First and foremost, our thoughts are with the people of the nation of Ukraine. The below commentary was written on February 28, 2022. As information is moving quickly, please check back to hear Astoria’s latest thoughts.

Key Highlights & Summary

- Russia makes up a small portion of the global economy. Its weight in the MSCI Emerging Market ETF (EEM) is 1.8%, and its weight in the MSCI All Country World ETF (ACWI) is 0.21%.

- The exposure of US equities to Russia is small. According to JPM Research, US companies have low direct exposure to both Russia (0.6% for Russell 1000) and Ukraine (0.1%). However, Europe is more exposed to the risks of the conflict as they are more economically linked with Russia.

- The US, EU, UK, and Canada have banned select Russian banks from SWIFT, the interbank system that allows easy transfer of money across borders. This will disconnect Russia from the international financial system, effectively halting international payments.

- We do not want to downplay the impact of the Ukraine Russian war. It certainly has notable implications for the price of oil, energy, natural gas, wheat, and inflation in general. Moreover, there are elevated risks of cybersecurity and additional geopolitical risks as it relates to China and Taiwan.

- However, we think the far bigger risk to the economy is the current levels of inflation, the US Federal Reserve embarking on an interest rate hiking cycle and unwinding their balance sheet. The Ukraine invasion has notably increased the price of commodities and will further increase overall inflation levels in our view. Moreover, global trade could decline, having further ramifications on economic growth and inflation. These are the issues the market will grapple with.

- Economic sanctions led to a near 30% decline of the Russian ruble on the morning of Monday, February 28th. The Russian stock market declined immensely by its close, as well. A small select group of Russian banks traded down as much as 30%-75% at one point during Monday’s trading on the London Stock Exchange. Russian central bank raised interest rates 20% from 9.5%.

Expect Inflation To Get Worse On The Back Of The Invasion

- According to Goldman Sachs’ every $10 a barrel rise in the price of oil increases headline inflation by about 0.2% and core inflation by 0.04%. Goldman also revised their oil forecast:

- “In the very short-term, we see risks skewed to significant further upside and are raising our 1-month Brent price forecast to $115/bbl (from $95/bbl previously), with significant upside risks on further escalation or longer disruption”.

- JPM also revised their oil forecast:

- “Reflecting the higher risk premium across the oil market and wider commodities complex, our baseline view calls for Brent oil price to average $110/bbl in 2Q22, $100/bbl in 3Q22 and $90/bbl in 4Q22, with the possibility that prices rise as high as 120/bbl in the interim, depending on the state of geopolitics”.

- We are concerned that the increase in crude oil and energy prices because of the invasion will increase to what is already a high inflation number. US gasoline prices rose 40% in January from a year earlier, along with double-digit price increases for basic food items such as flour and meat.

- Russia and Ukraine together represent more than 25% of the global wheat export market. Russia is also a large player in fertilizer production and is the#2 country in the producer of urea behind India.

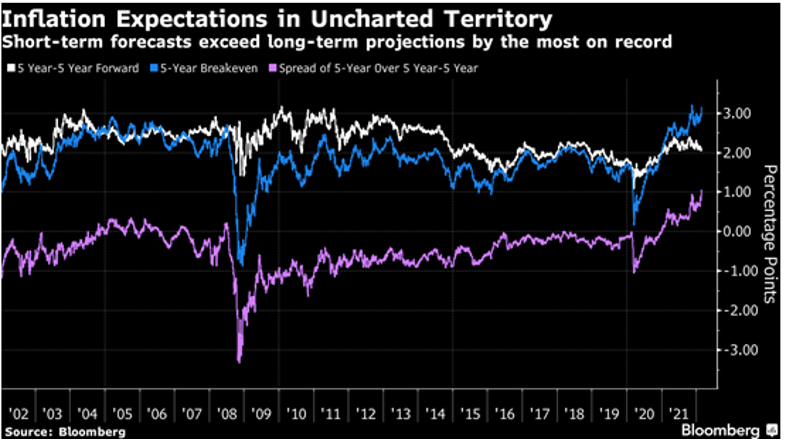

- As mentioned, inflation was a problem before the attack. The Fed’s preferred inflation measure, the core personal consumption expenditures index (PCE), came in at 5.2% last week-the highest reading going back to the Volcker era.

- Below are charts from Bloomberg showing rising breakeven inflation levels.

Supply Chain Issues Are Likely Impacted

- Supply chain issues were already a problem, and there are parts of the chain that are going to be impacted by the invasion. For instance, the Wall Street Journal reported the following:

- “Russia’s invasion of Ukraine is piling new troubles onto the world’s already battered supply chains. The fighting has shut down car factories in Germany that rely on made-in-Ukraine components and hit supplies for the steel industry as far as Japan. It has severed airways and land routes that had become crucial since the pandemic began gumming up sea trade. The conflict is also bottling up Ukraine and Russia’s vast commodity exports, sending the price of oil, natural gas, wheat, and sunflower oil rocketing. Shipping from Ukrainian ports, an important corridor for grain, metal, and Russian oil shipments to the rest of the world has all but ceased.” (Click here)

Europe Has Bigger Impact From The Invasion Than The US

- Russia is the biggest supplier of natural gas to the European region. According to Barron’s, Germany recently reported a 25% YoY increase in producer prices due to a 67% increase in energy costs.

Cyber Security & Additional Geopolitical Risk

- There is concern that there will be cybersecurity threats. On the day of the Russian invasion, Palo Alto Networks (PANW) and Crowdstrike Holdings (CRWD) jumped more than 14%.

- There is concern that China may invade Taiwan. China’s contribution to the global economy is far larger and more impactful. Hence, any invasion of Taiwan and subsequent sanctions will have a far greater impact on the global economy.

- We believe gold, held in PPI (AXS Astoria Inflation Sensitive ETF), could potentially benefit if these risks materialize.

Market Risks Were Already Elevated Prior To The Russian Invasion

- It is worth pointing out that certain market segments were trading in a bear market with price declines north of 20%. Those segments include unprofitable technology stocks, NASDAQ-100, and small-cap sector.

- Inflation readings evidenced by CPI and PPI were at multi-decade highs. There had been elevated macro risk related to the Fed’s rate-hiking path as well as their balance sheet unwind.

- No doubt that the Russian invasion added another risk factor which was already a fragile market.

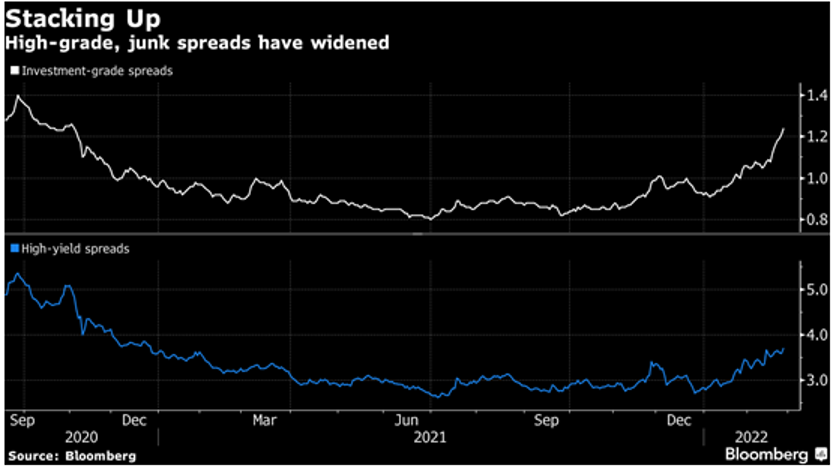

Possible Contagion Risk? Watch Credit Spreads

- On Monday, February 28, 2022, several Russian banks which trade on the London stock exchange traded down substantially.

- Sberbank -70%

- Rosneft -40%

- Gazprom -35%

- We see pictures of people waiting in line to take their money out. That is always a concerning sign.

- We are not experts in Russia’s contribution to the credit economy, but there could be tail risks of which we are not aware. Bank stocks falling 35-75% of their value is concerning.

- We are also concerned with this press release from the ECB

- “ECB assesses that Sberbank Europe AG and its subsidiaries in Croatia and Slovenia are failing or likely to fail.” (Click here)

- We will be watching US credit spreads to see if there is a material widen (see charts below for IG and HY).

What Happened With Prior Geopolitical Tensions?

- According to JP Morgan, over the last twelve geopolitical, macro volatility events that have occurred going back to the Israeli Arab War/Oil Embargo 1973, the average duration of a market selloff was 12 days, the average selloff being around 6.5%, and the recovery taking about 137 days.

Outlook

- Astoria has had an out of consensus view that inflation would be higher than most were expecting. Supply chains were negatively impacted due to Covid, plus there were significant amounts of liquidity pumped into the system by governments and central banks. These factors translated into more demand while supply was limited, resulting in higher inflation. The Russian Ukraine invasion could further exacerbate the underlying inflation readings. However, there is a point where if inflation is too high, it could put the global economy into a recession.

Best,

John Davi

Click here for original publication

Astoria Portfolio Advisors Disclosure: Past performance is not indicative of future performance. Any third-party websites provided on www.astoriaadvisors.com are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time-sensitive nature, or viability of any information shown on these sites. The material in these links is not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC and does not constitute a recommendation, offer, or solicitation for any security or investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website. Refer here for more details.