risk is taken in selecting credit exposures.

Corporate bond holdings offer an asymmetric return profile (best case scenario is receiving earned interest and return of principal; worst case is 100% loss of principal). While complete loss of principal is an extremely unlikely scenario, it would have an outsized impact on a portfolio if realized.

With constrained upside in the best-case scenario, and significant downside in the worst-case scenario (however unlikely), risk management becomes paramount.

To limit exposure to the risk of defaults, bond investors often focus on the 4 Cs – capacity, collateral, covenants, and character. This provides a framework for assessing the likelihood of repayment.

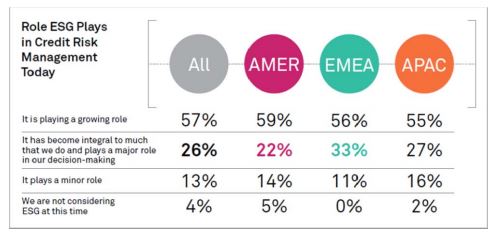

Additional data can clarify this framework or provide additional information to fill out the edges of the  risk mosaic. Making good decisions requires consideration of all material information. ESG data is now playing a key role in assessing a company’s risk. The S&P Global Market Intelligence 2019 ESG Survey found that credit risk professionals around the globe are taking ESG integration seriously.2 This is clearly illustrated in the nearby chart. 95% of the respondents from the Americas currently take ESG data into consideration to manage credit risk, 98% of respondents from the Asia Pacific region consider ESG, and 100% of participants from Europe, Middle East, and Africa consider ESG factors.

risk mosaic. Making good decisions requires consideration of all material information. ESG data is now playing a key role in assessing a company’s risk. The S&P Global Market Intelligence 2019 ESG Survey found that credit risk professionals around the globe are taking ESG integration seriously.2 This is clearly illustrated in the nearby chart. 95% of the respondents from the Americas currently take ESG data into consideration to manage credit risk, 98% of respondents from the Asia Pacific region consider ESG, and 100% of participants from Europe, Middle East, and Africa consider ESG factors.

The major rating agencies (S&P, Moody’s, Fitch) have all become signatories of the United Nations Principles for Responsible Investing (PRI) Statement on ESG in credit risk and ratings.3 As signatories, they, “commit to incorporating ESG into credit ratings and analysis in a systematic and transparent way.”

Moody’s has said that ESG risks were a material consideration in 1 out of 3 rating actions in 2019. “ESG issues are likely to be of growing importance in our assessment of credit quality, driven by factors such as stricter  environmental regulations, and heightened public awareness of issues such as climate change, sustainability, and diversity,” said Swami Venkataraman, Senior Vice President at Moody’s.4

environmental regulations, and heightened public awareness of issues such as climate change, sustainability, and diversity,” said Swami Venkataraman, Senior Vice President at Moody’s.4

Fitch Ratings attempts to drill down and determine which ESG considerations are relevant and material to the individual company’s credit rating.5 S&P similarly integrates ESG factors when relevant and material to creditworthiness.

S&P provides some examples of ESG factors that can influence a company’s credit rating, such as: Environmental – Greenhouse gas emission factors, including CO2 emissions; Social – Health and safety factors, such as safety violations that lead to financial and reputational damage; Governance – Board related factors, including factors linked to the board’s composition, independence, turnover, skill sets, key person risk management, culture, and oversight of management.6

In 2019, Duke Energy had its S&P credit outlook downgraded due to the legal & financial risks associated with having concentrated exposure to coal. In the past, Moody’s has also lowered Duke’s credit rating over concerns related to the cost of coal ash remediation obligations.7

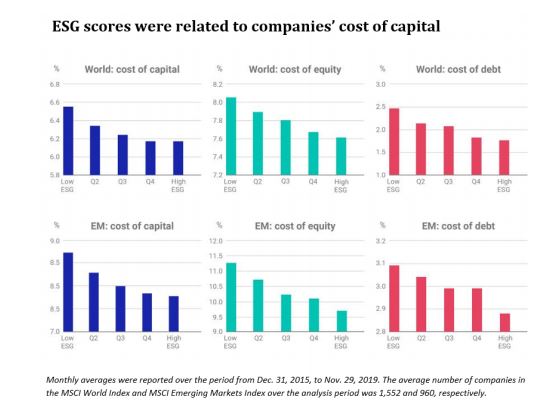

The fact that credit rating agencies are considering company-level ESG data when evaluating creditworthiness creates a clear link between ESG data and a company’s cost of capital. MSCI found that companies with high ESG scores, on average, experienced lower costs of capital compared to companies with poor ESG scores, in both developed and emerging markets during the four-year study period.8

The study also found that companies with high ESG ratings exhibited above market valuations and profitability. This would make sense, as a lower cost of capital should increase profitability, which could justify a higher valuation.

The study also found that companies with high ESG ratings exhibited above market valuations and profitability. This would make sense, as a lower cost of capital should increase profitability, which could justify a higher valuation.

The results of this study take us beyond our featured topic of ESG in credit risk and ratings but provide additional context around the importance of ESG considerations when making investment decisions.

–

–

–

References

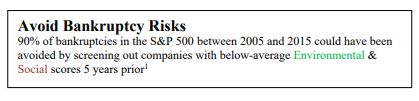

1 Bank of America Merrill Lynch (2019). 10 Reasons You Should Care About ESG:

https://www.bofaml.com/content/dam/boamlimages/documents/articles/ID19_1119/esg_matters.pdf

2 The S&P Global Market Intelligence 2019 ESG Survey: https://pages.marketintelligence.spglobal.com/ESG-Survey.html

3 UN PRI Statement on ESG in credit risk and ratings: https://www.unpri.org/credit-ratings/statement-on-esg-in-credit-risk-and-ratings-available-in-differentlanguages/77.article

4 Moody’s – ESG risks material in 33% of Moody’s 2019 private-sector issuer rating actions: https://www.moodys.com/research/Moodys-ESG-risks-materialin-33-of-Moodys-2019-private–PBC_1218114

5 Fitch, What Investors Want to Know: ESG Relevance Scores for Corporates: https://www.fitchratings.com/research/corporate-finance/what-investors-wantto-know-esg-relevance-scores-for-corporates-20-02-2020

6 S&P, The Role Of Environmental, Social, And Governance Credit Factors In Our Ratings Analysis:

https://www.spglobal.com/ratings/en/research/articles/190912-the-role-of-environmental-social-and-governance-credit-factors-in-our-ratings-analysis11135920

7 Moody’s downgrades Duke, Progress, and Duke Energy Progress; Duke outlook negative: https://www.moodys.com/research/Moodys-downgrades-DukeProgress-and-Duke-Energy-Progress-Duke-outlook–PR_342158

8 MSCI, ESG and the cost of capital: https://www.msci.com/www/blog-posts/esg-and-the-cost-of-capital/01726513589