By: BCM Investment Team

Producer price increases have paused to catch their breath in Richmond, and though existing home sales are slowing, housing price gains are continuing to soar—all while remaining under the radar of CPI. While Fed Chairman Powell remained firm in yesterday’s testimony that the inflation spike will reverse itself as the reopening rolls on and says it’s “very, very unlikely” we’ll see a return of 1970’s-style hyperinflation, he also acknowledged that the forces driving inflation “may turn out to be more persistent than we expected.” Are your portfolios positioned accordingly? Looking at generational trends meanwhile, baby boomers have piled out of the workforce while Gen Z has piled into the markets… and taken on significant risk in the process. How many are concentrated in the crypto space, which just saw Bitcoin’s short-term average dip below its long-term to form a death cross and then dive, however briefly, below $30,000? Finally, we offer a little perspective on the fixed income markets and take a look at commodities where, with the exception of oil, prices are largely moderating. Is this a temporary remission or has the rally truly ended?

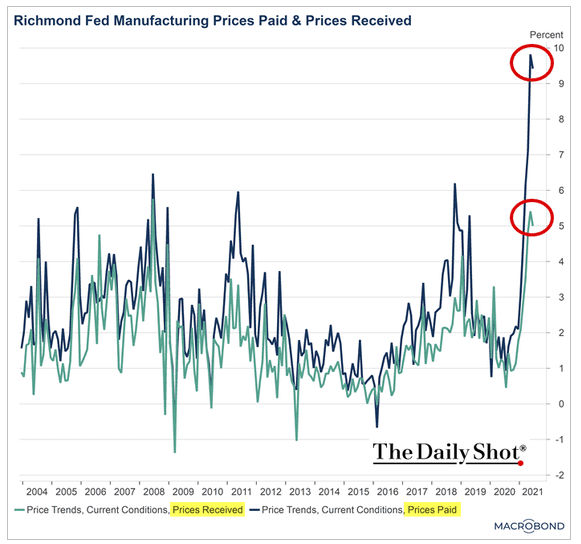

1. The Fed says inflation is transitory. To wit, are the red circles in the Richmond Fed’s PPI a pause or a peak?

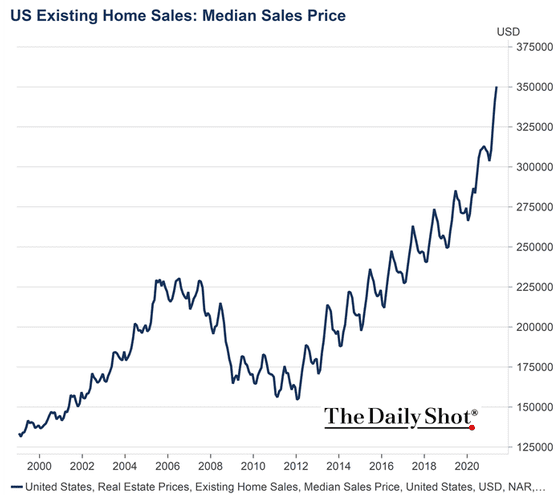

2. In two years, the average home price has increased ~30%. Since CPI uses equivalent rents, this inflation is not captured by CPI.

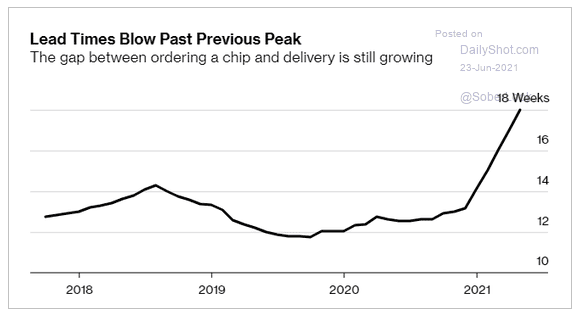

3. Another important post-pandemic anomaly. We have heard all about the delay in chips to auto and other manufacturers, and it is getting worse:

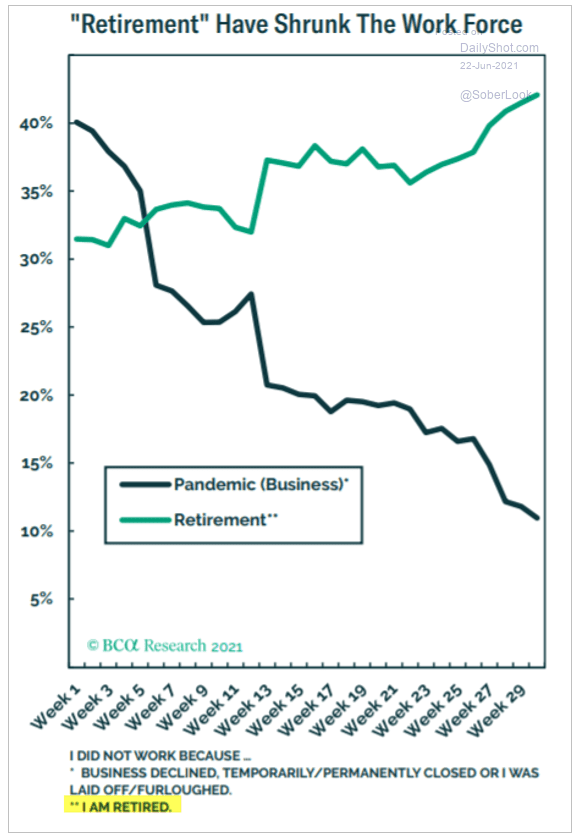

4. Many Boomers simply retired during the pandemic. What will it take to get some to reengage?

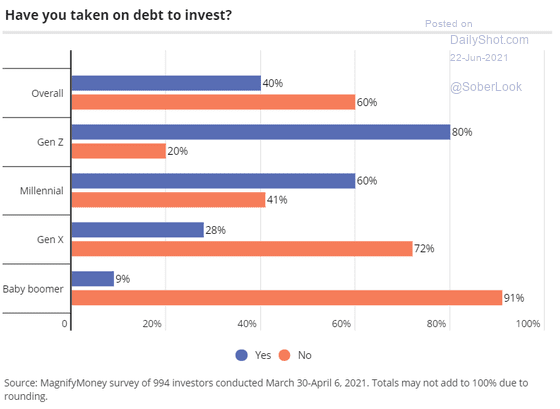

5. This is scary…forget margin debt…80% of Gen Z have taken a personal loan to invest. How will they react to a correction or worse?

6. The crackdown in China has put Bitcoin into a death cross and a head and shoulders pattern has formed. Crypto seems to defy gravity so equity metrics may not apply…

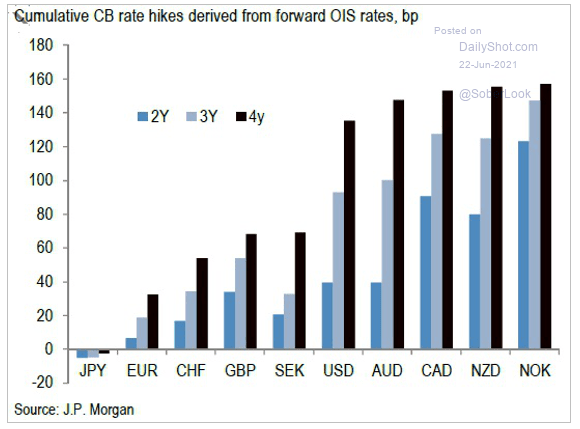

7. A little perspective. If we get the four, 25 bps rate increases and they all transfer to the yield curve (big assumption), then the 10-year UST will yield around 2.5%. This is still the low end of the historical range and quite accommodative.

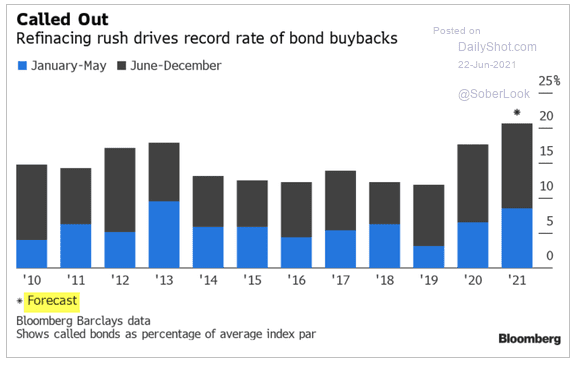

8. 1/5 of all junk bonds are callable this year at or near record low yields. Good for the companies, caveat emptor!

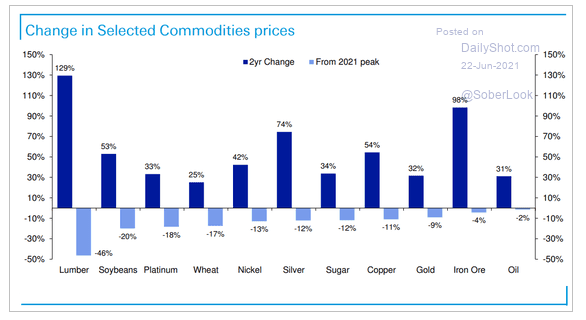

9. A recap of the commodity price moderations:

10. Oil is bucking the trend so far:

11. The global economy is nowhere near “back to normal”. Anomalies abound such as this one:

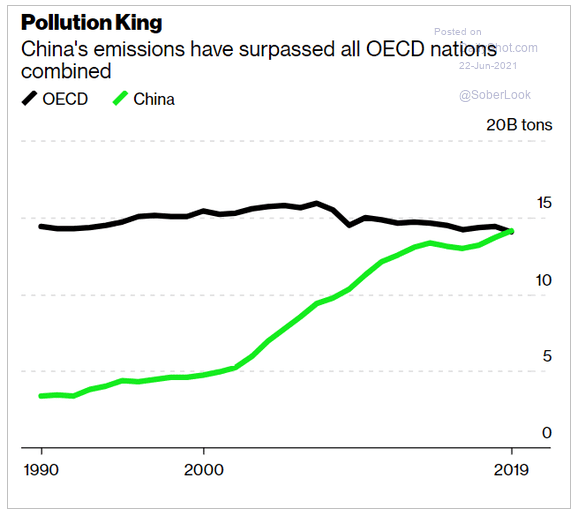

12. Note China is still an “emerging economy”…

This article was contributed by Beaumont Capital Management Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.