By Rebecca Felton, Senior Market Strategist

SUMMARY

- Third quarter earnings season has reinforced our belief in the strength of corporate America’s recovery.

- We believe inflation is closer to the Fed’s long-term objective than the headline numbers suggest.

- The recent nonfarm payroll numbers suggest to us that help is on the way for supply chain bottlenecks.

Economic and Earnings Growth to Persist

Third quarter 2021 earnings reporting season is winding down and US companies, in aggregate, delivered earnings and revenues that were higher than expectations…again. Reported earnings are a glance in the rear-view mirror, but management commentary during quarter-end calls gives investors a look ahead. We believe there is even greater emphasis placed on those comments during third quarter reporting as information gleaned during this time can serve as important inputs for strategists’ forecasts for the next twelve months. As all of Wall Street is looking for “clues” to next year’s growth, it seemed fitting to frame our discussion using famous quotes from some vintage television detective shows. So, test your skills and see if you can attribute them to some old favorites as we discuss some of the data we will use to help navigate through the end of 2021 and into 2022. Answers to our quote quiz can be found at the end of the piece.

“Just the facts ma’am”: Q3 Earnings Season Demonstrates Strength of Economic Recovery

With almost 90% of the companies in the S&P 500 reporting:

- Roughly 75% of companies reporting have exceeded expectations for both earnings and revenues, close to record levels.

- Due to effective cost management, at around 12% the blended average for corporate operating profit margins is among the highest ever recorded.

- Corporate fiscal health was strong coming into the quarter as companies collectively registered record levels of cash on their balance sheets.

- Cost pressures were a common theme, but so were comments about pricing power and strong demand.

- The top sectors, in terms of year over year growth in earnings, were Energy*, Materials, and Industrials.

- The sectors with the strongest revenue growth over the same time frame were Energy, Materials, and Communications Services.

*FactSet estimates that the Energy sector is reporting earnings in excess of $23 billion for the third quarter of 2021 compared to a loss during the same period of 2020. Thus, a year-over-year growth rate is not being calculated for the sector.

“I know what you’re thinking, and you’re right”: Some Measures of Inflation Still Close to Fed Objective

The Federal Reserve is (or commentators are) now describing inflation as ‘persistent’ where previously it was ‘transitory’. It is clear inflation may stay elevated for longer than was originally expected. The prospects of rising inflation combined with policy changes at the Federal Reserve and the waning effects of pandemic-related stimulus leads to questions around the implications for US economic growth.

When it comes to inflation, it is important who determines what is ‘high’ and what is ‘acceptable’. From the market’s perspective, the Fed’s view is most important since

they control monetary policy. They have stated that inflation of 2% over the longer run is consistent with that body’s mandate for maximum employment and price stability. Further, the Federal Open Market Committee (FOMC) has stated that when inflation has been running below 2%, monetary policy will try to achieve inflation modestly above that target for some time.

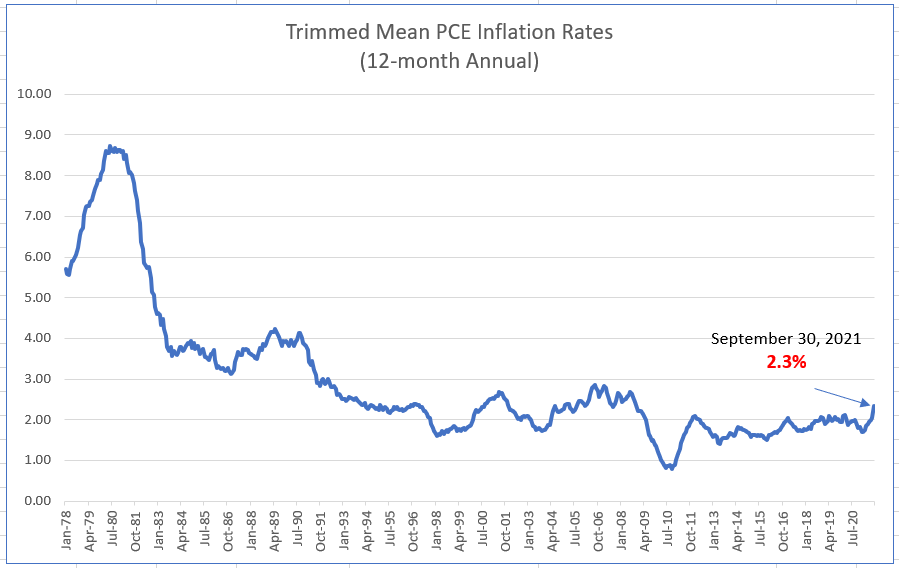

So where do we stand with respect to inflation? The headline number stood at 5.4% year over year at the end of September. However, looking at inflation through a different lens that strips out some of the more volatile elements reveals that inflation is actually closer to the Fed’s target than what you see scrolling across your television screen. Below is a chart showing the Fed’s Trimmed Mean Inflation Rate which stands at 2.3% as of September 30, 2021, well within their acceptable range. The trimmed mean is designed to reduce the short-term influence of the more volatile constituents currently driving headline inflation. We think the Fed pays more attention to these kinds of measures than headline data, and thus is willing to hold off on raising rates. As a result, we are optimistic about growth in 2022.

Source: Federal Reserve Bank of Dallas. The Trimmed Mean PCE inflation rate is an alternative measure of core inflation in the price index for personal consumption expenditures (PCE). It is calculated by staff at the Dallas Fed, using data from the Bureau of Economic Analysis (BEA).

“Just one more thing”: Help is on the Way for Supply Chain Bottlenecks

When will the supply chain pressures ease? We believe the answer to this question holds one of the keys to the persistence of elevated inflation. Throughout earnings season, corporate management teams have acknowledged cost pressures, but have also focused on pricing power and strong demand. The COVID-19 crisis has been a once-in-a-generation phenomenon which rendered the ability to forecast the depth of the earnings plunge, as well as the strength of the recovery, almost impossible. We believe that holds true for forecasts regarding how long it will take for supply chain disruptions to dissipate. There have been forecasts that the supply chain woes will linger through 2023, but there are also signs that conditions impacting the problem are abating. Worker shortages have been a significant contributor to the problem, but the most recent nonfarm payroll report coming in at 531,000 handily beat expectations. This is good news for companies that have had to cut back production due to the inability to fill positions. Companies are also utilizing air freight to offset the impacts of port congestion, as well as on-shoring and near-shoring manufacturing capacity if possible. While these are likely costly alternatives, above average cash levels and pricing power can serve as offsets for what are likely temporary solutions.

“Let’s be careful out there”: Remain Bullish, Markets Susceptible to Headline Risk

Equity valuations are above average, but valuation is a condition rather than a catalyst. We accept that markets are susceptible to headline risk as we navigate the path of an uneven global recovery. Earnings growth in 2022 is unlikely to match that of 2021. However, we believe that fact is already priced into valuations. There are opportunities for companies that have pricing power and can grow earnings in a constrained supply-chain environment, in our view. Thus, our strategies are positioned as risk-on based on our tactical process and our belief in the strength of the recovery.

Test Your Memory:

“Just the facts ma’am”: This phrase is generally attributed to the charter Sergeant Joe Friday from the TV show Dragnet which ran from 1951-1959 and from 1967-1970. Interestingly, the character never said that phrase exactly; rather he said, “All we know are the facts, ma’am”.

“I know what you’re thinking and you’re right”: This phrase is credited to the character Thomas Magnum in the series Magnum P.I. which originally aired from 1980-1988.

“Just one more thing”: This quote is most often associated with the character Lieutenant Columbo from the series Columbo, which ran for a total of ten seasons from 1968 through 1978 with subsequent specials in the late 1980s through the early 2000s.

“Let’s be careful out there”: These were the words of caution attributed to the character Sgt. Phil Esterhaus as he concluded roll call on the series Hill Street Blues which ran from 1981-1987.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1911728