By Doug Sandler, CFA, Head of Global Strategy

SUMMARY

- We believe concentrated positions can make portfolios more susceptible to “lightning strikes”.

- Concentrated positions in the stock of one’s employer can be especially dangerous, in our view

- The more a concentrated position underperforms, the more difficult it becomes to execute a well-devised investment plan, in our view.

Market Volatility Presents Opportunity to Address a Major Portfolio Risk, In Our View

In our opinion, concentrated positions present one of the biggest obstacles standing in the way of an investor achieving their long-term investment goals. The most sophisticated financial planning tools and the most capable portfolio management teams cannot insulate an investor from the risks presented by these positions. While many investors would prefer to address a concentrated position ‘tomorrow’ when share prices are higher or their tax status is more favorable, it is important to recognize that time is not always on the investor’s side. In this day of 24-hour news, the fortunes of any company can change rapidly without warning alarms. We have seen too many investors losing too much money over the years due to an unexpected event impacting a concentrated position in their portfolios.

What is a Concentrated Position?

The term “concentrated position” could mean different things to different people. We define concentration as any single position that is three or more times larger than an average position in a portfolio. (Our definition does not apply to mutual funds, exchange-traded funds [ETFs] or other potentially diversified investment vehicles.) Concentrated positions can end up in a portfolio for many different reasons: they can come from a successful investment; they can be inherited from a parent or grandparent; or they can represent a percentage of ownership in a current or former employer.

Why Concentrated Positions Can Be Dangerous

Why Concentrated Positions Can Be Dangerous

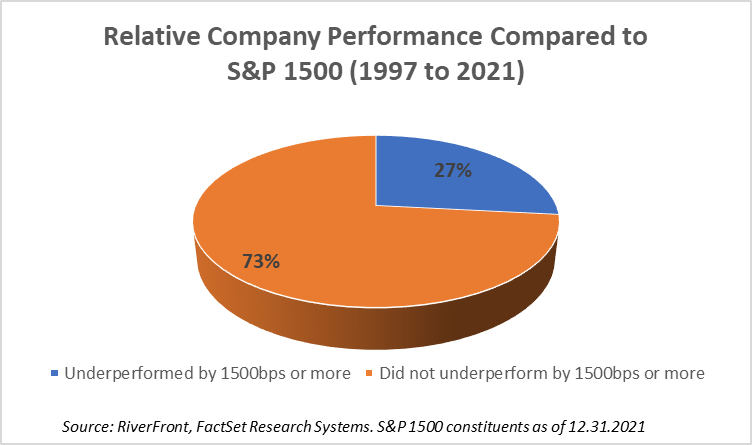

- Concentrated positions can make portfolios more susceptible to “lightning strikes”: A concentrated position can be like a tall tree in a lightning storm. While this risk may be obvious, what might surprise investors is the frequency at which portfolio “lightning strikes” occur. The risk that a single position couldunderperform the market by a significant margin – say 15% annually – is not insignificant. For example, over the last 25 years, on average 27% of the companies comprising the current S&P Composite 1500 Index have underperformed the index by more than 15 percentage points in a single year (Chart, above). In fact, in years like 1998, 1999, and 2020, more than 40% of companies underperformed by that margin. This is one of the many reasons that concentrated positions are often not permitted in the institutional management world and can be viewed as a potential ‘breach of fiduciary duty.’

- Concentrated positions in the stock of one’s employer can be especially dangerous, in our view: We invest for many reasons, but one of the primary objectives is to protect against an uncertain future. We believe a properly structured investment portfolio can act as an income supplement during periods of wage softness or unemployment. For this reason, we think a concentrated position in the stock of an employer is especially dangerous. There is typically a strong correlation between the performance of a company’s stock and the compensation and job security of that company’s employees. During those periods when job security is low and compensation is most under pressure, an investor with a portfolio dominated by the stock of their employer could likely find their financial hardships exacerbated. In the last twenty years, ex-employees of some of America’s most well-known companies have had to learn this lesson the hard way.

- Concentrated positions can force sub-optimal strategies: Generally speaking, an investment plan with significant limitations and restrictions is more likely to produce sub-optimal risk-adjusted performance. In our view, investors who ask their financial advisors to manage around or ignore a concentrated position are making a choice to hold a potentially inferior portfolio and accept inferior risk-adjusted returns. The more a concentrated position underperforms, the more difficult it becomes to execute a well-devised investment plan. A 20% position in a stock that underperforms the market by 20% in a single year costs the entire portfolio 400 basis points. Concentrated positions also present the greatest risk to those investors who regularly rely on withdrawals from their portfolio to supplement their income. An investor who takes systematic withdrawals will be forced to increasingly eat into the healthy portions of their portfolio to compensate for the decline in their concentrated position. Diversification does not ensure a profit or protect against a loss.

Lessening Concentrated Position Risk in 4 Steps

- Accept the Situation: The first step of any treatment plan typically involves the acceptance that there is a problem. Concentrated positions present significant portfolio risk, where the upside opportunity rarely outweighs the downside risk. We believe that recognizing the controlling risk is a ‘must’ and not a ‘nice to have’ will make the next three steps easier.

- Create a Plan: Hope is not a strategy and without a plan, concentrated position risks can be compounded. This is where a financial advisor can help. A well-structured plan should address the position, but also include additional measures that can be taken to further address portfolio risk. For example, eliminating a portfolio’s allocation to other highly correlated assets, like other stocks in the same industry, can reduce the portfolio’s susceptibility to the concentrated position, in our view.

- Execute the Plan: The intent of an execution plan is to reduce the risk of ‘bad timing’. The best execution plans, in our view, are to incorporate a. Immediacy, b. Opportunism, and c. Gradualism. Behavioral finance pitfalls like ‘high-water marks’ and/or ‘low-cost bases’ should be considered but not impede addressing concentrated positions. Value-added solutions such as tax management or tax transition overlay services can further assist in execution.

- Adjust the Plan: Volatile market environments lead to changing investment landscapes. As the landscapes change, so should the execution plan. For example, periods of significant market weakness often provide windows to accelerate execution plans for tax-sensitive portfolios since capital losses in the portfolio can be netted against capital gains in the concentrated position. Any reduction in taxes would depend on an Investor’s tax situation.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

The S&P Composite 1500® Index is designed to measure the performance of the large-, mid-, and small-capitalization segments of the U.S. equity market. The Index consists of those stocks included in the S&P 500® Index, the S&P MidCap 400® Index, and the S&P SmallCap 600® Index.

An investment cannot be made directly in an index.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2400522