By Dan Suzuki, CFA, Richard Bernstein Advisors

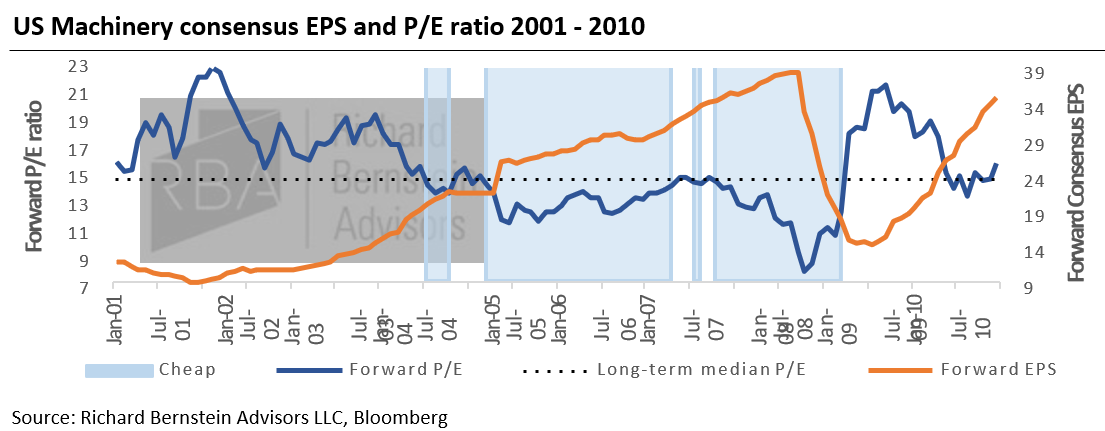

With the slowdown in the US corporate profit cycle showing few signs of an imminent reversal, we continue to emphasize high quality and stable earnings over cyclicality within our portfolios. These positions have become very contrarian because investors believe defensive sectors have become expensive while cyclical sectors are cheap. But comparing the valuations between cyclical and defensive industries comes with some complications. For cyclical stocks, valuations tend to be elevated when profits are bottoming (when you should be buying them) and cheap when profits are peaking (when you should be selling them). Take a look at the P/E multiples for Machinery stocks (a deep cyclical industry) during the last cycle. They became consistently “cheap” (trading below their long- term median P/E) throughout 2005-2008 and only started screening “expensive” (trading above their long-term median) after the stock market bottomed in the spring of 2009.

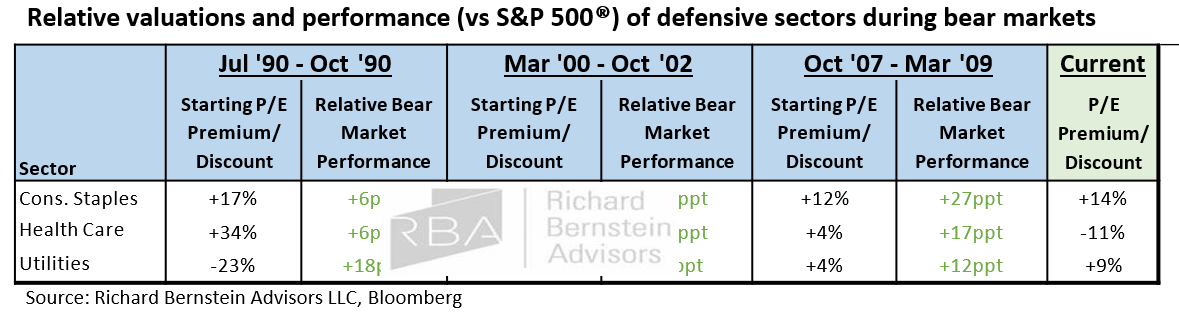

We analyzed the valuation and subsequent performance of defensive sectors going into the last three bear markets. With the exception of the Tech bubble — when Info Tech traded at a P/E of 60x, Telecom traded at 34x and everything else traded at a discount— defensive sectors have almost always traded at a premium going into bear markets, yet they have consistently outperformed during the subsequent bear markets. History suggests, therefore, that the market’s present valuation of cyclicals may a warning signal rather than an opportunity.

Relative valuations and performance (vs S&P 500®) of defensive sectors during bear markets

Dan Suzuki, CFA

Portfolio Strategist

Please feel free to call your regional portfolio specialist with any questions:

Phone: 212 692 4088

Email: [email protected]

For more information About Dan Suzuki, please click here.

Richard Bernstein Advisors is a participant in the ETF Strategist Channel.